One of the leading candidates to be the next Republican candidate for President of the United States has accused BlackRock of being part of “the most powerful cartel in human history.”

Vivek Ramaswamy made the comments at the Richard Nixon Foundation on Sunday. They quickly spread to many parts of the online space. The dark horse candidate, who is closing in on second-place Florida Governor Ron DeSantis, has been a vocal critic of Environmental, Social, and Governance (ESG) standards in corporate America.

Vivek Ramaswamy Is Still a Distant Third

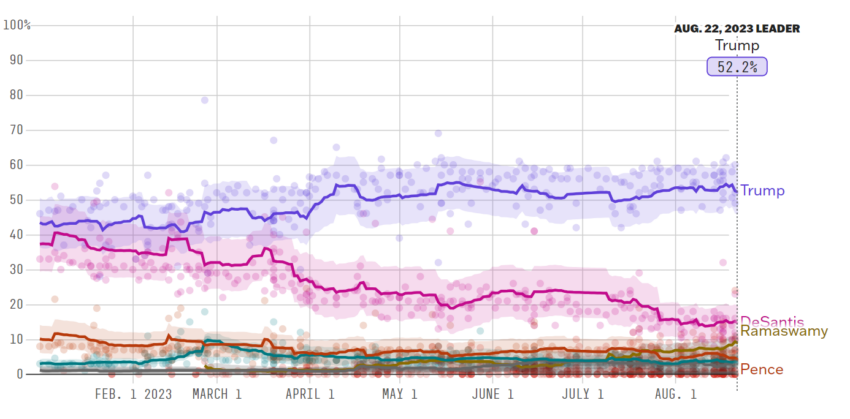

The candidate has stirred controversy. However, Ramaswamy is still a very distant third, hitting only 9% in the polls. He is still way behind former President Donald Trump who is at over 50%.

The attack on BlackRock is one of the most vociferous in recent months. Furthermore, it comes at a critical juncture for BlackRock, as it seeks spot Bitcoin ETF approval from the Securities and Exchange Commission.

If given the green light, this could be among the earliest spot Bitcoin ETFs for US investors. The asset manager led the recent wave of applications, submitting on June 16. Others, like Invesco, WisdomTree, ARK Invest, and Valkyrie, joined shortly after.

In a post on X (formerly Twitter), Ramaswamy singled out BlackRock, State Street, and Vanguard, the “Big Three” investment firms. He stated:

“BlackRock, State Street, & Vanguard represent arguably the most powerful cartel in human history: they’re the largest shareholders of nearly every major public company (even of each other) & they use *your* own money to foist ESG agendas onto corporate boards – voting for “racial equity audits” & “Scope 3 emissions caps” that don’t advance your best financial interests.

This raises serious fiduciary, antitrust, and conflict-of-interest concerns. As President I will cut off the real hand that guides the ESG movement – not the invisible hand of the free market, but the invisible fist of government itself.”

BlackRock Has Sought to Dodge the ESG Label

What is at stake is “our sovereignty itself,” said Ramaswamy during his speech, calling it a “monarchical vision.”

“We the people cannot be trusted with those questions. So business leaders and government leaders, and government leaders, and three letter acronym institutions have to work together, dissolving the boundaries of the public and private sector,” he added.

Since 2017, BlackRock has striven to reinvent itself as a leader of the ESG movement. Proponents of ESG want to encourage companies to do good things for the environment, society, and their own management.

However, ESG’s critics believe it foists a political agenda on businesses that should be looking after their own interests. And, in theory, those of their shareholders, who do not receive maximum returns through ESG investing.

But since then, BlackRock has sought to distance itself a bit from the movement. Or at least to avoid being tarred with its terminology. In June, Larry Fink, BlackRock’s CEO, said he had stopped using the “weaponized” term ESG in recent months.

Recent reports suggest that, despite the vicious attacks, BlackRock may have little to worry about. At least when it comes to its spot Bitcoin ETF.

Various sources have confirmed to Galaxy Digital’s Mike Novogratz that approval is a matter of “when, not if,” according to an earnings call on August 8. Galaxy Digital has partnered with Invesco on its own spot Bitcoin ETF application.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.