TRX, Tron’s native coin, has seen a modest 4% increase over the past week. However, underlying on-chain metrics suggest that this bullish momentum may be short-lived.

This analysis explores these on-chain metrics and highlights the key price targets TRX holders need to pay attention to.

Tron Holders Exit the Market

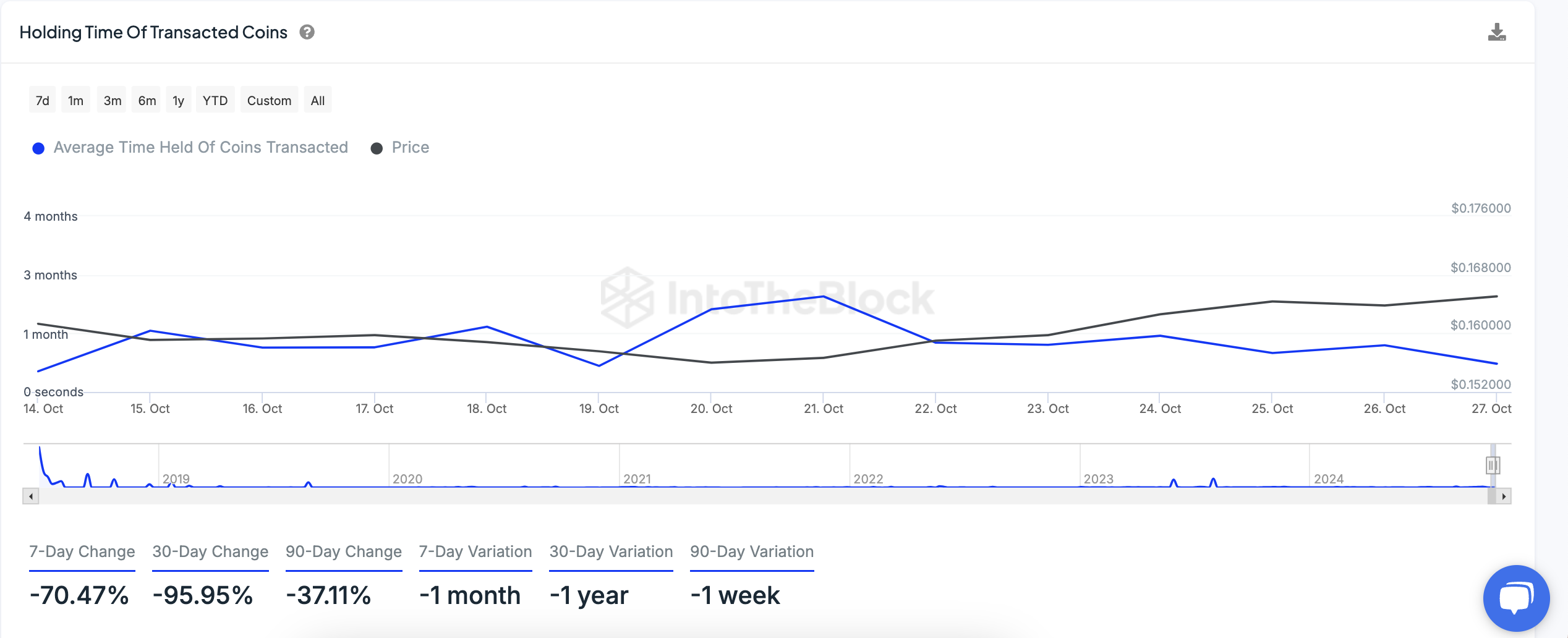

Over the past week, Tron’s Coins Holding Time has declined by 70%. This metric tracks the length of time that coins have been held before being traded.

A declining coin holding time is often seen as a bearish signal. This means that investors hold the asset for shorter periods of time on average. It indicates investors are less optimistic about the asset’s near/long-term prospects.

