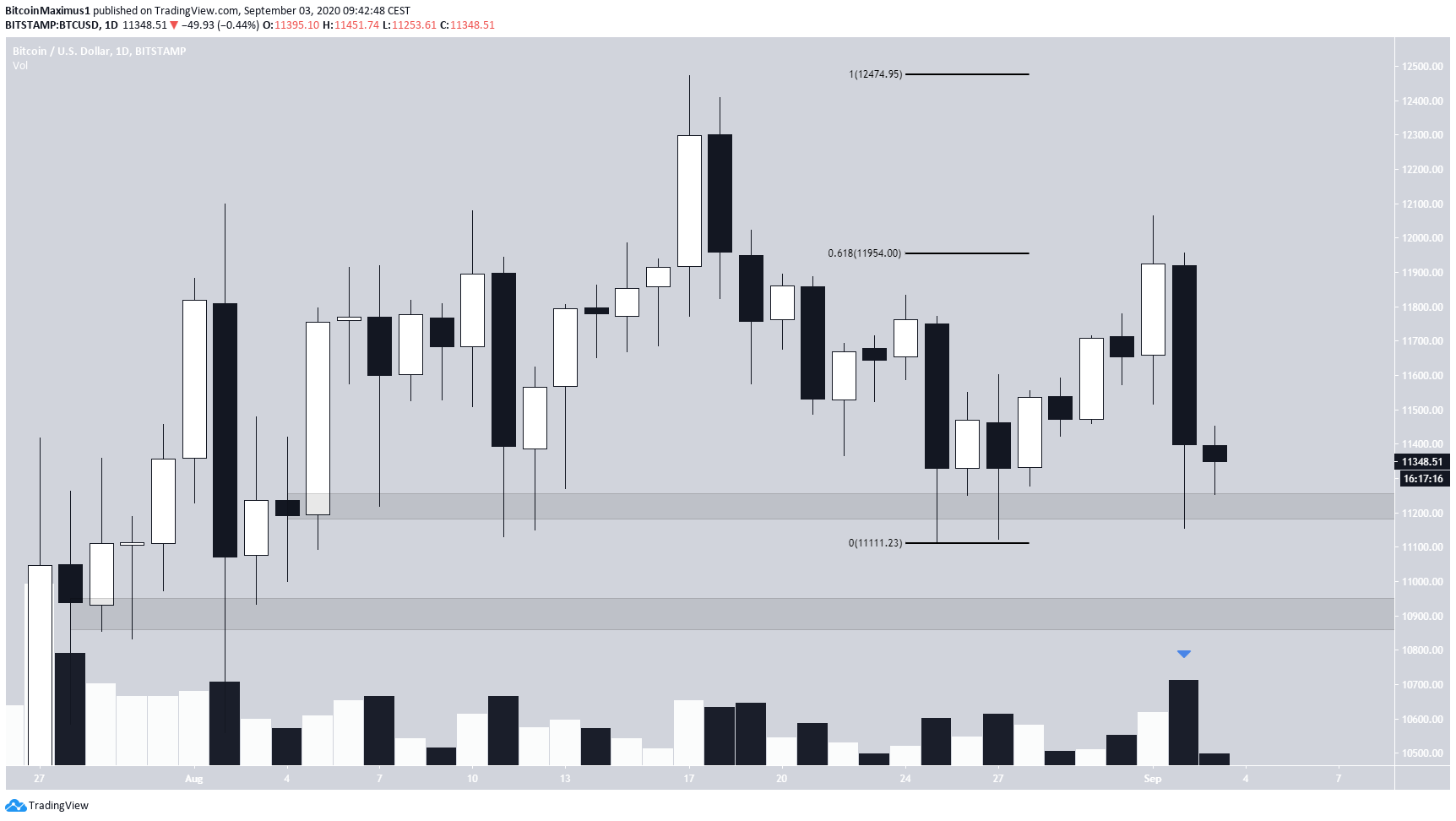

On Sept 2, the Bitcoin (BTC) price created a bearish engulfing candlestick and decreased considerably, falling back to the $11,200 support area.

While the area is likely to initiate a bounce, BTC could fall towards $10,800 afterward.

Bitcoin Rejection Causes Dump

The Bitcoin price had been increasing since Aug 27, when it created a double-bottom near the $11,200 support area. On Sept 1, the price reached a high of $12,065, slightly above the 0.618 Fib level of the entire decrease.

On Sept 2, the price created a bearish engulfing candlestick that took the price back to the aforementioned $11,200 support area.

The decrease transpired with significant volume, increasing the legitimacy of the move. However, volume is still considerably lower than that of July 27, the bullish engulfing candlestick that eventually led to the $12,473 local high.

