Venture capital spending on crypto and web3 projects has seen a resurgence in November. The money has started to flow again following a massive market rally that has seen Bitcoin hit another 2023 high today.

Crypto markets have surged 25% since the beginning of November, with around $340 billion entering the space. This has resulted in a resurgence of interest from venture capitalists who are pouring money back into the sector.

Crypto VC Funding Up

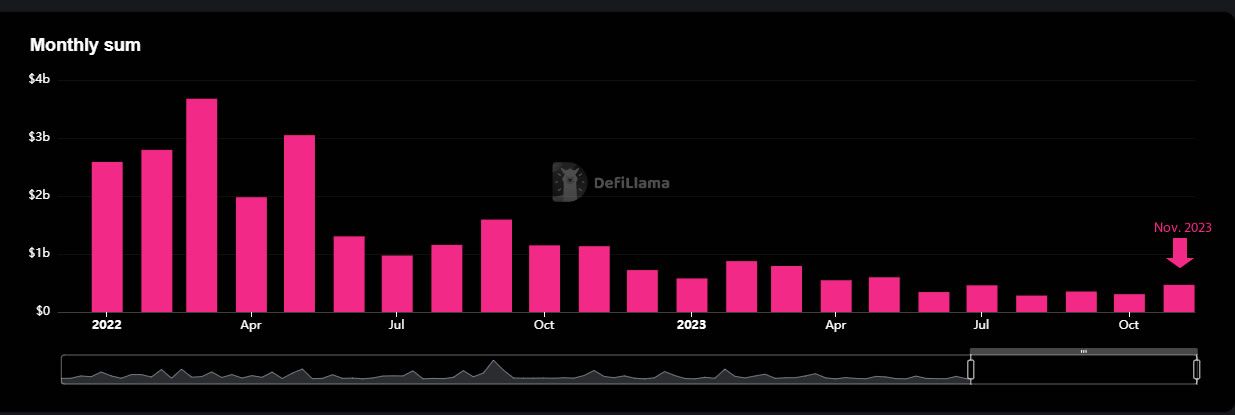

According to DeFiLlama, crypto venture funding has increased 52% in November from October levels.

There was $467.6 million raised by web3 firms in November compared to $307.7 million raised in October.

November’s figure, while still way down from bull market highs, is the highest VC funding has been for six months.

During the market cycle peaks, it was not uncommon to see several billion invested in crypto startups every month. However, the bear market saw monthly figures dwindle to a low of $283 million in August.

Read more: What’s the Relation Between Venture Capital Investment and Crypto Market Prices?

Almost a quarter of November’s venture funding total was raised by crypto exchange and wallet provider Blockchain.com. On November 15, the firm closed a $110 million Series E funding round led by UK-based Kingsway Capital with participation from Lakestar, Lightspeed Venture Partners, and Coinbase Ventures.

Another huge funding round was made by Fnality International in mid-November. The fintech firm, which is developing a blockchain-based wholesale payment system, raised $95 million in a Series B round.

Other notable raises in November include cryptography chipmaker Ingonyama with $20 million and regulatory-compliant blockchain investment firm Superstate with $14 million.

Moreover, double-digits were also raised by Matr1x Fire, Blast, and Privy.

More Money For Fintech

According to data from CryptoCarp, the figure for the month could be over $2 billion in crypto venture capital funding.

However, this data is slightly skewed as it includes debt refinancing and community raises, so it is not strictly venture capital. Moreover, it includes a broader range of fintech firms and not just crypto or web3.

Nevertheless, General Partner at Dragonfly Rob Hadick commented on the uptick on December 6.

“VC in crypto is starting to show some of the same signs of previous bull markets. Quicker deals, lighter touch diligence, bidding wars, more focus on friendly governance terms, etc.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.