This week, the crypto market saw significant developments, including a downturn that shook investor confidence and Ripple’s ongoing legal battle with the SEC. Additionally, BlackRock made a strategic move to include options trading on its spot Ethereum exchange-traded fund (ETF).

Each event highlights the volatility and potential within the crypto sector.

MicroStrategy’s $2 Billion Bet: Doubling Down on Bitcoin Amid Market Uncertainty

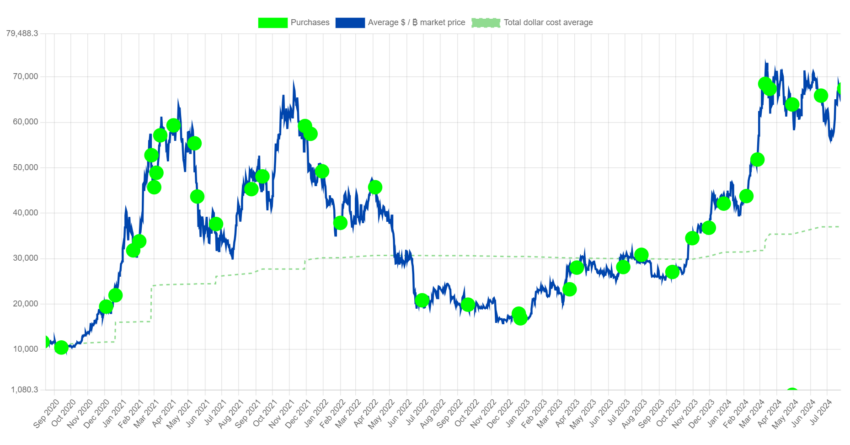

Virginia-based software firm MicroStrategy continues its aggressive strategy of expanding its Bitcoin holdings. The company recently disclosed plans to sell up to $2 billion worth of Class A shares to fund further Bitcoin purchases and other corporate uses.

This decision reinforces MicroStrategy’s role as a key player in the Bitcoin market. Particularly, the company acquired 12,222 BTC in Q2 2024, spending over $805 million at an average price of $65,880 per coin. With these new acquisitions, MicroStrategy now holds 226,500 BTC, cementing its position as the largest public holder of Bitcoin.

“After yet another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins reflecting a current market value 70% higher than our cost basis,” the firm’s president Phong Le stated.

Read more: Who Owns the Most Bitcoin in 2024?

Crypto Market Crash: Triggers, Repercussions, and Recovery

Early this week, the crypto market experienced a dramatic downturn, with total market capitalization dropping by 12.5% to $1.97 trillion. Bitcoin, the largest cryptocurrency by market cap, plummeted to $53,399, while Ethereum fell sharply by 21.2% to $2,100.

Several factors contributed to this decline. These include weak US economic data, the unwinding of the yen carry trade, and significant liquidations from institutional traders like Jump Trading. Collectively, these factors exacerbated the market’s volatility, leading to widespread concern among investors.

However, the market demonstrated resilience, rebounding the next day as Bitcoin regained its footing above $60,000 and Ethereum recovered to $2,626. Analysts attribute the recovery to anticipated Federal Reserve rate cuts. Increased activity from crypto whales, who have accumulated Bitcoin in large quantities, also played a role.

BlackRock Eyes Options Trading for Spot Ethereum ETF

BlackRock recently submitted a filing for options trading on its spot Ethereum ETF, iShares Ethereum Trust (ETHA). Filed with the US Securities and Exchange Commission (SEC) via Nasdaq, the proposal revealed that the ETF would hold Ethereum as its primary asset. Furthermore, Coinbase will be the trust’s custodian.

James Seyffart, an ETF analyst at Bloomberg Intelligence, commented on Nasdaq and BlackRock’s filing to add options on Ethereum ETFs. He noted that the SEC’s final decision will likely be around April 9, 2025.

“SEC is not the only decision maker on adding options here. Also need signoff from Options Clearing Corporation (OCC) and Commodity Futures Trading Commission (CFTC),” Seyffart added.

