The Uniswap decentralized exchange (DEX) hit a new milestone yesterday, hitting $100 billion in cumulative volume since its launch in 2020.

Uniswap has become the first DEX to cross this $100 billion volume milestone, a feat that founder Haydn Adams celebrated on Twitter on Feb 15.

The value counts all processed transactions since Uniswap’s launch in August 2020.

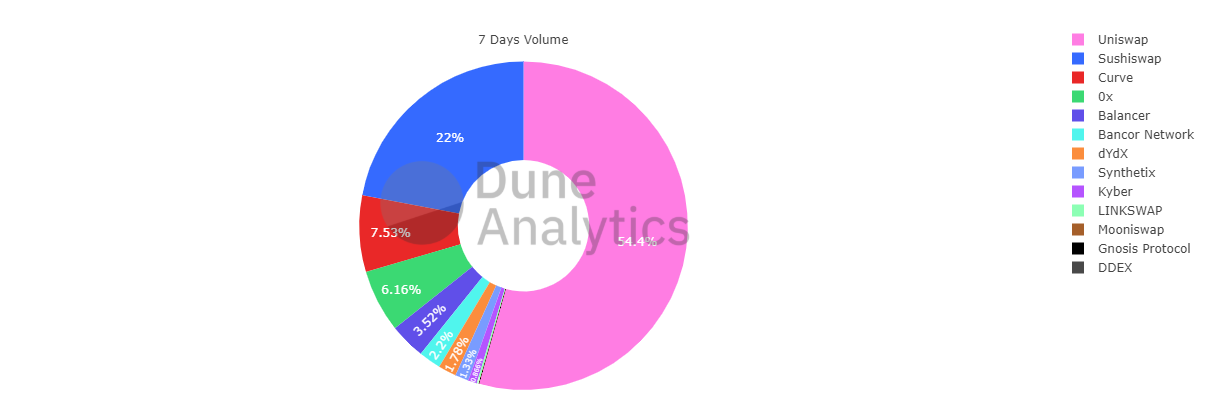

The statistic is just another reminder of Uniswap’s dominance over the DEX market. It’s the market’s most popular DEX by far, beating out SushiSwap and Curve Finance by a handsome margin. The latter two processed roughly $2.9 billion and $1 billion respectively in the last seven days, while Uniswap processed a staggering $7.3 billion.

Uniswap on a Tear

Uniswap continued its record-setting behavior from January 2020, which saw growth in numerous areas. This includes an approximate 25% increase in liquidity to $3.6 billion.

The popularity gives Uniswap a 54% share of the DEX market. However, despite its dominance, there is still heavy competition from Sushiswap and the like.

Uniswap is expected to release a new version of its platform, Uniswap v3, in the months to come. This should attract even more users — though it’s impossible to when DeFi markets will peak. By all accounts, it doesn’t look like the momentum is stopping any time soon.

The UNI token has also fostered much discussion. Uniswap users were airdropped 400 UNI tokens in September 2020. The token now stands at a price of approximately $20 — a 10x increase since its all-time low.

DEX Growth Going Up — Gas Fees Follow

Alongside the DeFi industry, DEXs have taken much of the spotlight since mid-2020. They are the hubs for yield farming and liquidity provision, but the growth of Ethereum-based services has come at a literal cost. Gas fees have been painfully high in recent weeks, with simple transactions occasionally costing over $100.

Layer-2 (L2)-based solutions like Loopring provide an alternative to the problem, though investors are still flocking to the likes of Uniswap and SushiSwap. These L2 exchanges conduct transactions at a significantly cheaper rate.

However, the much-hyped Ethereum 2.0, which would bring about sharding and other features to the protocol, also aims to fix these problems. ETH 2.0 will be released in phases, and traders are hoping that gas prices will go down as scaling solutions are deployed.