Over the past few days, there has been an overwhelming spike in the activity level on Uniswap.

Records from the on-chain analytics firm, IntoTheBlock, reveal several indicators are beginning to reach new milestones on Uniswap.

Smashing Records

The total daily traded volume on the protocol surged by 43% within the last two days. Jan. 25 closed with a trading volume of just below $925 million.

This increase has been accompanied by a similar movement in Uniswap transaction fees — more than doubling that of Bitcoin.

Data from the fee tracker, Crypto Fees, indicates that transactions seen on Uniswap account for about a quarter of the total fees on the Ethereum network. The total amount of fees paid for Jan 25. was $2.77 million.

The high gas prices recorded during this period are indicative of traders’ unwavering willingness to participate in the market at any cost.

While Uniswap’s liquidity has risen above $3.5 billion, its pool of interchangeable funds accounts for a 63% growth since the beginning of the year.

Uniswap Trails Ethereum in social Media Mentions

Following the rise of Ethereum’s price to new highs, Uniswap and Aave seem to have trailed the smart contract token as they have entered the highest-ranking topics of discussion on social media platforms.

Data from Santiment shows that UNI in third place among topics of interest for crypto enthusiasts. The native Uniswap token UNI came in third, just after Aave and Ethereum on this list.

The recent performance of Ethereum appears to have ignited this interest in related tokens. Meanwhile, DeFi also ranked fourth place after UNI. The DeFi ecosystem, which exists primarily on the Ethereum network, accounts for the majority of exponential growth in the level of interest in the smart contract token. This has contributed immensely to its overall value as some believe that it could lead to a parabolic advance for ETH prices.

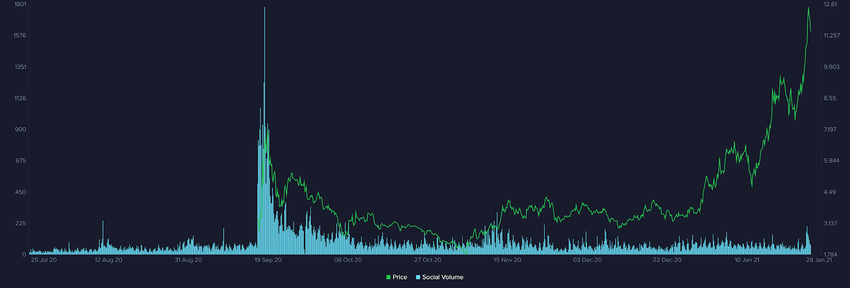

A closer look at the social volume metric for UNI explains the increasing engagements which began on Sunday. The volume, which sits at 62 points, corresponds with the recent upswing in the UNI price to $13 before retracing slightly.

UNI is one of the many DeFi tokens that has recorded substantial gains in this bullish market. Closing 2020 just above $5, UNI has made an impressive 136% gain to $12.26.