Uniswap (UNI) price has surged 4% over the last 3 trading days. But crypto investors appear to be unconvinced about the bullish momentum. Will the bears force another downswing?

Uniswap flashed a bullish price surge as the altcoin markets jumped 5% on April 26. However, on-chain data depicts Uniswap holders are increasingly moving tokens onto exchanges. Are the bears setting up a bull trap?

Uniswap Holders Are Loading Up Their Exchange Wallets

On-chain data shows that Uniswap investors have moved a significant number of their tokens onto exchanges in recent weeks. Glassnode’s Balance on Exchange metric tracks the real-time balances of a token deposited in recognized exchange wallets.

Looking at the chart below, the Balances of UNI deposited in Exchange wallets increased by 4.2 million tokens between Apr. 2 and Apr. 25. This represents an 11% increase in the number of tokens available to be traded on the market.

Typically, when investors move assets into exchanges, they may be looking to book profits in the short term. Hence, with investors moving such a sizable amount of tokens into exchanges within a short period of time, Uniswap could witness some selling pressure in the coming days.

Bears Piling Up Sell Orders

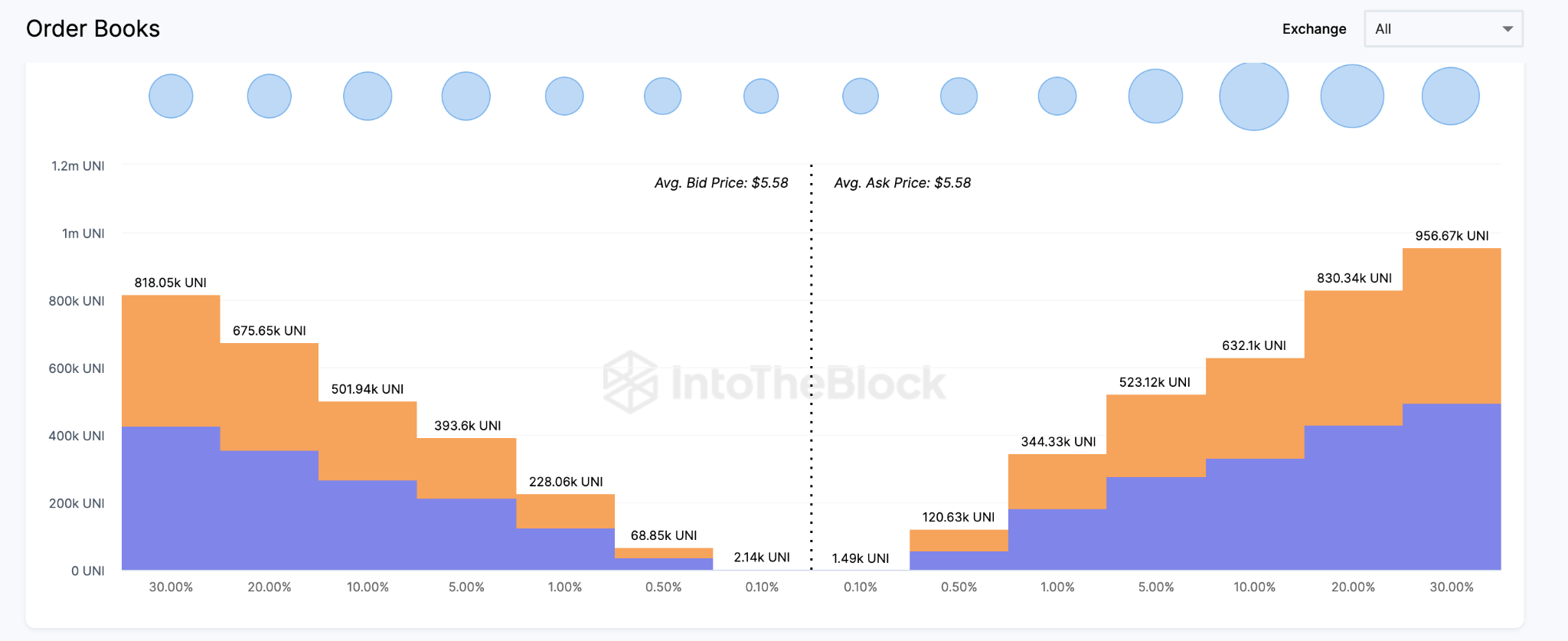

UNI holders could be looking to pile on significant sell pressure across top exchanges, according to data presented by IntoTheBlock. The Exchange Market-Depth chart provides insight into the number of active buy-orders and sell-orders placed by investors across prominent crypto exchanges.

