The Web3 Foundation has announced a plan to deploy millions in grants over the next year to boost development and projects on the Polkadot ecosystem. However, the former crypto darling has fallen out of favor among investors as its token price continues to tank.

On October 10, the Web3 Foundation announced a new program to kickstart teams and individuals wanting to contribute to the success of Polkadot.

Polkadot Development Push

The Foundation is a development agency for Polkadot and its canary network, Kusama. It believes that growth should be driven by Polkadot’s community and has launched an initiative to support it.

The program will target to deploy 20 million Swiss Francs (around $22.1 million) and 5 million DOT tokens currently valued at around $18.8 million throughout 2024.

The capital will augment the community-governed funding mechanism from the Polkadot Treasury. It stated that this will help projects that will,

“Have a meaningful impact on the future of Polkadot.”

There was no further information from the Foundation or Polkadot at the time of writing.

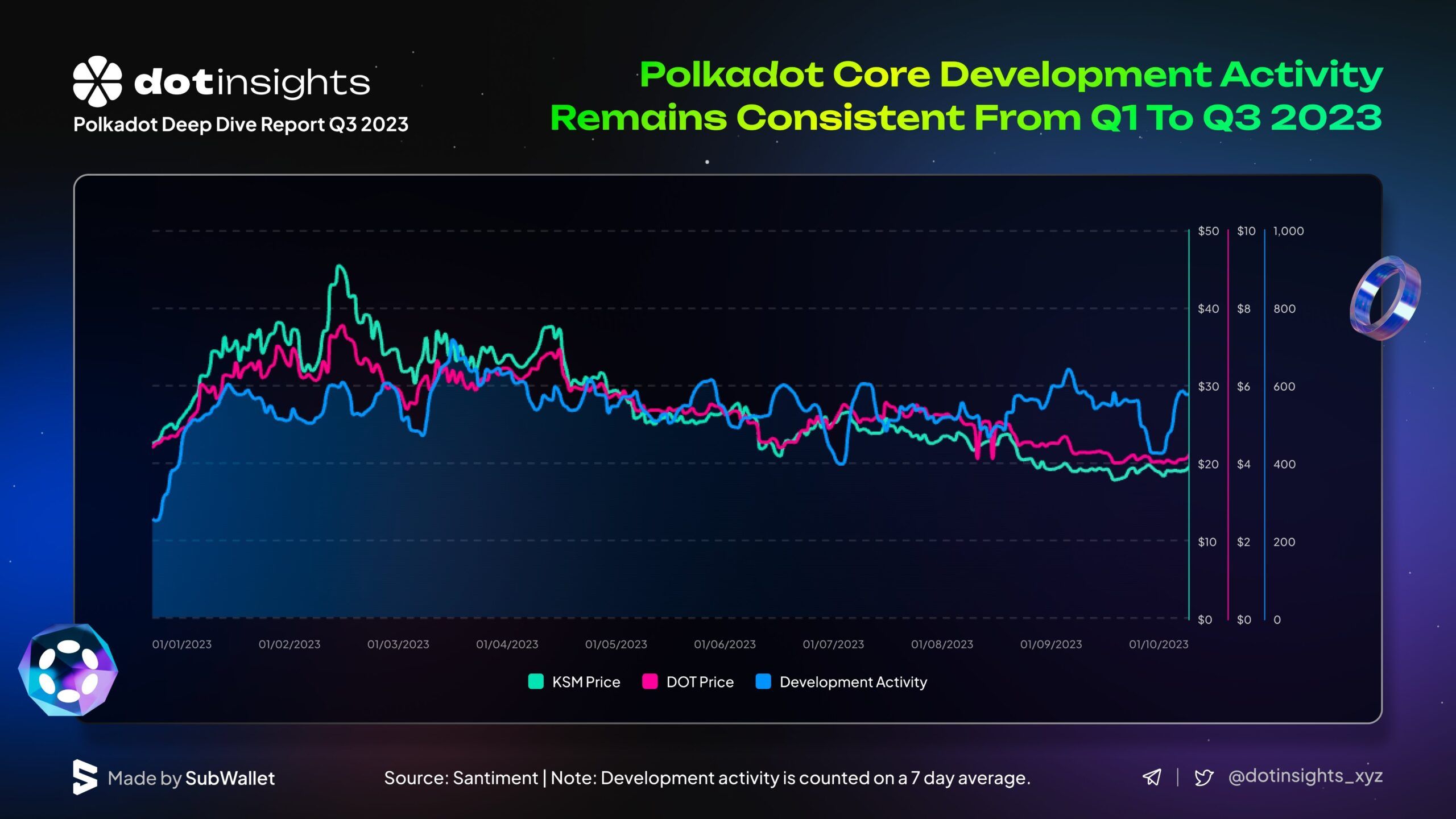

Despite the bear market that has decimated the price of DOT, the ecosystem continues to build and expand.

On October 10, Dotinsights released its Q3 ecosystem progress report.

Polkadot continued to be a strong Web3 player in terms of development activity, according to data from Santiment. Moreover, active core Polkadot developers reached an all-time high in Q3, according to TokenTerminal.

Validator staking on the network has been relatively stable for the period, it added. Furthermore, nomination pools reached a new milestone in Q3, surpassing 15,000 pool members in September.

The top DeFi parachains on Polkadot included Acala Network, Astar Network, Moonbeam, Parallel Finance, and Hydra. By the end of Q3, these five parachains had a combined $125.6 million in total value locked, with Moonbeam leading at $37.4 million.

DOT Disappoints and Dumps Again

Despite the positive fundamentals and continued development in the ecosystem, the Polkadot native token continues to get crushed.

DOT is down again today, dropping 2% to trade at $3.76 at the time of writing.

Furthermore, DOT is currently trading at its lowest level since August 2020 as the asset continues to fall out of favor with the former “Ethereum killer.”

DOT has lost 93% since its bull market peak of $55 in November 2021. Kusama (KSM) is in a worse position, also trading at a three-year low, having dumped 97% from its all-time high.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.