If the price were to decrease from this support area, the next would be found near $10,800. This area contains multiple low wicks from the beginning of August.

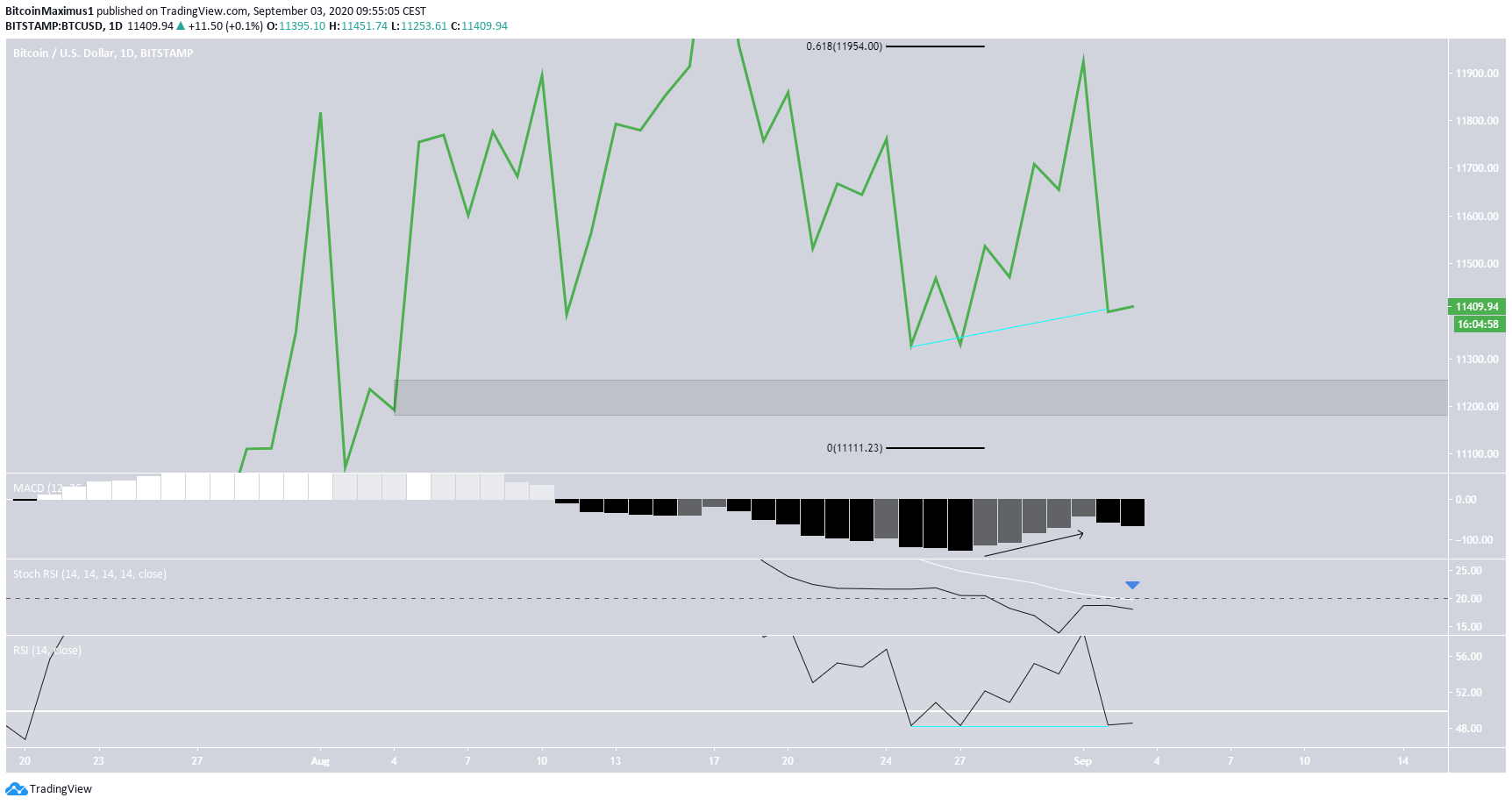

In the daily time-frame, technical indicators do not show signs of a reversal yet:

- The MACD was previously increasing, getting ready to cross into positive territory. Instead, it reversed during the decrease on Sept 2, and is falling yet again.

- The stochastic RSI is oversold but rejected a bullish cross yesterday.

- The RSI is possibly in the process of generating hidden bullish divergence but is not yet confirmed. It has also fallen below 50.

Therefore, even though technical indicators are not bearish, there is no sign of a reversal yet.

