Bitcoin (BTC) price dropped below the critical $27,000 support level for the first time since March 2023. But critical on-chain data currently shows no signs of a panic sell-off, giving hope of an early recovery. Will investors’ bullish price predictions be validated?

On Thursday, Bitcoin’s (BTC) price fell by 2.19%, bringing its May 2023 decline to 10%. While the latest CPI stats supported a positive shift in market sentiment. But, concerns about the US debt ceiling and a possible recession weighed heavier on BTC and the broader crypto market.

This added to concerns among Bitcoin maximalists about the negative impacts of the BRC-20 Meme Coin rave on transaction fees.

However, despite the skittish macro conditions, on-chain data shows no signs of a panic sell-off as long-term investors remain tight. Will it be enough to avoid a drop to $25,000?

Bitcoin Long-term Investors Remain Confident

One of the critical indicators of previous Bitcoin price crashes is a frantic sell-off by long-term investors. But currently, it does not look like this is the case for the current price correction.

Currently, BTC Mean Coin Age has remained solid this week, despite the heightened uncertainty surrounding the US debt-ceiling and money markets.

Mean Coin Age evaluates the average days that all coins in circulation have stayed in their current wallet addresses. When it rises, it means that, on average, investors are holding their coins longer.

Looking at the chart below, since the recent blip when Bitcoin price dropped below $29,000 around May 6, BTC Mean Coin Age has continued to rise this week.

Despite the 10% price retracement, BTC Mean Coin Age has increased marginally, from 1,465 to 1,472 days.

When Mean Coin Age rises during a price correction, as seen above, it indicates that most long-term investors across the network are holding firm.

While the recent downtrend appears to be driven by short-term traders and speculators, the bullish conviction among long-term holders could soon set the positive Bitcoin price prediction back on track.

Bullish Investors Are Looking to Buy the Dip at $25,000

In further support of the positive Bitcoin price prediction, it appears that bullish investors have now positioned to scoop the dip if the BTC price drops to $25,000.

