The Waves (WAVES) price has increased by 125% over the past week. The long-term upward trend still looks strong, and the price is expected to move towards the resistance levels all the way to 70,000 satoshis.

There is the possibility of a short-term retracement prior to the resumption of the upward move.

Waves Doubles in Value

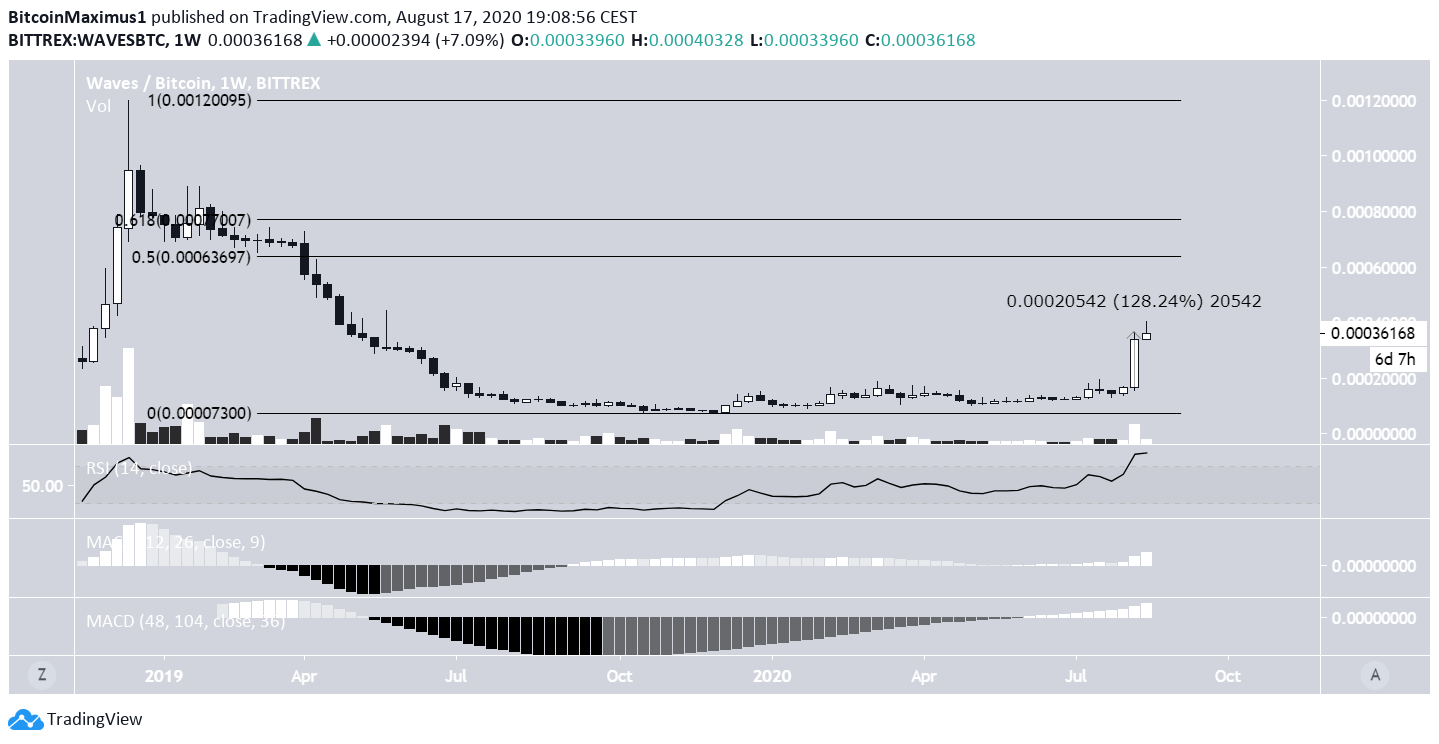

The Waves price had been consolidating for an entire year during the period between July 2019-2020. After gradually moving upwards, the price finally created a massive bullish engulfing candlestick during the week of Aug 10-17 and increased by 130%. Indicators are bullish. The increase transpired with significant volume, and the MACD is moving upwards. While the RSI is inside the overbought territory, it has not generated any bearish divergence yet. If the price continues moving upwards, the next resistance areas are found between the 0.5-0.618 fib levels of the entire previous decrease that began in December 2018.

