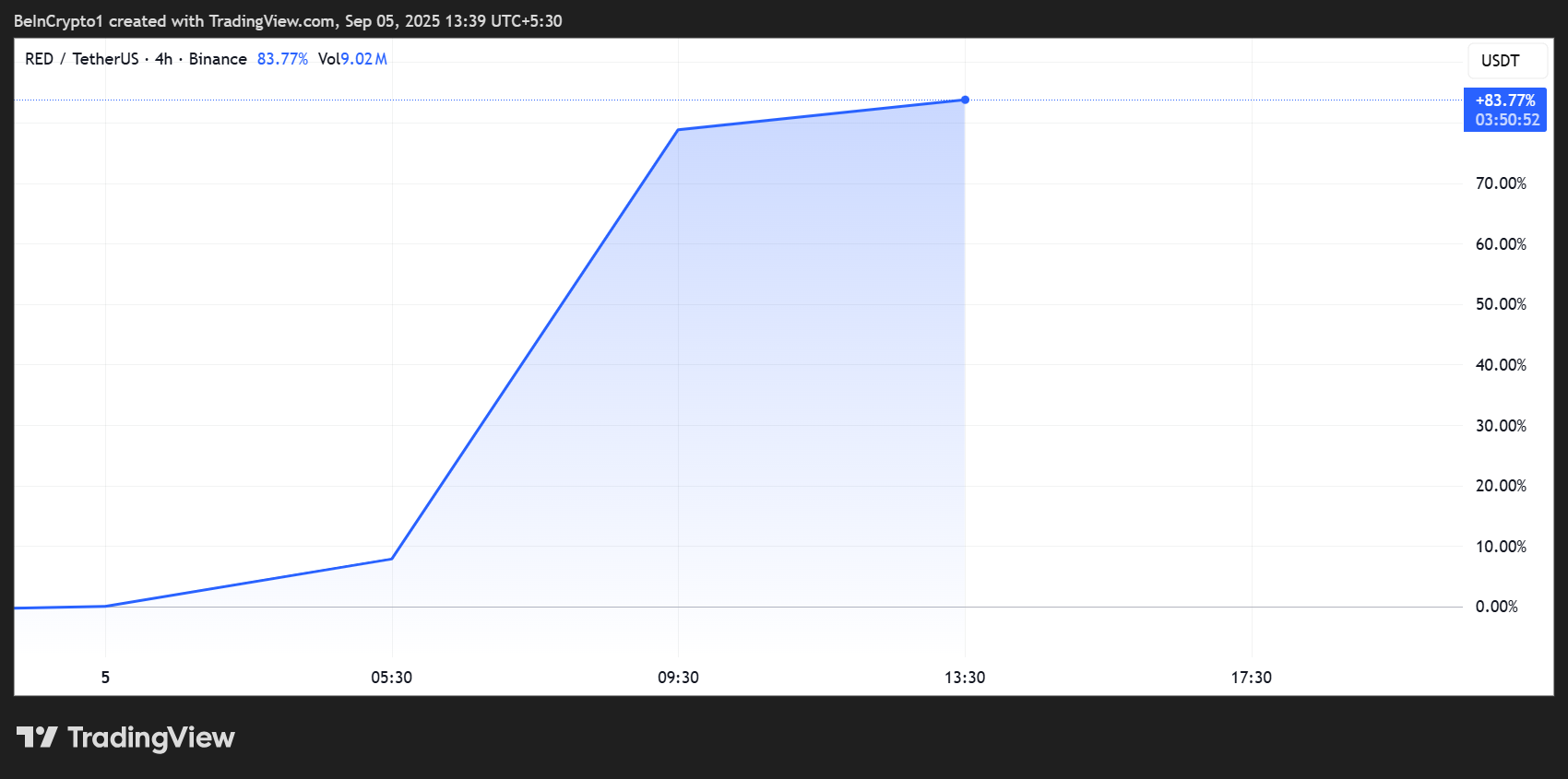

Upbit, Korea’s largest crypto exchange, fueled a surge of over 80% for RedStone (RED) on Friday, positioning it among the top gainers on September 5.

Token listings on popular exchanges tend to cause such reactions, similar to how altcoin delistings cause prices to tumble.

Upbit Lists RED: What Users Need to Know

The exchange said it would list RedStone on Friday, September 5. This would position RED to trade on the Korean won (KRW) market and support transactions based on the Ethereum network.

“Only deposits/withdrawals via the specified network (RED–Ethereum) will be supported. Always confirm the network before depositing,” Upbit articulated.

In the immediate aftermath of this announcement, RED soared by 83%, topping out at $1.1900 on the Binance exchange.

However, the exchange indicated that trading could be delayed if sufficient liquidity is not secured. For now, Upbit noted that the tentative listing time is 17:00 (KST) (UTC+9).

Further, for about 5 minutes after trading support begins, sell orders at prices 10% or lower than the previous day’s closing price (0.00000366 BTC or 568.8 KRW) will be restricted.

Only limit orders will be allowed for about two hours after trading support begins. This means all other order types will be restricted within this duration.

