Crypto US stocks are back in focus today as MARA Holdings, Galaxy Digital (GLXY), and Strategy Incorporated (MSTR) react to Bitcoin’s latest breakout. MARA is up nearly 29% over the past month and continues to attract cautious optimism from analysts.

Galaxy Digital is gaining momentum after its Nasdaq debut, despite reporting a substantial Q1 loss. Meanwhile, Strategy remains volatile as it balances aggressive BTC acquisitions with a new $2.1 billion preferred stock offering and mounting legal scrutiny.

MARA Holdings (MARA)

MARA Holdings has shown notable strength over the past month, gaining nearly 29% and consistently trading above the $15 level since May 9. Although it closed 2.16% lower yesterday, the stock is up 4.8% in pre-market trading today.

Analyst sentiment remains cautiously bullish—seven of 17 analysts rate it a “Strong Buy,” nine suggest holding, and only one recommends a “Strong Sell.”

The average 12-month price target is $20.27, implying a potential upside of nearly 28% from current levels.

Financially, MARA reported Q1 2025 revenue of $213.9 million, up from $165.2 million a year earlier, largely due to a 77% increase in the average Bitcoin price. However, the Bitcoin halving led to reduced production, and price volatility at quarter-end resulted in a net loss of $533.4 million.

Despite the loss, MARA increased its Bitcoin holdings to 47,531 BTC, marking a 174% year-over-year jump. Technically, the stock maintains a bullish EMA setup, but the narrowing gap between lines suggests waning momentum.

If the trend weakens, MARA could test support at $15.67, $15.25, or $14.47; a renewed breakout could push it toward resistance at $16.69 and potentially above $17.

Galaxy Digital (GLXY)

Galaxy Digital (GLXY) is gaining traction following its Nasdaq debut. It closed up 2.42% yesterday and jumped another 7.84% in pre-market trading as Bitcoin hit fresh all-time highs.

The long-awaited U.S. listing on May 16 marked a significant milestone, with shares opening at $23.50. However, CEO Mike Novogratz criticized the process as “unfair and infuriating,” highlighting the company’s regulatory hurdles.

The listing comes amid a surge in market attention, though some investors remain cautious due to the company’s recently reported Q1 net loss of $295 million.

Despite the mixed sentiment, Galaxy is moving forward with ambitious plans, including collaborating with the SEC to tokenize its shares for integration into decentralized finance (DeFi) platforms.

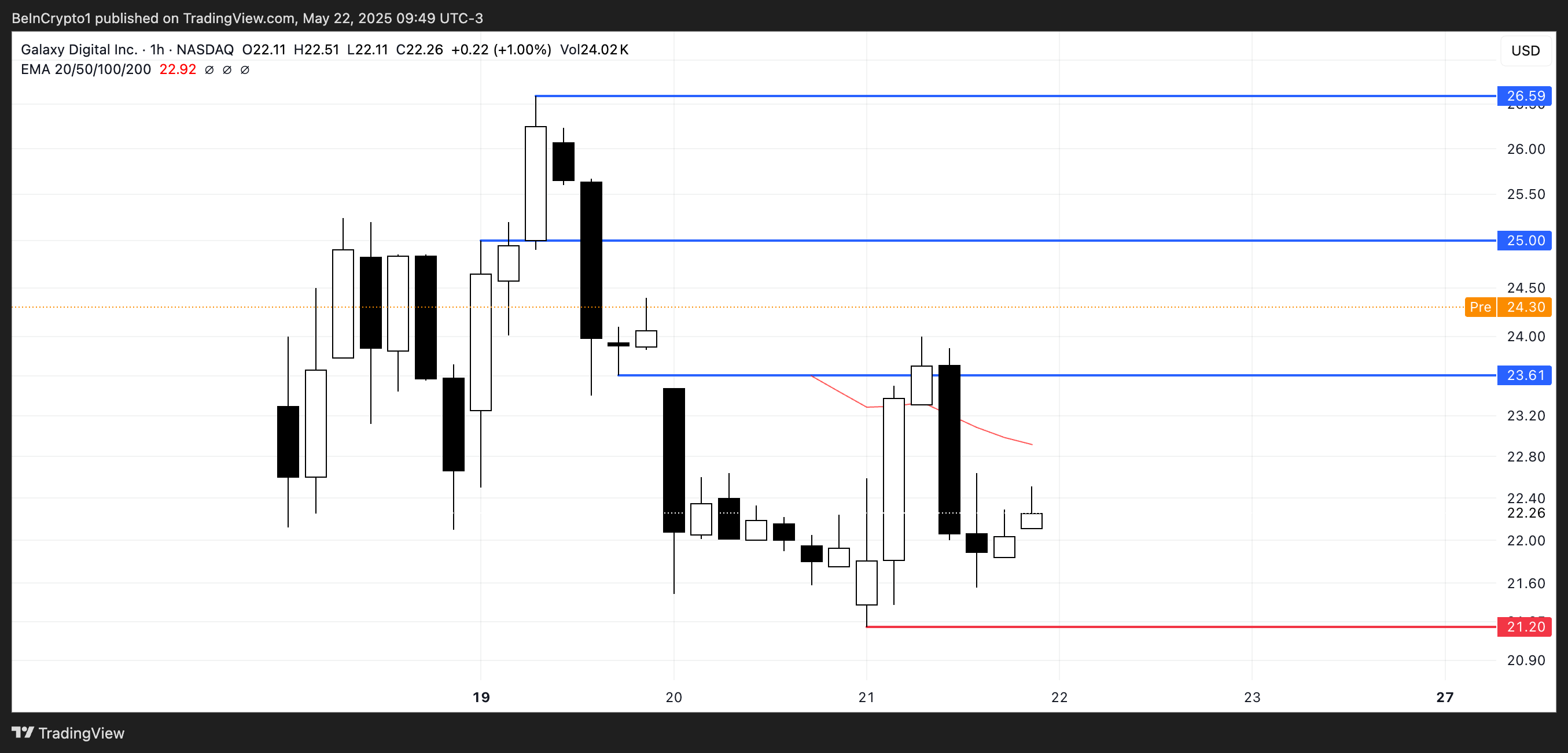

Technically, GLXY has been down 4.5% since its listing and is hovering near key support levels. If the pre-market momentum holds, the stock could challenge resistance at $25 and possibly push to $26.59.

However, a break below $22 would expose downside risk toward $21.20.

Strategy Incorporated (MSTR)

Strategy (MSTR) continues to trade in a volatile range, closing down 3.41% yesterday despite Bitcoin hitting a fresh all-time high. Still, it’s showing signs of recovery with a 2.64% gain in pre-market trading.

Analysts remain broadly bullish on the stock: Out of 16 analysts, 15 rate it a “Strong Buy” or “Buy,” with just one recommending a “Strong Sell.” The average 12-month price target is $527.20, a nearly 31% upside from current levels.

MSTR is up 39% year-to-date, fueled by Bitcoin’s strong performance and sustained institutional interest in BTC-related equities.

However, investor sentiment remains mixed following the company’s announcement of a $2.1 billion offering of 10.00% Series A Perpetual Strife Preferred Stock. Proceeds will be used for general purposes, including further Bitcoin acquisitions—an aggressive strategy that continues to divide opinions.

Adding to the pressure, Strategy faces a class-action lawsuit accusing executives of misleading shareholders about its BTC exposure. Technically, MSTR remains in an uptrend, but if momentum fades, it could test support at $377.77, with further downside toward $343.

However, a renewed wave of buying could push the stock back toward resistance at $430, especially if macro tailwinds for crypto persist.