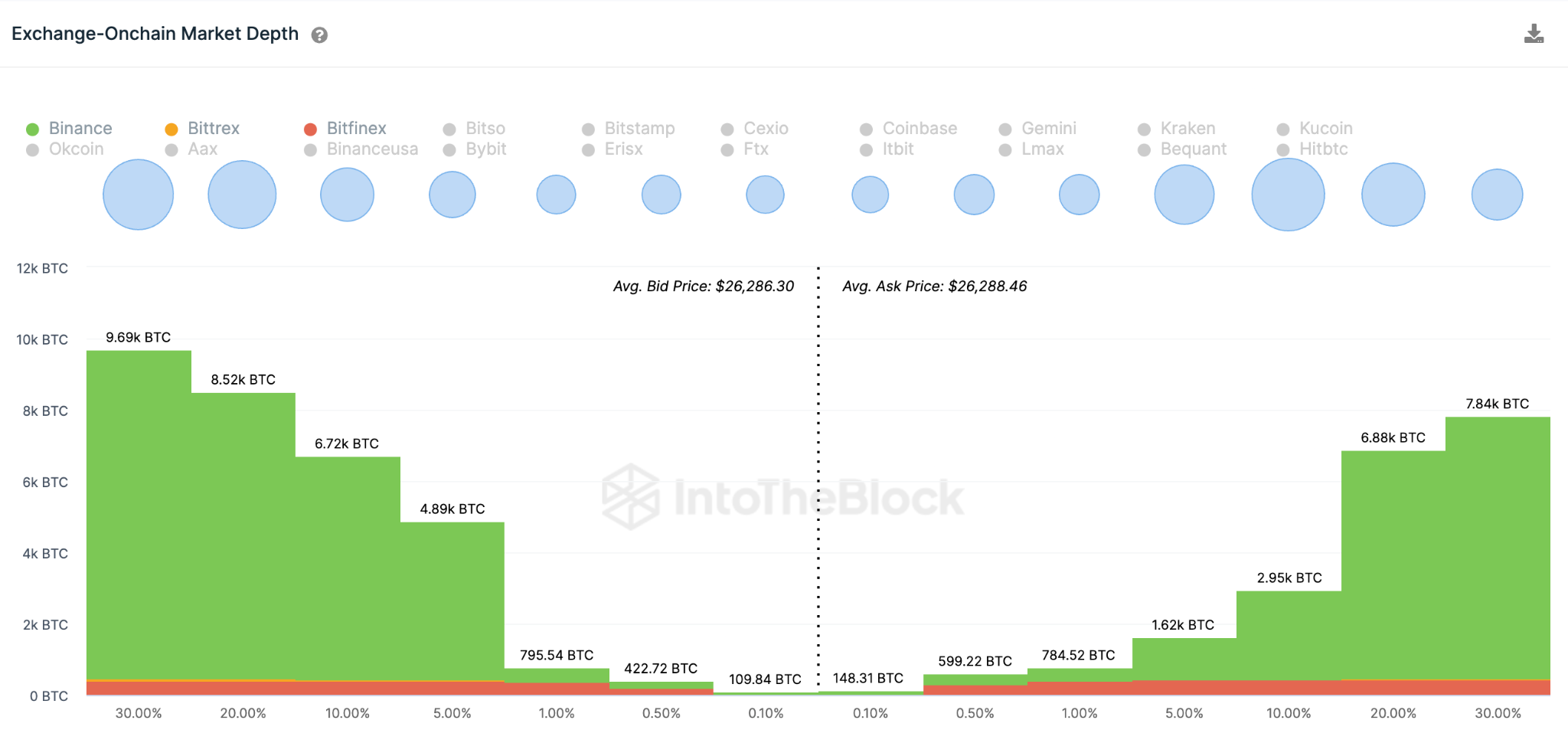

Specifically, the aggregate order books of exchanges presented below show that investors have placed active limit orders to purchase 4,890 BTC around the $25,000 range.

This is far higher than the 1,620 BTC sell-orders that traders have placed.

Moreso, the total demand for BTC across these exchanges currently towers above the sell wall by more than 10,300 coins.

With this level of excess demand and confidence among long-term holders, prices are likely to rise quickly when the macro markets sentiment turns positive again.

BTC Price Prediction: Bulls Can Push For $30,000 Again

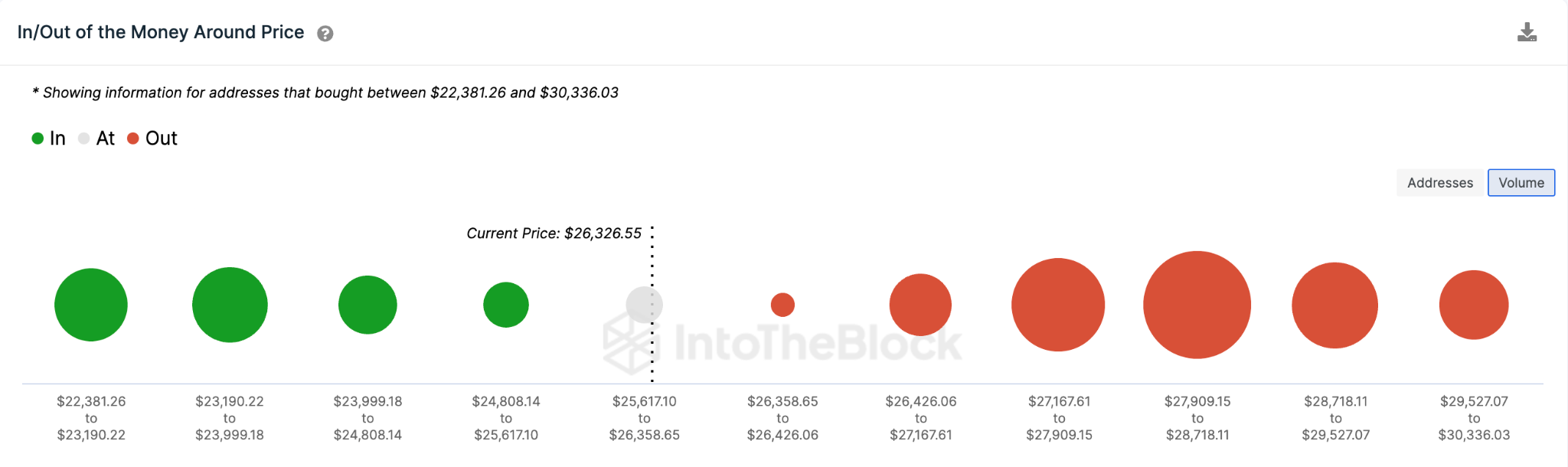

For the bulls to be confident of the bullish Bitcoin price prediction, BTC must first clear the initial resistance at $27,500. But 1.6 million investors that bought 686,000 BTC at an average price of $27,500 may prevent it.

If the positive BTC price prediction plays out as expected, the bulls can garner enough momentum to push for $30,000 again.

Still, the bears could invalidate the positive outlook if BTC sinks unexpectedly below $25,000. Although, as seen above, the bullish support from 91,000 addresses that had bought 75,000 Bitcoin for an average price of $25,259 will likely prevent the drop.

If that support level cannot hold, the bullish Bitcoin price prediction could be effectively invalidated and trigger a drop toward $23,000.