Meanwhile, the RED price reaction to the listing announcement is typical of how such developments influence altcoins’ values. When an asset secures listing on a popular exchange, the expectation of improved liquidity triggers investor attention.

For instance, American Bitcoin debuted on Nasdaq with a 60% surge. In the same way, the Caldera price surged 60% recently after Upbit and Binance listed its ERA token.

Conversely, but in a different light, token delistings cause the reverse, as seen with three altcoins, BAKE, HIFI, and SLF falling over the cliff after the Binance delisting announcement.

RedStone Acquires Credora to Bolster DeFi Oracle and Credit Infrastructure

The Upbit listing comes a day after RedStone, a blockchain oracle provider, announced the acquisition of Credora, an on-chain credit rating platform backed by Coinbase Ventures.

The move strengthens RedStone’s decentralized finance (DeFi) position by combining its real-time data feeds with Credora’s expertise in transparent credit assessment.

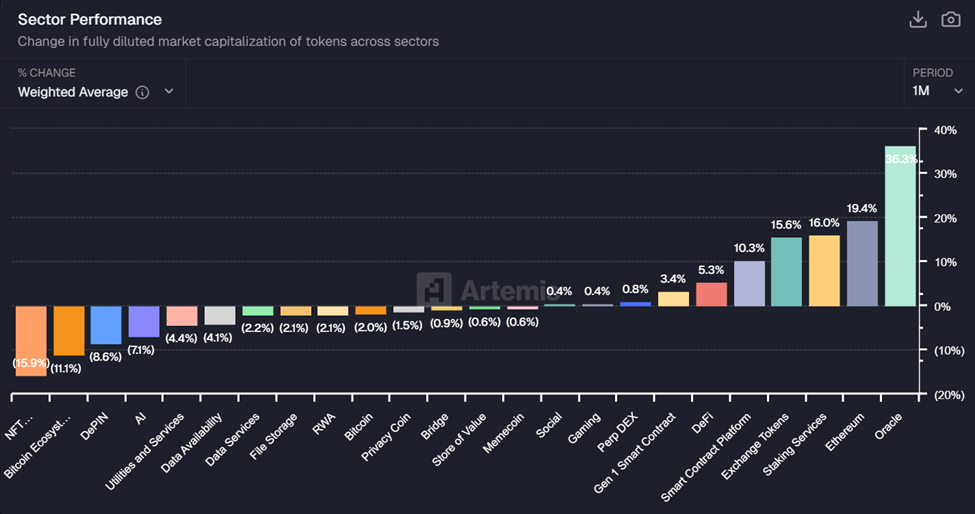

Over the past month, Oracle tokens have been one of the top-performing categories in the crypto market.

The interest comes as investors increasingly view data infrastructure as critical to DeFi’s next growth cycle.

RedStone’s deal positions it to ride that momentum by expanding into credit intelligence, a sector often cited as essential for institutional adoption.

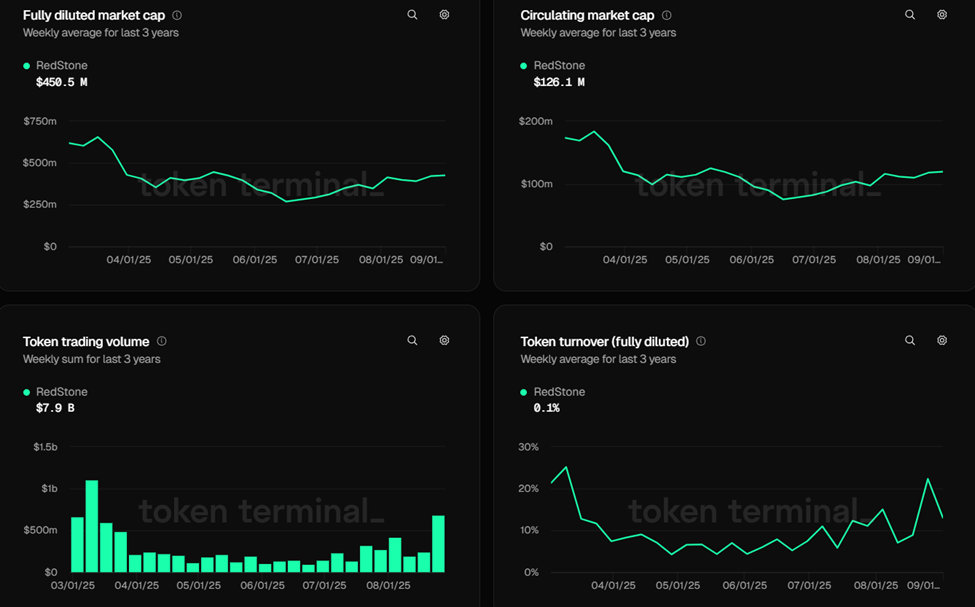

Still, concerns remain over RedStone’s network activity and total value locked (TVL). These metrics remain relatively low despite strong token performance. Data from Token Terminal and DefiLlama suggest usage lagging behind valuation.

These metrics raise questions about whether market excitement will translate into sustained adoption.