Warren Buffett, a stalwart critic of Bitcoin and crypto, is indirectly reaping the benefits of the asset class he has often dismissed.

Despite his well-documented skepticism, Buffett’s investment conglomerate, Berkshire Hathaway, is witnessing substantial gains from a stake in a company that operates within the crypto market.

How Warren Buffett Turns Crypto Into Profit

Berkshire Hathaway, under Buffett’s guidance, has long championed the value of investing in companies with strong cash flows and solid business models. This approach has helped the company navigate through market fluctuations with remarkable resilience.

Yet, Buffett’s aversion to Bitcoin and crypto has been a consistent theme, famously remarking in a 2018 interview that cryptocurrencies essentially produce nothing, and their value solely depends on the willingness of the next person to pay a higher price.

“If you told me you own all of the Bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything,” Buffett said.

However, Berkshire Hathaway’s investment strategy reveals a nuanced approach to the crypto market. The firm made a significant investment in Nu Holdings. This is a Brazilian fintech company that launched a platform for trading cryptocurrencies, Nucripto, in 2022.

Despite Buffett’s personal stance, his company’s foray into an entity that embraces crypto indicates a recognition of the sector’s potential profitability.

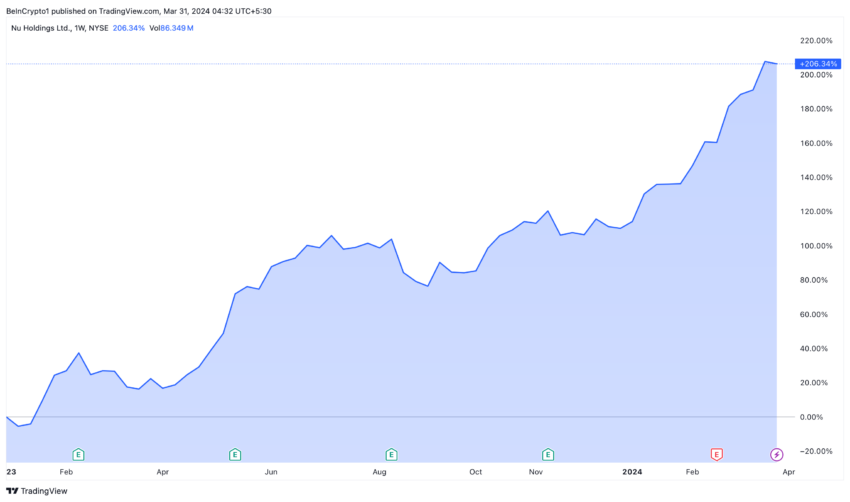

Nu Holdings has been a standout performer in Berkshire Hathaway’s portfolio. Since the initial $500 million investment in 2021, followed by an additional $250 million, the company has seen its value soar, with stock prices surging nearly 50% in 2024 alone. This performance comes on the back of an impressive run in 2023, marking a near 100% increase in stock value.

This strategic investment reflects a possible shift in the markets, where even traditional investors recognize the growing influence of digital currencies. Bitcoin’s stellar performance in 2024, outpacing major indices, adds further intrigue to Buffett’s investment strategy moving forward.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

While Buffett’s personal sentiments towards Bitcoin and cryptocurrencies remain unchanged, the financial success of crypto-related ventures within Berkshire Hathaway’s portfolio might prompt a reevaluation of his stance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.