The Exchange Market Depth chart below shows how active sell orders tower above the current demand. Specifically, the bears have placed sell orders for 3.4 million UNI tokens. Meanwhile, buyers have only requested 2.7 million tokens around the current prices.

This dearth of demand could culminate in downward pressure on the price of UNI over the coming days. This is because when the supply of an asset exceeds demand, the market gets saturated momentarily.

Unless Uniswap can attract significant traction in the coming days, many UNI holders may want to lower their prices to fill their limit orders.

UNI Price Prediction: Unlikely to Beat the $5.9 Resistance

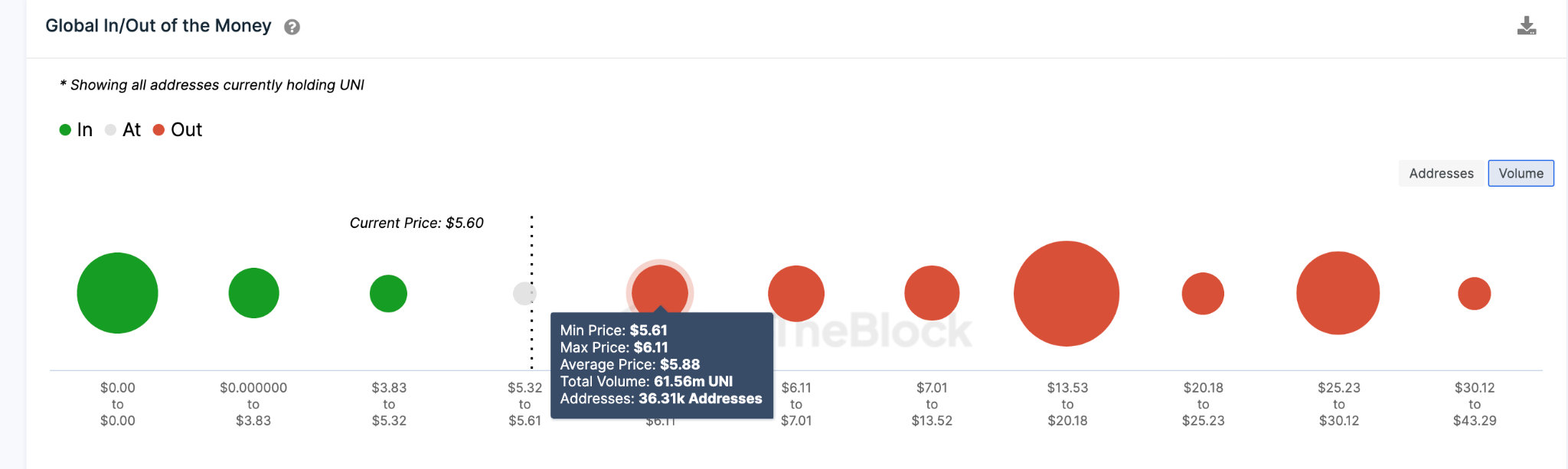

IntoTheBlock’s Global In/Out of The Money data shows that UNI price must sustain the $5.32 support to prevent a bearish reversal. However, a panic sale from 13,000 holders that bought 9.4 million tokens around this price level could force the downswing.

And if Uniswap loses that support, holders can expect a sharp slump toward $4.7. Around that zone, a cluster of 30,000 addresses holding 18 million tokens can provide more formidable support.

Still, the bulls could negate the bearish outlook if UNI can break above $5.90. Although, as stated above, the resistance from the 36,000 addresses holding 61 million UNI tokens could impede the rally. But if the bulls manage to breach that resistance, Uniswap price could rise as high as $6.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.