The Uniswap (UNI) price reached a new all-time high on March 8 but has been decreasing since.

Similarly, Polkadot (DOT) has been falling back since reaching its all-time high on Feb. 20.

New All-Time High for UNI

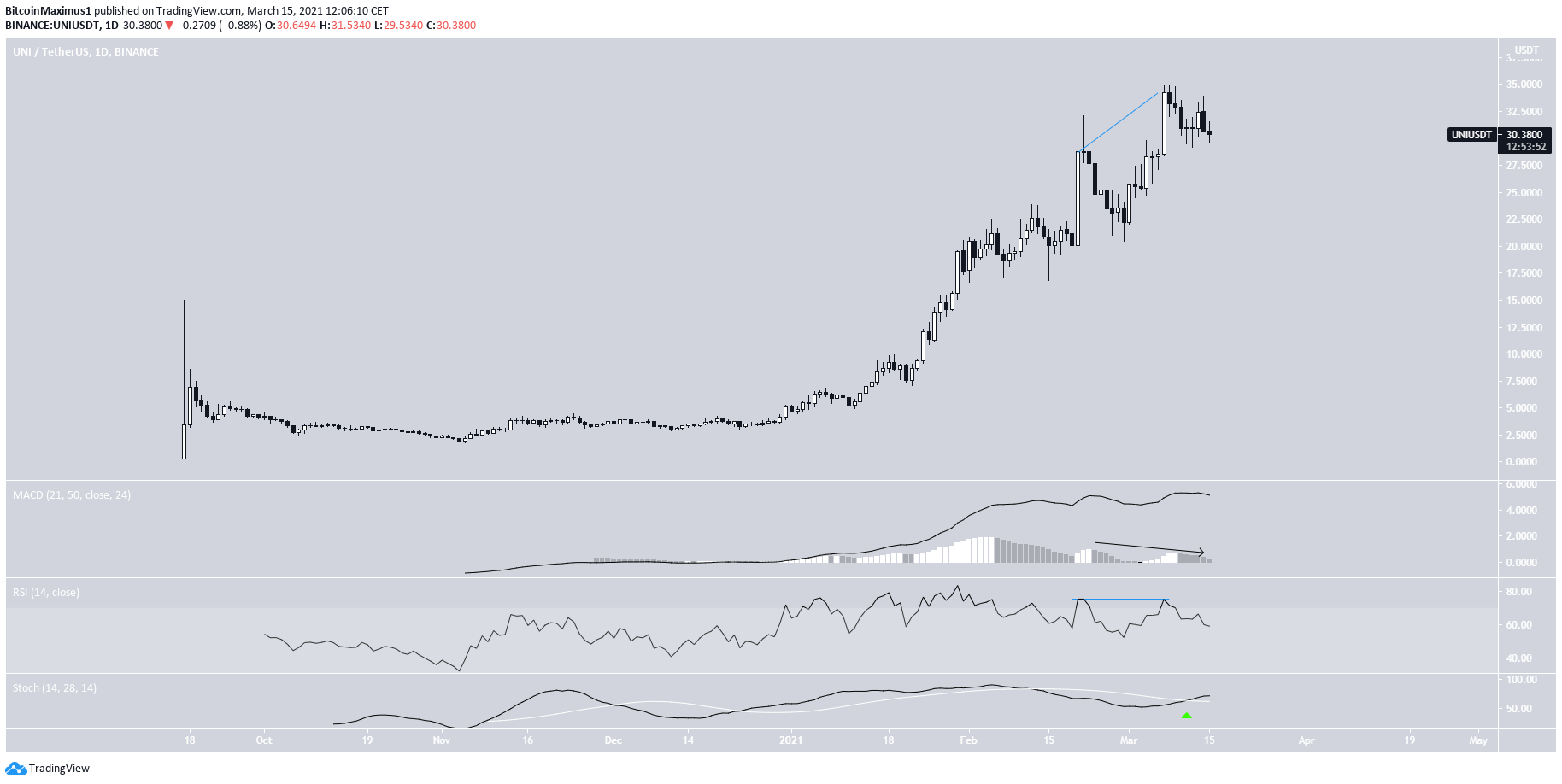

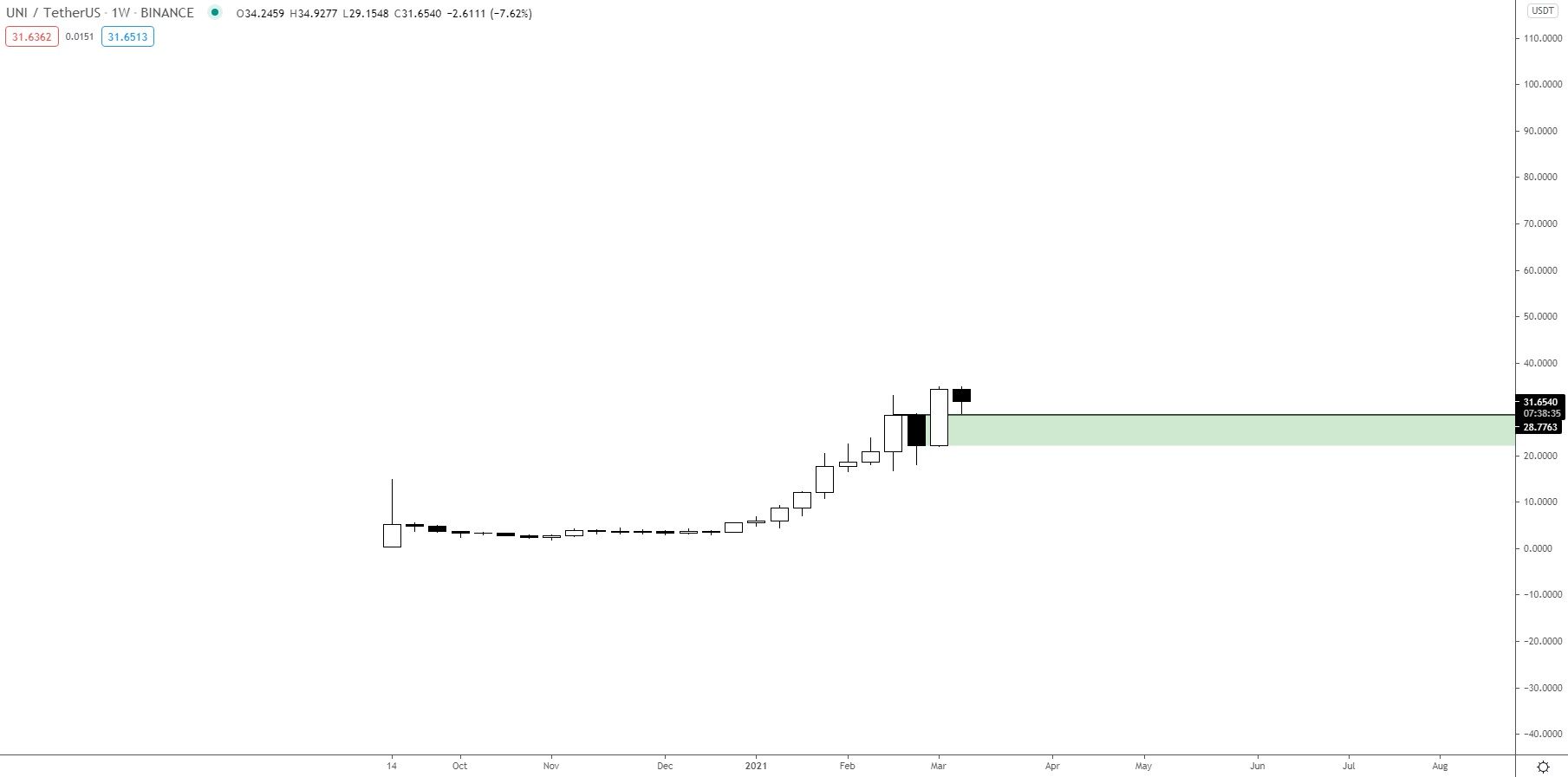

UNI has been on an extended upward move for the entirety of 2021. On March 8 it reached a new all-time high price of $34.92.

However, it generated some bearish divergence and has decreased slightly since.

The Stochastic oscillator has made a bullish cross, and the MACD is still positive despite some decreasing.

Therefore, it’s still likely that the long-term trend is bullish.

Cryptocurrency trader @TheEurosniper outlined an UNI chart, stating that the current retest is expected to provide a bounce. This could take UNI towards a potential new high.

However, UNI has fallen below the retest levels since. Short-term indicators are bearish, so it’s possible that UNI will continue to decrease.

If so, the next closest support area is found at $28. This level also coincides with an ascending support line.

Afterwards, a breakout and new all-time high would be expected.

DOT Lags Behind

DOT has also been on a downward path since Feb. 20 when it reached a new all-time high of $48.20.

Unlike UNI, technical indicators in the daily time-frame are bearish.

If DOT were to keep falling, the closest support levels would be found at $27.95 and $23.50. These are the 0.382 and 0.5 Fib retracement levels of the previous upward movement.

The six-hour chart shows a potential breakdown from an ascending support line.

If this is a zig-zag corrective structure, DOT could decrease all the way to $23.70.

This fits with the 0.5 Fib retracement level from the previous chart. In addition, it would give waves A:C a 1:1 ratio.

The MACD and RSI support this possibility.

Conclusion

While both UNI and DOT are expected to eventually reach new all-time highs, a short-term drop is expected first. The drop is likely to be sharper for DOT than it is for UNI.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.