Bitcoin started its 275th mining period with its difficulty decreased by 15.3 percent, following a 7.3 percent drop, in November. This is the second largest decrease in Bitcoin’s history after an 18 percent drop registered in Nov 2011 — and the first back-to-back decrease since October 2017.

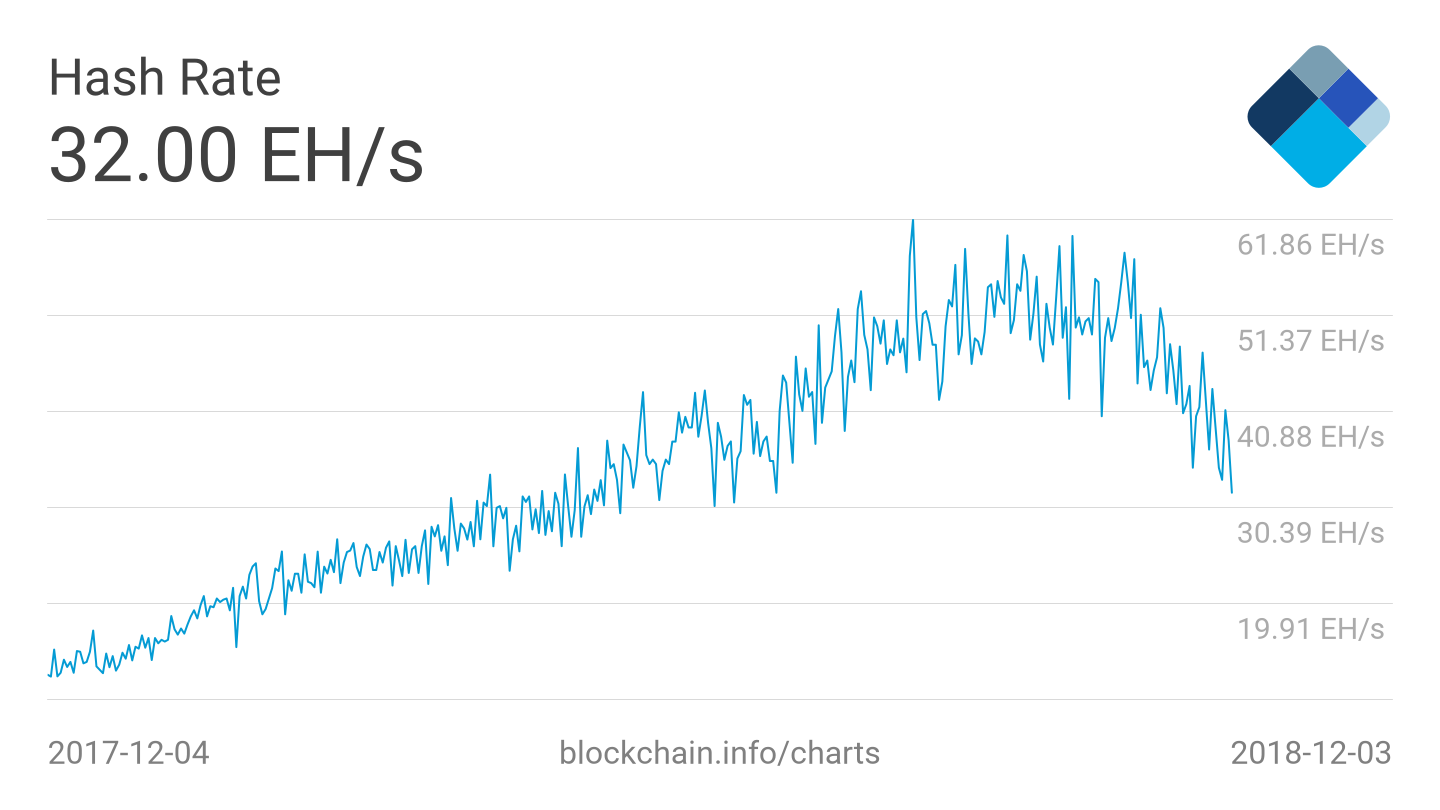

The cryptocurrency community is agitated by another slew of near record numbers following a hash rate collapse to 37.7 EH/s and the Bitcoin price’s 40 percent decrease in November. Is another sign of a doomsday scenario being played out? Or a flash of light in a tunnel?The 275th Bitcoin mining period has started with block 552,384. ⛏ New difficulty: 5,646,403,851,534 (-15.13%)

— Bitcoin Block Bot (@BtcBlockBot) December 3, 2018

What is mining difficulty and what affects it?

Mining difficulty is a blockchain network parameter. It defines how difficult it is to perform mathematical calculations and discover a new block. Miners get paid for discovering new blocks of a chain. To do that, they solve intricate mathematical puzzles and perform lengthy calculations. So, mining difficulty defines how complicated those puzzles are. This parameter helps to regulate how fast new coins are issued. Moreover, miners use this parameter as a reference when choosing the most cost-effective equipment in terms of power consumption to capacity ratio. Mining difficulty is influenced by different factors, including the aggregate computing power required to mine a new bock, better known as a hash rate. Thus, if the hash rate goes down, mining difficulty follows the lead. And that’s what happened this time: the hash rate has been sliding gradually since mid-October and affected the mining difficulty.

All must die

The bad scenario is based on the assumption that both declining hash rate and the collapse of mining difficulty are a factor of a mining exodus. Current Bitcoin mining breakeven price is somewhere in the range $7,000-$4,500, depending on the type of equipment, cost of electricity, and other overhead expenses. Considering that one bitcoin goes for $3,900 at the time of writing, miners are operating at a loss, disregarding their cost optimization efforts. To stop the financial pain, miners switch off their equipment. Large companies freeze their mining facilities, while small players fall out of business all together having no incentive to hold on. Without miners, Bitcoin blockchain will come to a halt, while the coins’ value will drop to zero. So far, so sad. But isn’t there a silver lining?

Keep Calm and Mine On

Mining difficulty and hash rate serve as self-regulation tools that allow the system to adjust itself in case of massive distortions or imbalances. As the process becomes less power-intensive and less difficult, mining breakeven price moves down, while miners profitability grow. The adjustment process is likely to take a while, but the network activity is unlikely to die down and reduce the Bitcoin price to zero. Also, mining difficulty is a fluid parameter that changes every two weeks depending on.a market condition, so it is more a reflection of the past conditions rather than a clue for future developments. The collapsing market forces the community to seek for guidelines, which often result in distorted conclusions and flimsy arguments. What do you think of the recent mining difficulty data? Does it mean anything for you as a trader? Let us know what you think in the comments below.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Tanya Chepkova

Tanya started as a financial news feed translator and worked as a financial analyst, news editor and content creator in various Russian and Foreign media outlets. She came to the cryptocurrency industry in 2016.

Tanya started as a financial news feed translator and worked as a financial analyst, news editor and content creator in various Russian and Foreign media outlets. She came to the cryptocurrency industry in 2016.

READ FULL BIO

Sponsored

Sponsored