Ripple vs. SEC: The Legal Battle Intensifies

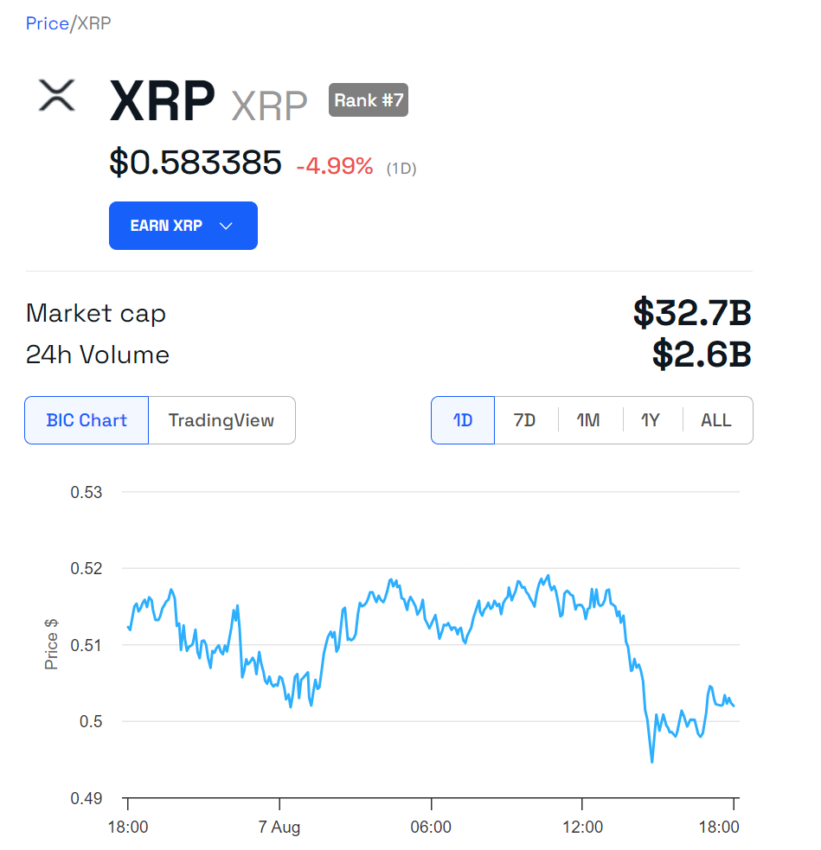

This week, Ripple Labs’ legal battle with the SEC took a new turn. US federal judge Analisa Torres ordered the company to pay a $125 million penalty for the unregistered sale of its XRP token.

While this penalty is way lower than the SEC’s initial $2 billion demand, the case remains far from resolved. The SEC is expected to appeal the ruling, particularly focusing on classifying XRP’s secondary sales as securities and the reduced fine imposed on Ripple.

The outcome of this case could have far-reaching implications for the crypto industry. It could potentially set new standards for digital asset regulation in the US.

The recent developments have significantly affected XRP’s market performance. Following the court order, the price of XRP surged by 27%, rising from $0.5018 to $0.6373 within just one and a half hours. However, after reports of a potential appeal by the SEC, XRP’s price dropped to $0.5833, representing a 4.99% decrease in the last 24 hours.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Meme Coins Made Easy: Creating Digital Tokens on X

The crypto community this week is buzzing with the latest trend of creating meme coins directly on X (Twitter) through the platform makenow.meme. This service allows users to mint meme coins by only tweeting a ticker name, tagging @makenowmeme, and including relevant media.

Since its launch on July 31, the platform has facilitated the creation of over 4,000 meme coins, attracting significant attention from crypto enthusiasts and industry leaders. However, the platform has faced challenges, including rate limits imposed by X, which temporarily halted the tweet-to-mint function. Despite these setbacks, the service has resumed.

Remarkably, just days before makenow.meme’s debut, Pump.Fun surpassed Ethereum in daily revenue, securing $863,525 in 24 hours, according to DeFiLlama.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.