Uniswap (UNI) has been moving upwards since Feb 24 and is approaching the end of a bullish pattern.

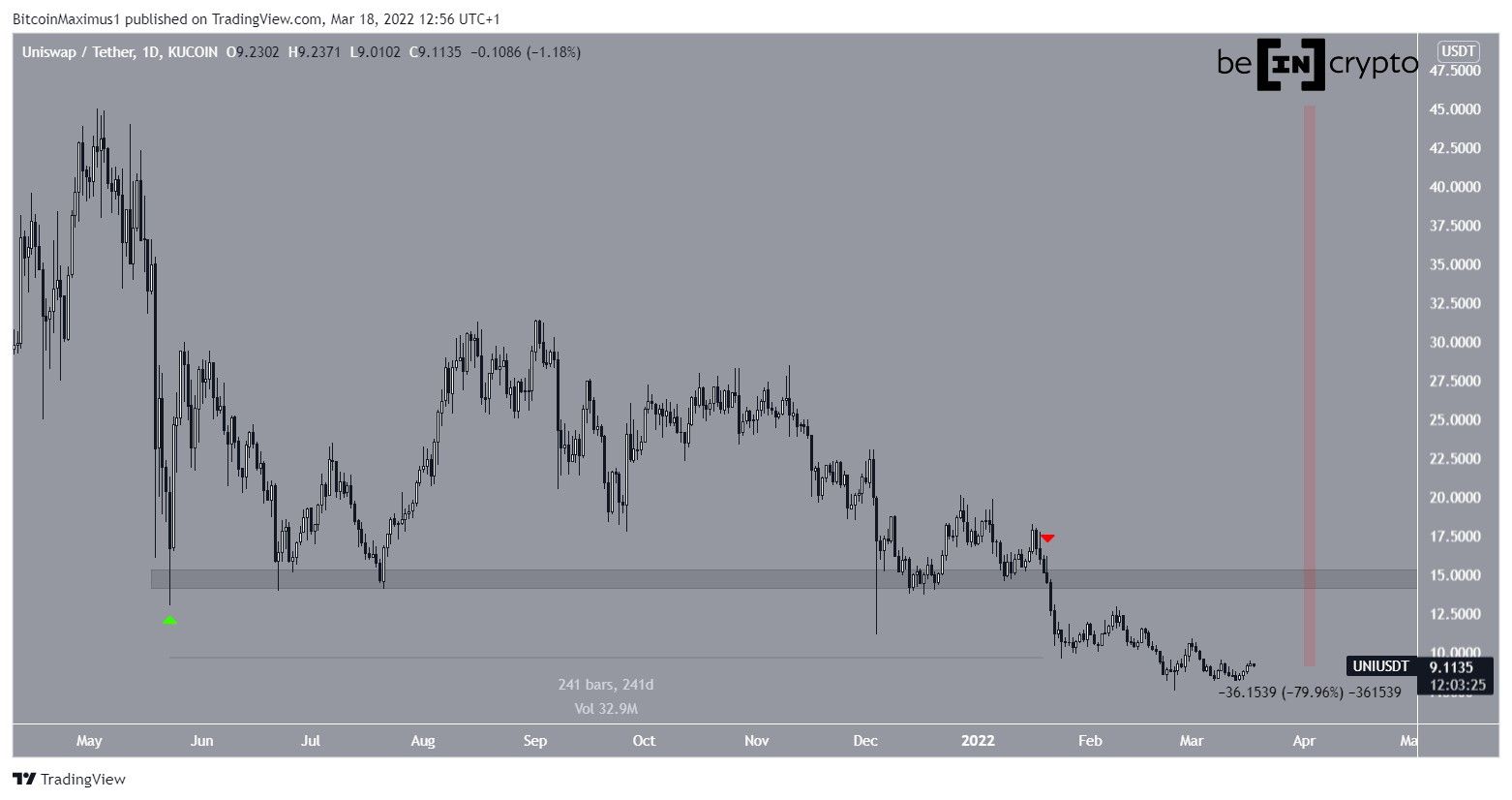

UNI has been decreasing since reaching an all-time high price of $45.04 on May 3. Beginning on May 23 (green icon), the price bounced at the $14.80 horizontal area and continued trading above it for 241 days.

However, it finally broke down on Jan 19, 2022 and proceeded to reach a low of $7.51 on Feb 24.

Measuring from the aforementioned all-time high, UNI has decreased by 80% so far.

Until the price manages to reclaim the $14.80 horizontal area, the trend cannot be considered bullish.

Current wedge

Since Sept 21, UNI has been decreasing inside a descending wedge. The descending wedge is considered a bullish pattern, indicating that an eventual breakout is likely.

In addition to this, technical indicators support the possibility of a breakout. This is visible in the bullish divergences that have developed in both the RSI and MACD (green lines). Such divergences usually precede significant bullish trend reversals.

When measuring the most recent portion of the downward movement, the closest resistance area is at $19.50. This is the 0.5 Fib retracement level and a horizontal resistance area.

Therefore, if a breakout from the wedge occurs, UNI would be expected to reclaim the long-term $14.80 resistance area.

UNI wave count analysis

Cryptocurrency trader @TheTradingHubb tweeted a chart of UNI, stating that the correction could soon come to an end.

The most likely wave count suggests that the decrease since the all-time high is part of an A-B-C corrective structure (white). In it, waves A:C have had a 1:0.618 ratio, which is the second most common in such structures. This also fits perfectly with the bullish divergences in the RSI and MACD.

The sub-wave count is given in black, showing that wave C has developed into an ending diagonal. Such patterns are usually retraced rapidly once a breakout occurs.

Therefore, if UNI breaks out from the wedge, it would confirm that the correction is complete.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here