The United States Personal Consumption Expenditure (PCE) Index increased by 3.4% year-on-year, staying in line with expectations. Bitcoin (BTC) increased by 0.69% following the announcement of the data.

The US PCE index helps analyze the spending behavior of consumers and how their spending habits react to the inflation data.

Bitcoin Price Shows Less Than 1% Rise After Announcement of US PCE Data

According to the US Bureau of Economic Analysis, the index surged by 0.4% month-on-month, aligning with expectations. Whereas the YoY increase was 3.4%

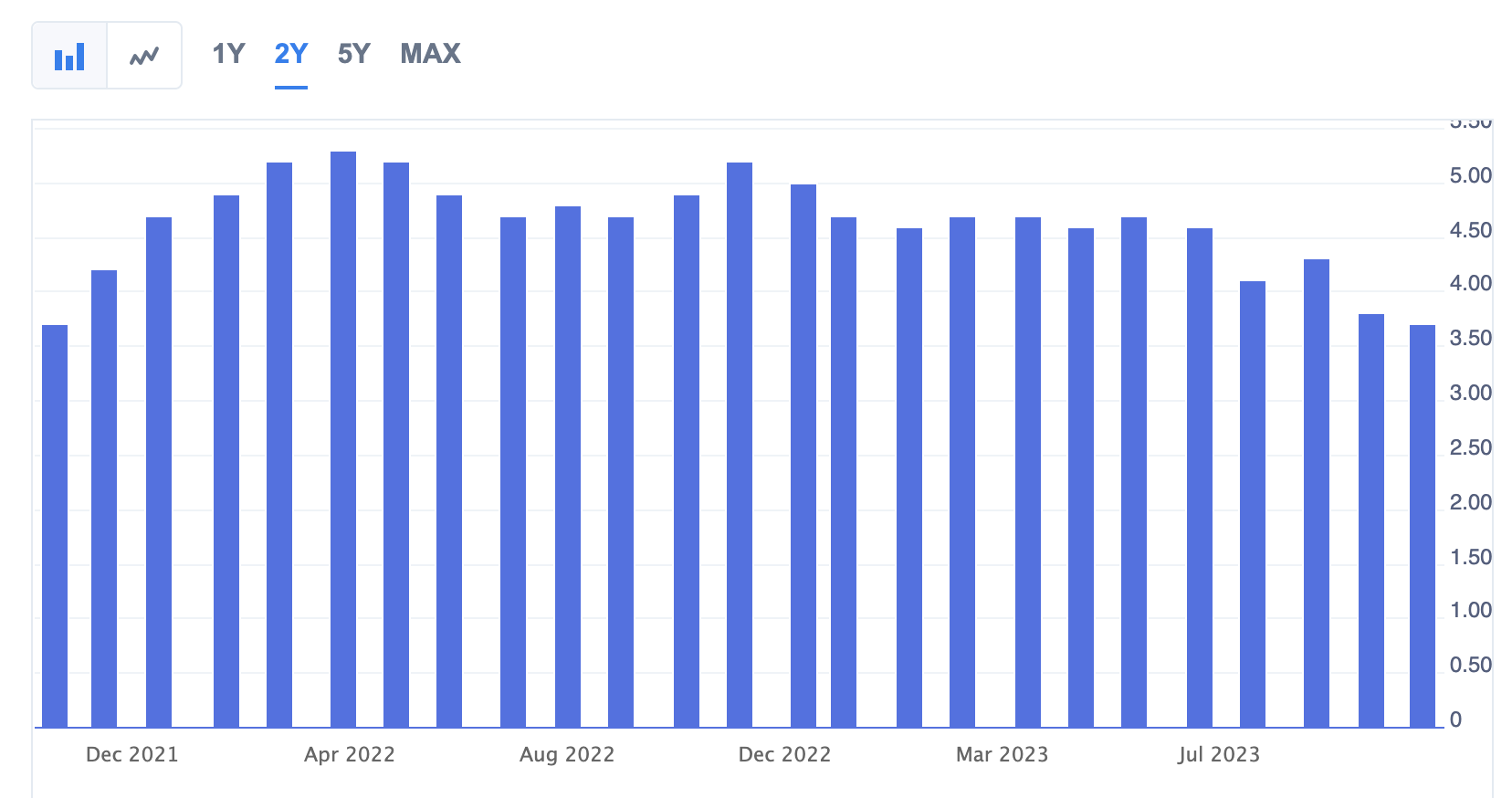

The core PCE index, which excludes food and energy, increased 3.7% YoY and 0.3% MoM. The core PCE inflation is nearly at its two-year low.

“Core inflation continues to lose speed,” Jeffrey Roach, Chief Economist for LPL Financial in Charlotte, told Reuters. “This report will not likely change the Fed’s view that inflation will slow in the coming months as demand slows.”

Analysts from Bank of America have suggested that even with the surprising surge in US economic expansion during the third quarter, a deceleration towards the year’s end could still result in a “soft landing” rather than no landing at all.

Last month, the core PCE index increased by 3.8% YoY. Whereas in August, it rose by 4.3%.

After the announcement of the data, the price of Bitcoin (BTC) increased by 0.69%, trading at $34,154. At the same time, the price of Ethereum (ETH) stood at $1,794, with a 0.89% increase.

Read more: 7 Ways To Handle Retirement With Increasing Inflation

Do you have anything to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.