The Binance Coin (BNB) price has been rejected by a long-term horizontal resistance area. It is also following a short-term resistance line.

The BNB price has decreased since reaching an all-time high of $691.80 in May 2021. The downward movement accelerated after the Binance Coin price created a lower high in Nov. of the same year.

In May 2022, the BNB price broke down from the horizontal area with an average price of $240. The area had provided support since Sept. 2021.

Now, it has turned to resistance and rejected the price in Nov., creating a massive bearish engulfing candlestick (red icon). While this caused a sharp fall, the Binance Coin price recovered with a bullish engulfing candlestick after two weeks (green icon).

As a result, the technical analysis from the weekly time frame provides a mixed outlook, leaning on bearish. The price movement can be seen as bearish despite the bullish engulfing candlestick, since the BNB price is trading below resistance. On the other hand, the RSI is neutral.

BNB Price Completes Correction

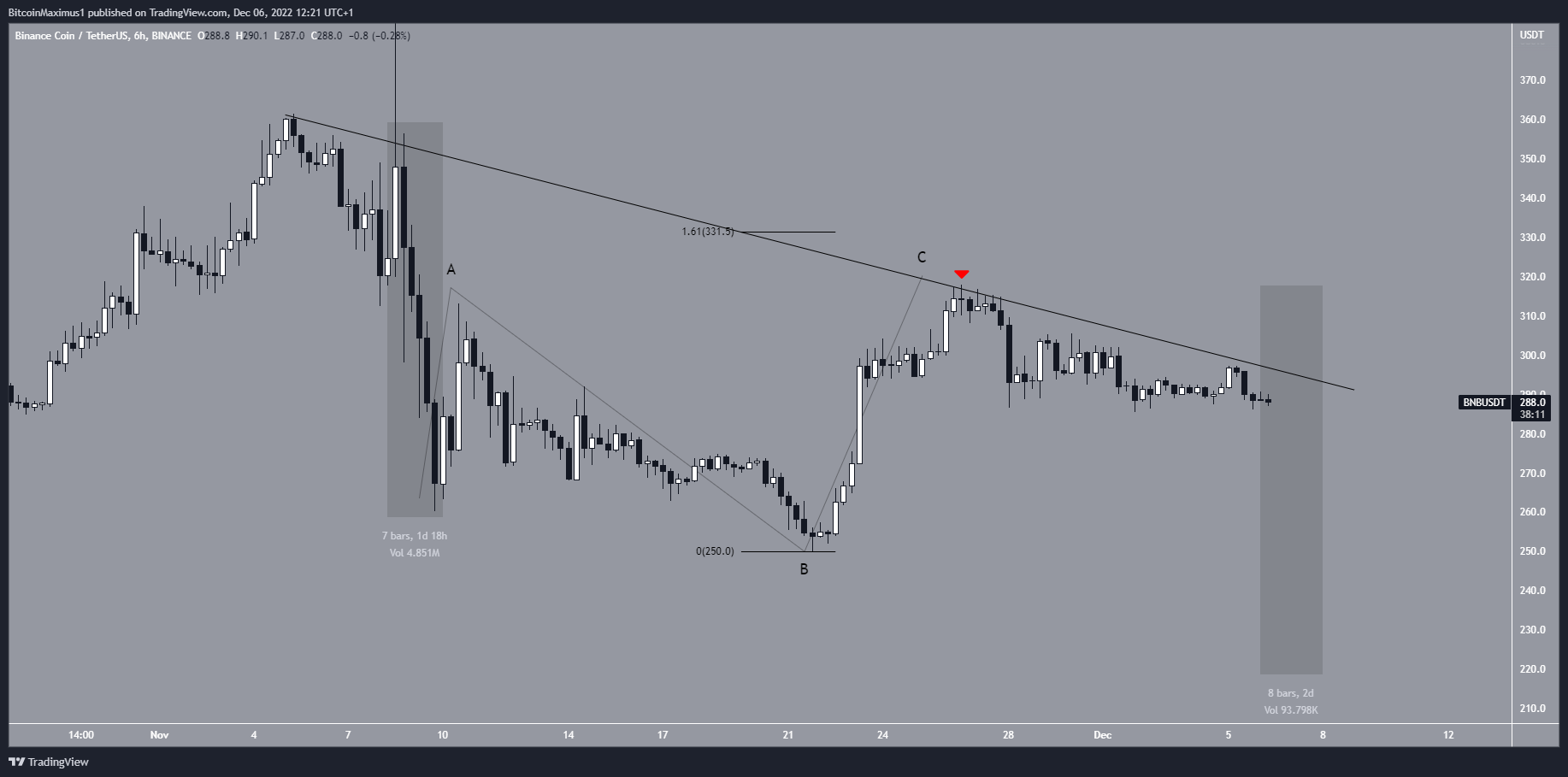

The short-term six-hour chart also provides a bearish outlook for two reasons.

Firstly, it seems that the Binance Coin price has completed an A-B-C corrective structure (black), in which waves A:C had a 1:1.61 ratio.

Secondly, the BNB price is following a descending resistance line. The line caused a rejection on Nov. 26 (red icon). Afterward, the Dec. 2022 price movement has been bearish. There has also been a slight drop over the past 24 hours.

The short-term trend is considered bearish as long as the line is in place. If both portions of the BNB decrease have the same height (highlighted), the price could fall to $220.

BNB/BTC Top Soon?

The BNB/BTC pair has been on a long-term upward trend since Aug. 2017. The highest price reached so far has been ₿0.0197, which is an all-time high.

The most likely count suggests that BTC is in sub-wave five (black) of wave five (white). As a result, the entire upward movement could end soon.

The first potential target for the movement’s top is at ₿0.021, created by the 2.61 external retracement of wave four. The target is likely also because it would give sub-waves one and five a 1:1 ratio.

So far, there are no clear bearish signs besides the long upper wick after the all-time high (red icon).

Bearish divergence in the RSI once the BNB price reaches the target would confirm that a top is in place. In that case, the BNB price could fall to its wave four territory at ₿0.008.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.