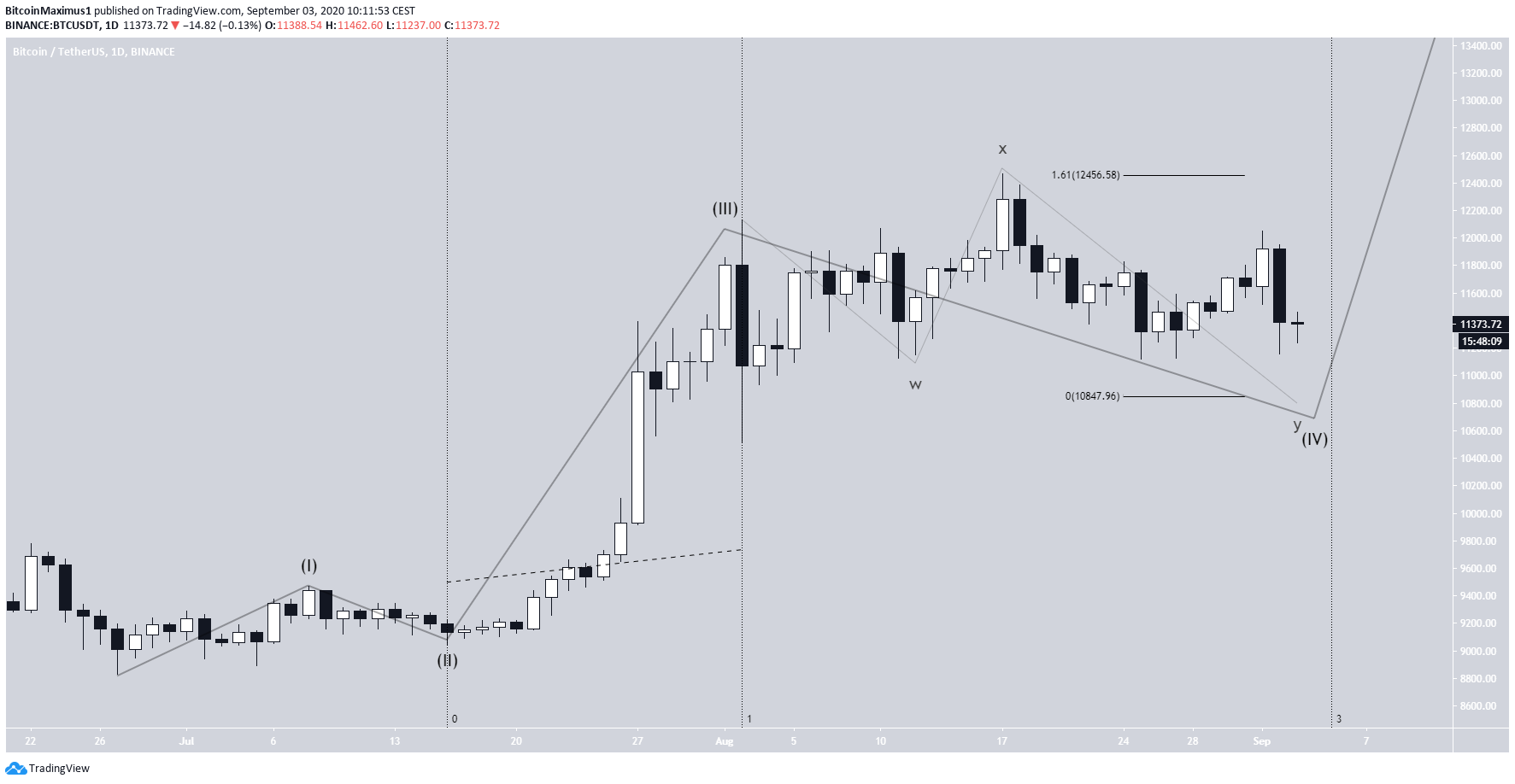

Wave Count

In BeInCrypto’s Sept 2 Bitcoin analysis, we stated that the price has likely begun wave 5. However, yesterday’s decrease puts that wave count in doubt and makes it possible that the price is still in wave 4.

If so, BTC is likely in the Y wave of a complex W-X-Y structure, which could end near $10,800. This is both the 1.618 Fib level of wave W and the previous support area.

Due to the time it took for the price to complete wave 3, it looks like the correction is already overextended, and could be completed by Sept 5.

A closer look at wave Y, reveals that it is transpiring in an A-B-C sub-wave formation. Using the length of A, we also find a similar target of $10,710.

Another reason that supports the theory that BTC is still correcting is that the previous upward move (in white below) looks corrective due to the several overlaps, while the ensuing downward move (in black) looks impulsive.

If the price were to initiate an impulsive upward move, it would suggest that wave 5 has begun.

To conclude, after a bounce, the BTC price is expected to drop towards $10,800. Afterward, it is likely to resume its longer-term upward movement.

For BeInCrypto’s previous Bitcoin analysis, click here!