The 2022 crypto collapse fallout is still echoing to this day. However, recent research has found that large account holders were among the first to pull their funds, accelerating the crypto bank runs.

New research from the Federal Reserve Bank of Chicago released in May revealed the extent that large account holders had over the crypto bank runs in 2022.

$13 Billion Crypto Bank Run

It noted that last year’s run on large crypto platforms was “spearheaded by customers with large holdings, some of which were sophisticated institutional customers.”

Celsius, for example, had 35% of all withdrawals in June before the lender froze withdrawals and filed for bankruptcy. These were made by whale accounts of more than $1 million.

Furthermore, whales with more than $500,000 in investments were the fastest to withdraw. Additionally, they withdrew proportionately more of their funding, according to the research.

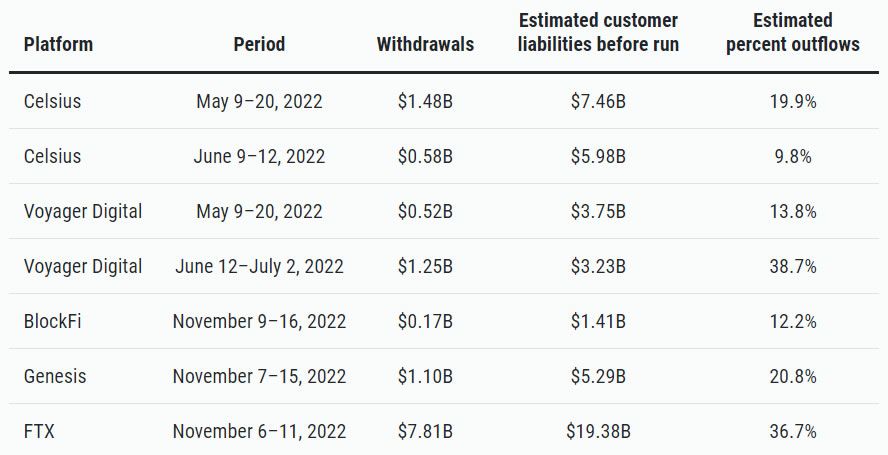

The largest crypto bank run, with an estimated outflow of 36.7% in just five days, was FTX.

“In one of the most severe episodes, customers withdrew a quarter of their investments from the platform FTX in just one day.”

The research used bankruptcy filings to characterize the outflows of customer funds from five platforms. These were BlockFi, Celsius, FTX, Genesis, and Voyager Digital.

Furthermore, users withdrew almost $13 billion from these platforms during their respective bank runs.

The Chicago Fed found that most of these platforms had inadequate run-risk protection in the lead-up to the FTX collapse in November.

Researcher Jonathan Rose, a historian of the Federal Reserve System, said bank runs such as the recent collapse of Silicon Valley Bank can happen even faster than crypto bank runs.

The research concluded that consumers are now more aware of high-risk, high-yield crypto investments than during the previous bull market.

“This turmoil has made consumers and investors more aware of the risks of crypto-asset investment opportunities than they may have been in 2021 amid the excitement of an asset class experiencing rapid price appreciation.”

Crypto Market Outlook

Digital asset markets crashed to a bear cycle low of $820 billion in November 2022 following the crypto bank runs.

2023 has seen a recovery in the crypto markets, but the sentiment remains in bearish territory. Regulatory pressure is now being ramped up. However, markets have gained 44% since their low points last year.

Total capitalization has dipped marginally to $1.18 trillion at the time of writing. Aside from a brief surge in mid-April, it has been relatively flat for the past two months.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.