Uniswap has finally launched its native UNI token with yield farming rewards on four new pools. The move could be huge for Ethereum as it’s the primary pair in all of those pools.

Token swapping DeFi protocol Uniswap has joined the farming frenzy with the long-awaited launch of its own UNI token. Being one of the largest decentralized exchanges in the industry, it will no doubt attract hordes of yield farmers looking to load up.

UNI Farming Has Arrived

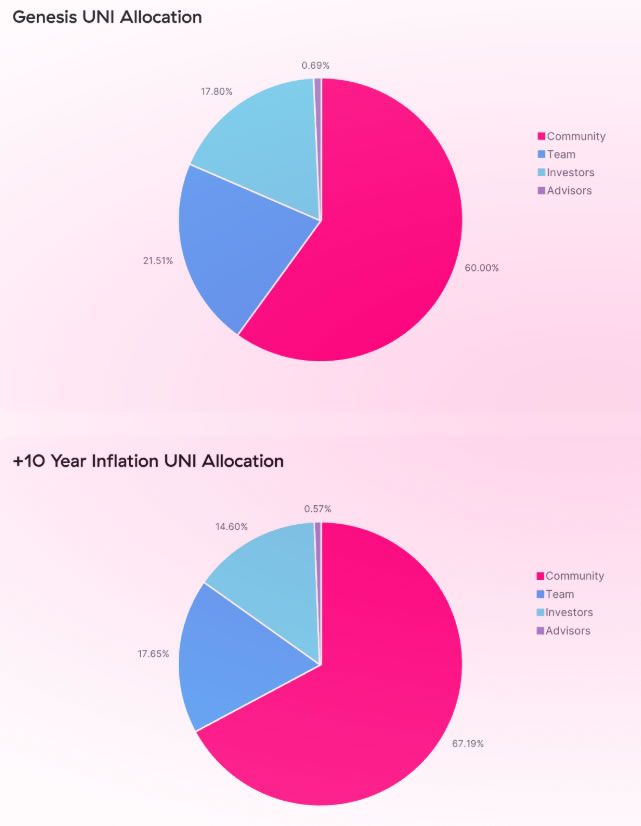

The announcement added that 60% of the UNI genesis supply is allocated to Uniswap community members, while a quarter of this has already been distributed to past users. A billion UNI have been minted from the get-go and will be distributed over the course of four years, it added.

We’re thrilled to announce that UNI, the Uniswap Protocol governance token, is live now on Ethereum mainet!

Read more:https://t.co/RD3mwEUyHn

Ethereum Address: 0x1f9840a85d5af5bf1d1762f925bdaddc4201f984

— Uniswap Labs 🦄 (@Uniswap) September 17, 2020

The further breakdown will allocate 21.51% to team members and future employees, 17.80% to investors, and 0.069% to advisors, all with a four-year vesting period. Historical liquidity providers, users, and SOCKS holders will be airdropped the 15% based on a snapshot ending on Sept 1, 2020.

There will be a perpetual inflation rate of 2% per year, which will start after four years to ensure continued participation and contribution to Uniswap at the expense of passive UNI holders.

Bullish For Ethereum

The long-awaited liquidity mining program will go live on Friday, Sept 18 2020 12:00 am UTC, running until Nov 17. The big news for Ethereum is that the four pools are all ETH based; ETH/USDT, ETH/USDC, ETH/DAI, and ETH/WBTC.

5 million UNI will be allocated per pool to liquidity providers proportional to liquidity in the respective pools. This roughly equates to 83,333.33 UNI per pool per day or 54 UNI per pool per block.

Within an hour of the announcement, Binance had already listed UNI for the following pairs UNI/BTC, UNI/BNB, UNI/BUSD, and UNI/USDT.

The crypto community started celebrating instantly with the majority of commentary stating how bullish this will be for Ethereum.

Compound Finance founder Robert Leshner expressed his happiness at Uniswap’s usage of Compound Governance system contracts to manage the protocol, adding that it is “Another win for open source, composability, and community tooling.”

Really proud of @UniswapProtocol for using the Compound Governance system contracts to manage Uniswap 🦄

Another win for open source, composability, and community tooling 🦄 https://t.co/XVW9k5BMok

— Robert Leshner (@rleshner) September 17, 2020

Cinneamhain Ventures Partner, Adam Cochran, added to the sentiment;

“Well played by @UniswapProtocol – this looks like a very well thought out governance and distribution model. This is going to be crazy for the ETH market!”

At the time of press, ETH prices were approaching $380 and increasing while UNI was changing hands for $3.50 according to Uniswap.info.