Core Scientific (CORZ), Robinhood Markets (HOOD), and Strategy Incorporated (MSTR) are drawing attention today. CORZ rose after appointing Elizabeth Crain to its Board and reinforcing its shift toward AI infrastructure.

HOOD confirmed a $250 million CAD acquisition of WonderFi, expanding into Canada and going head-to-head with Wealthsimple. MSTR bought 7,390 BTC for $765 million, raising its total holdings to over 576,000 BTC, while facing a class-action lawsuit over its Bitcoin-focused strategy.

Core Scientific (CORZ)

Core Scientific (CORZ) closed yesterday with a modest gain of 0.65% and is already up 5% in pre-market trading, following the appointment of Elizabeth Crain to its Board of Directors.

Crain brings over thirty years of experience in investment banking and private equity, having co-founded Moelis & Company and held senior roles at UBS. She will also Chair the Audit Committee, a key position as Core Scientific continues its strategic shift toward AI-related infrastructure.

Her appointment, along with Jordan Levy’s being named Chairman, marks a pivotal moment for the company as it enhances its leadership team amid a broader transition in business focus and operations.

CORZ’s chart shows signs of renewed strength, with a potential golden cross forming on its EMA lines. Analyst sentiment remains overwhelmingly bullish—16 out of 17 analysts rate the stock as either a “Strong Buy” or “Buy,” with a one-year price target averaging $18.28, representing a 68.49% potential upside.

If momentum holds, the next key resistance level is $13.18, which could be tested in the short term.

However, investors should watch for support at $10.34; if it fails, the stock may retrace to $9.45 or even $8.49.

Robinhood (HOOD)

Robinhood has officially announced its $250 million CAD acquisition of Toronto-based WonderFi, signaling a major step in its Canadian expansion strategy.

The deal, which offers a 41% premium over WonderFi’s last closing price, will bring WonderFi’s 115-person team and established crypto brands—Bitbuy, Coinsquare, and SmartPay—under Robinhood Crypto’s umbrella.

The acquisition is set to close in the second half of 2025 and is expected to significantly bolster Robinhood’s crypto presence in Canada.

Robinhood Crypto executive Johann Kerbrat recently emphasized the company’s focus on tokenization and financial accessibility, highlighting how fractionalized assets like real estate can open up previously inaccessible markets to everyday investors.

The company submitted a 42-page proposal to the SEC seeking a federal framework for tokenized real-world assets. It aims to bring traditional financial markets on-chain with legally recognized asset-token equivalence.