Read more: 7 Best Tron Wallets for Storing TRX

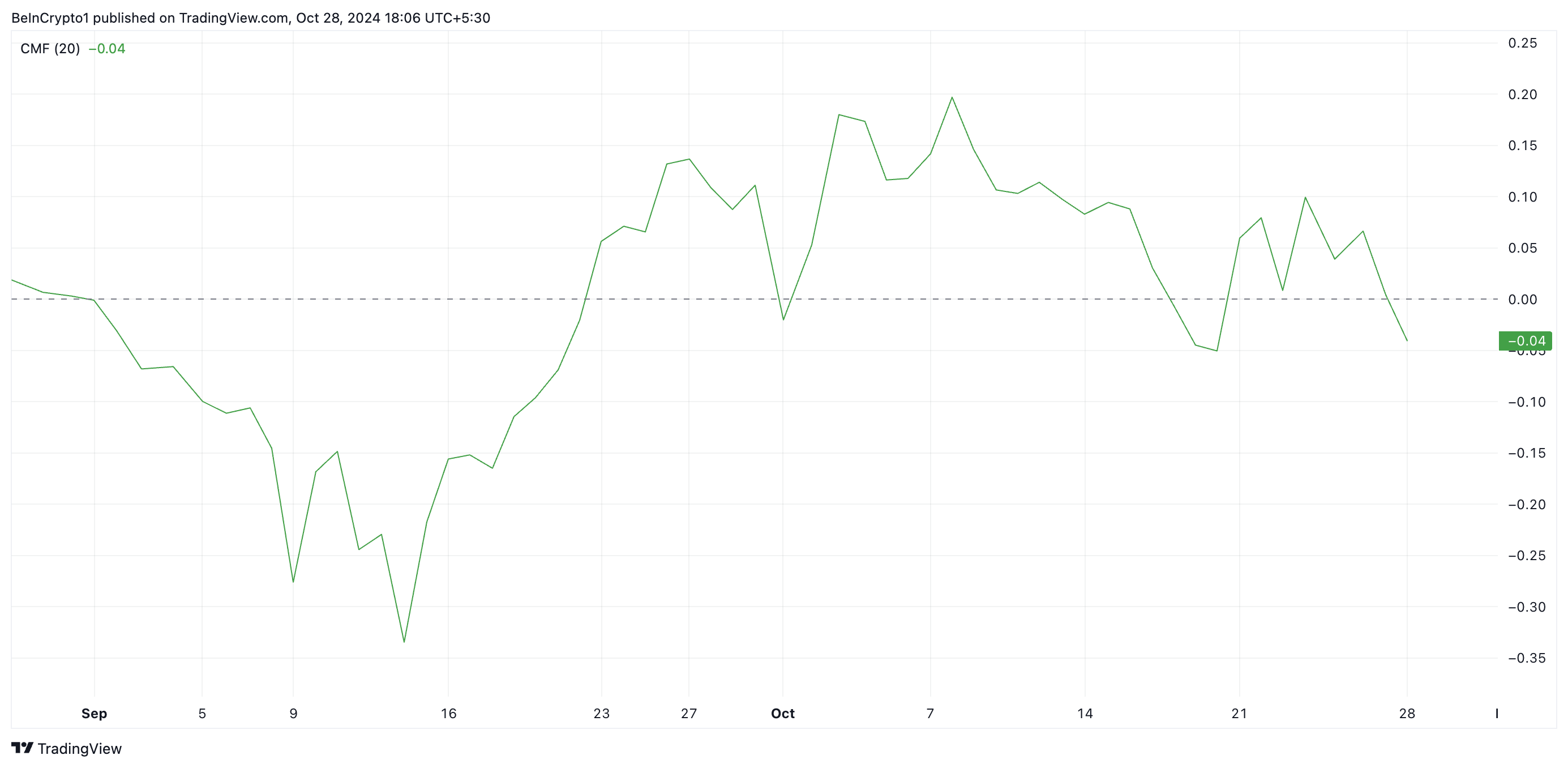

The recent 70% drop in Tron (TRX) coins’ holding time over the past week points to a rise in selling activity. This shift aligns with Tron’s Chaikin Money Flow (CMF) indicator, which has fallen below the zero line to -0.04.

The CMF measures buying and selling activity, and TRX’s CMF decline, even as the price rose over the past week, highlights a bearish divergence. This divergence suggests that the recent price increase lacks strong buyer support, with many traders reducing their positions.

Additionally, the coin’s exchange netflow spiked during the review period, supporting the bearish outlook. This metric tracks the difference between the amount of assets flowing into exchanges and the amount flowing out.

IntoTheBlock’s data shows that over the past seven days, 2.22 million TRX coins have been sent to exchanges. When this metric surges, it indicates increased selling pressure. This means that the uptick in TRX inflow into exchanges can lead to a decline in its price as its supply on these platforms increases.

TRX Price Prediction: Pay Attention To This Support Level

TRX is trading at $0.1638 at press time, attempting to break above the $0.1645 resistance level. However, increasing selling pressure could make this breakout challenging in the near term, potentially pushing TRX’s price down toward the key support level at $0.1555.

Read more: TRON (TRX) Price Prediction 2024/2025/2030

Conversely, if market sentiment shifts from bearish to bullish, TRX’s price may successfully breach this resistance line and aim for $0.17 — a level it last reached in August.