This week, Bitcoin and the broader crypto market experienced a sharp decline following the release of US Consumer Price Index (CPI) data.

Speculation about BlackRock launching its own blockchain has also surfaced. Additionally, Binance’s delisting of several altcoins triggered significant market reactions.

Bitcoin’s “Fakeout” Following CPI Data Release

On August 14, the US Bureau of Labor Statistics (BLS) released July’s Consumer Price Index (CPI) data. The figure was lower than the previous month, leading to speculation that the Federal Reserve might cut rates in September, possibly by 25 basis points.

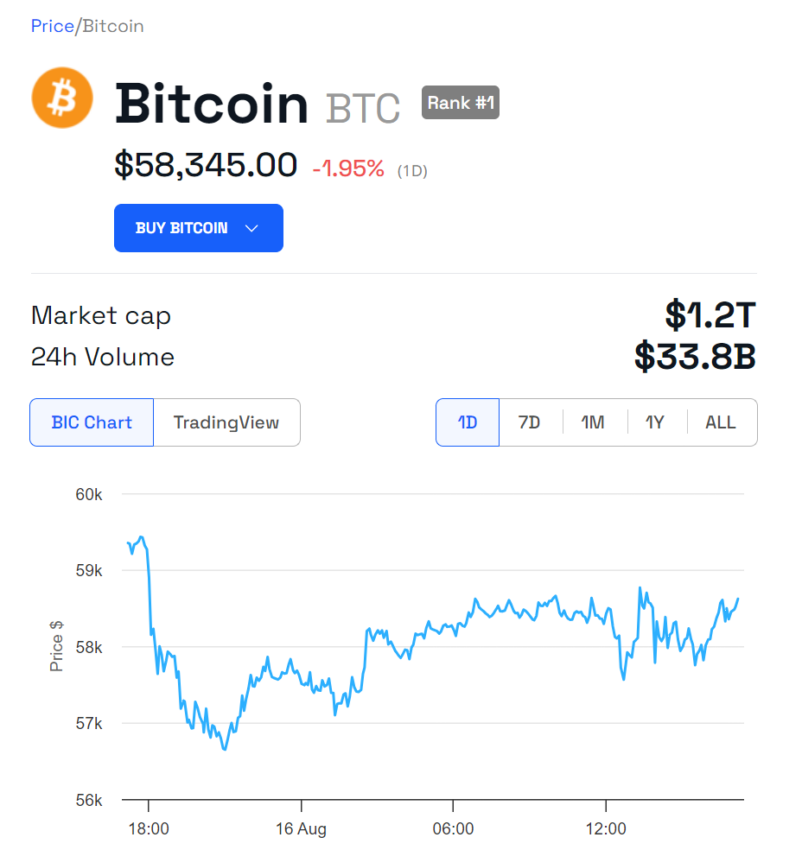

Bitcoin initially reacted positively to the data, trading above the $60,000 level. However, this proved to be short-lived, as the price quickly reversed, dropping below $60,000 — a move known in trading circles as a “fakeout.” At the time of writing, Bitcoin stands at $58,345, reflecting a 1.95% decrease in the past 24 hours.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Despite this volatility, analysts maintain a positive long-term outlook for Bitcoin. Potential catalysts for a bullish trend include anticipated rate cuts, increased inflows into Bitcoin exchange-traded products (ETPs), and favorable regulatory developments.

Institutional Investors and Wall Street Giants Reveal Spot Crypto ETF Holdings

This week, institutional investors disclosed their positions in Bitcoin and Ethereum ETFs through their 13-F filings with the US Securities and Exchange Commission (SEC). Goldman Sachs, for example, holds positions in seven of the 11 available spot Bitcoin ETFs in the US. Its largest stake is in the iShares Bitcoin Trust (IBIT), with an investment valued at approximately $238.6 million.

In addition to IBIT, Goldman Sachs has invested heavily in other Bitcoin ETFs. Notably, the bank holds $79.5 million in Fidelity’s Bitcoin ETF (FBTC) and $56.1 million in the Invesco Galaxy Bitcoin ETF (BTCO), among others.

Similarly, Morgan Stanley, another Wall Street giant, also demonstrated a preference for BlackRock’s IBIT, with positions valued at $188 million. Furthermore, Morgan Stanley has smaller holdings in the Ark 21Shares Bitcoin ETF (ARKB) and the Grayscale Bitcoin Trust (GBTC).

The trading firm DRW Capital also presented its significant stake in crypto ETFs, particularly focusing on Ethereum. The company’s filings indicate an allocation of over $150 million to the Grayscale Ethereum Trust.

Additionally, the State of Wisconsin Investment Board (SWIB) reported owning nearly 2.9 million shares of BlackRock’s spot Bitcoin ETF (IBIT) as of June 30. This position, valued at nearly $99 million, marks a significant increase from the previous quarter, where SWIB held around 2.5 million shares. Interestingly, SWIB also reduced its exposure to the Grayscale Bitcoin Trust by offloading 1 million shares during the first quarter.

Vetle Lunde, a senior analyst at K33 Research, recently noted that the second quarter of 2024 saw a notable increase in institutional ownership of Bitcoin ETFs. The 13-F filings revealed that 1,199 professional firms held investments in US spot ETFs as of June 30. This number marks an increase of 262 firms from the previous quarter.

“While retail investors still hold the majority of the float, institutional investors increased their share of total AUM by 2.41 percentage points, now accounting for 21.15% in Q2,” Lunde remarked.

This growth in institutional participation is significant. It indicates that large financial entities are becoming more comfortable with the risk-reward profile of crypto investments.

Hydra Update Prepares Cardano for Chang Hard Fork

On August 9, Cardano released version 0.18.0 of its Hydra Head scaling solution. This upgrade is particularly crucial as Cardano prepares for its upcoming Chang hard fork, which aims to fully decentralize the blockchain.

Sebastian Nagel, a Cardano developer, emphasized that one of the key features of this update is the ability to withdraw funds from an open head without closing it. This improvement aligns with Cardano’s broader goal of transitioning into a decentralized network. Charles Hoskinson, Cardano’s founder, envisions it as a global system featuring advanced governance and community-driven initiatives.

Speculation Surrounding BlackRock’s Blockchain Initiative

According to a report by Token Terminal, BlackRock could be exploring the launch of a proprietary blockchain similar to Coinbase’s Layer-2 network, Base. The report suggests that such a blockchain could centralize the record-keeping of BlackRock’s vast holdings, enhancing transparency, efficiency, and security. If this plan materializes, it will align with BlackRock’s broader strategy of leveraging technology to streamline its operations and offer novel solutions to its clients.

However, such a project would have challenges, including managing the complex regulatory environment and ensuring the blockchain’s security and scalability. Despite BlackRock not confirming these plans and potential challenges, the asset management firm potentially launching a blockchain could represent a major shift in the traditional finance sector.

Six Altcoins Take a Hit After Binance Delisting Announcement

On August 12, Binance, the world’s largest crypto exchange by trading volume, announced the delisting of six altcoins. Effective August 26, 2024, at 03:00 UTC, Binance will remove all spot trading pairs for these tokens.

Historically, when Binance announces the listing or delisting of altcoins, it significantly impacts their prices. The recent delisting decision immediately caused the prices of the affected tokens to drop.

Read more: Which Are the Best Altcoins To Invest in August 2024?

The tokens impacted were PowerPool (CVP), Ellipsis (EPX), ForTube (FOR), Loom Network (LOOM), Reef (REEF), and VGX Token (VGX). Some of these even experienced value declines exceeding 20%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.