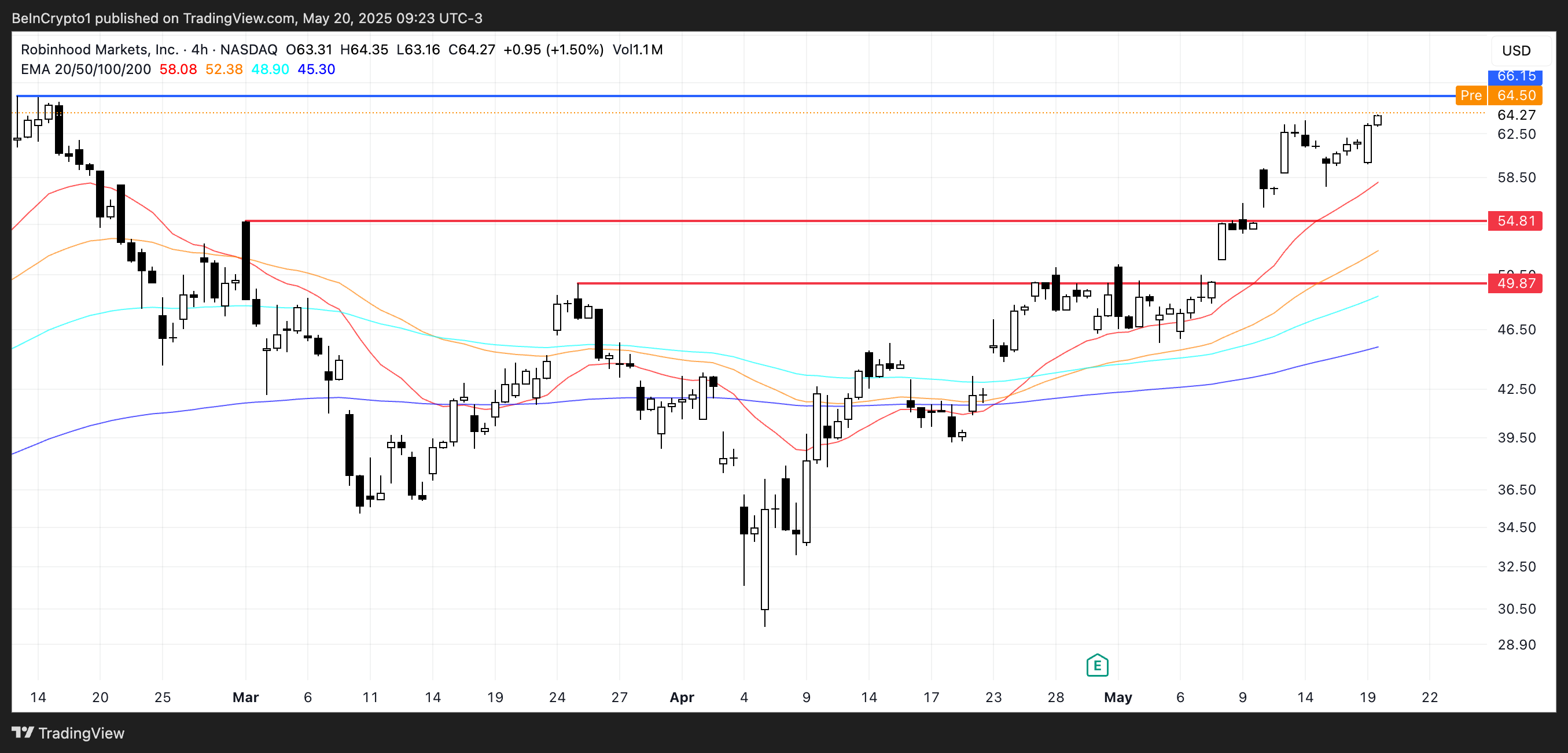

HOOD shares closed up 4% yesterday and are up slightly in pre-market trading, extending a remarkable 56% rally over the past 30 days. Technically, the stock’s chart shows strong momentum, with its short-term EMA lines clearly above the long-term trend—suggesting sustained bullish sentiment.

The next key resistance sits at $66.15; a clean break above that could push HOOD into uncharted territory, surpassing the $70 mark for the first time and establishing new all-time highs.

Strategy Incorporated (MSTR)

Strategy (formerly MicroStrategy) has added another 7,390 BTC to its corporate treasury, spending approximately $765 million as Bitcoin traded above $100,000.

This latest accumulation brings its total holdings to 576,230 BTC—acquired for $40.2 billion—now valued at over $59.2 billion, reflecting an unrealized gain of roughly $19.2 billion. However, the aggressive Bitcoin strategy continues to attract scrutiny.

The company and its executives, including Executive Chairman Michael Saylor, have been hit with a class-action lawsuit alleging they misrepresented the risks tied to their Bitcoin-centric investment approach.

Strategy is still the largest corporate holder of Bitcoin, despite legal pressure. Its Bitcoin-first approach has inspired similar treasury strategies in Asia and the Middle East.

MSTR closed yesterday up 3.4% and is down 0.47% in the pre-market. The stock is up nearly 43% in 2025. It is trading near key support at $404; if lost, it could fall to $383.

If momentum returns, MSTR could rise to $437. Analyst sentiment is strong—16 out of 17 rate it a “Strong Buy” or “Buy.” The one-year average price target is $527, implying a 27.5% upside.