The United States central bank has released the minutes of its December meeting revealing its outlook on interest rates for the coming year.

The Federal Reserve’s latest policy statement was published on Jan. 3, as reported in this week’s economic calendar. The statement was crafted to signal that interest rates may have peaked, while still leaving the door open to future hikes if needed.

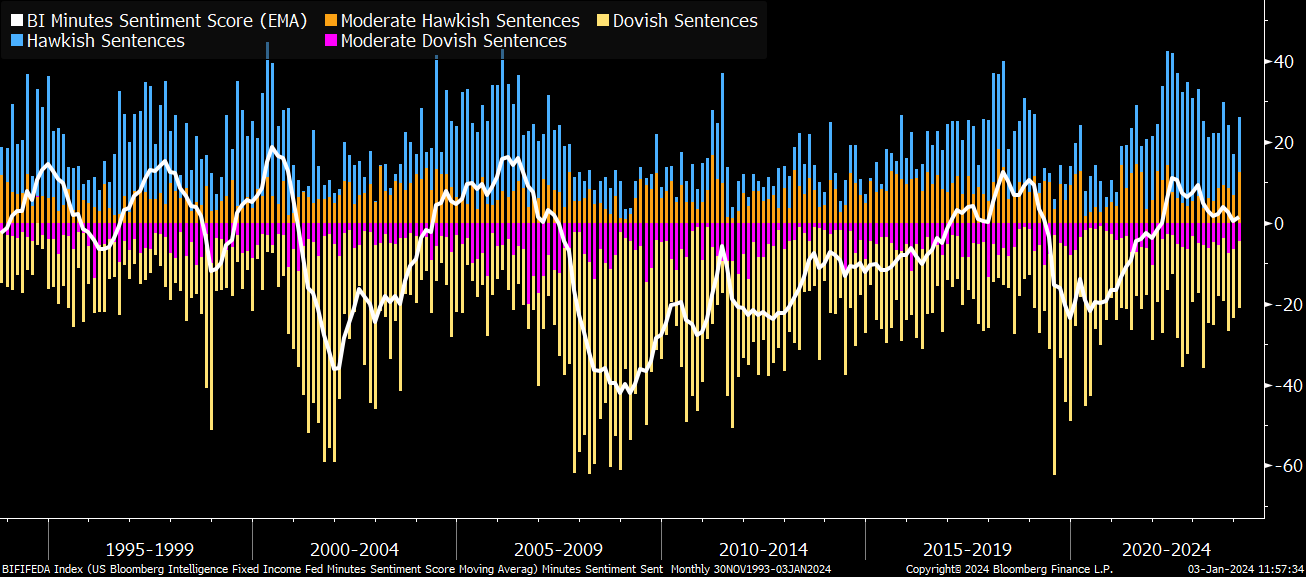

Fed Remains Slightly Hawkish

The Federal Open Market Committee which sets the rates agreed to hold its benchmark rate steady in a range between 5.25% and 5.5%.

It suggested that the rates, which have been this high since July, are at or near their peak.

Moreover, committee members indicated they expect three 0.25 percentage point cuts by the end of 2024. However, there was a little uncertainty surrounding this.

“In discussing the policy outlook, participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves,”

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Fed officials noted their past rate hikes are having the intended effect of slowing demand and cooling the labor market to bring down inflation.

Inflation has moderated significantly from its 2022 peak, allowing the Fed to pivot away from rate hikes. It is currently 3.1%, down from 9% in mid-2022, according to Trading Economics.

Fed officials also indicated that rates may need to remain high for some time. This would be to achieve further disinflation, as progress so far has been aided by supply chain improvements.

In addition to the hawkish stance, officials also discussed plans to eventually stop shrinking the central bank’s balance sheet.

Market Impact

US stock markets fell on Wednesday as investors digested the Fed’s last meeting minutes.

Crypto markets fell even harder, but their decline was connected to another leverage flush-out and rumors over potential Bitcoin ETF rejections.

Moreover, rates remaining high makes holding cash or bonds more attractive than high-risk assets such as crypto.

Crypto markets also rely heavily on leverage and loans. As rates go up, some speculative investors may get margin calls forcing the liquidation of crypto holdings which increases volatility.

Crypto market capitalization had fallen 4.6% on the day to $1.73 trillion at the time of writing.