Short-Term Trend Shows Weakness

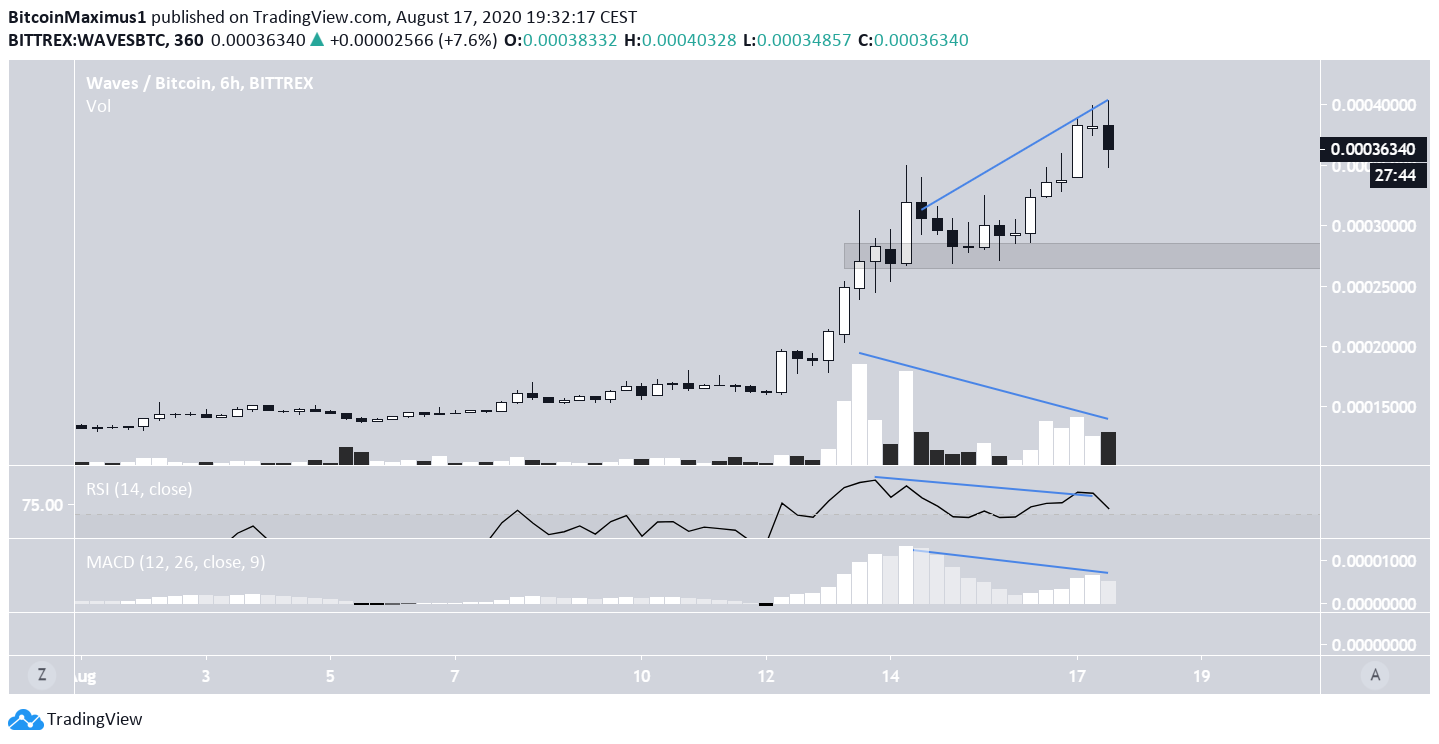

On the other hand, lower time-frames reveal that the trend has begun to show weakness. There is a bearish divergence in the RSI and MACD. The MACD has almost turned negative. Furthermore, the volume has been decreasing even though the price is making higher-highs, a sign that a reversal is likely near. If the price begins to decrease, the closest support area would be found at 26,000 satoshis. Afterward, the price is expected to continue moving towards the long-term targets outlined previously.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored