According to a recent report, President Trump’s new tariffs may fundamentally shift the dynamics of global Bitcoin (BTC) mining, making the US less competitive than other countries.

The tariffs, announced by the Trump administration on April 2, are set to escalate the cost of essential mining equipment, impacting imports and even the global hashrate.

Impact of Trump’s Tariffs on Bitcoin Mining

Jaran Mellerud, CEO of Hashlabs Mining, highlighted that new reciprocal tariffs would increase the cost of importing mining machines to the US by at least 24% compared to tariff-free countries like Finland.

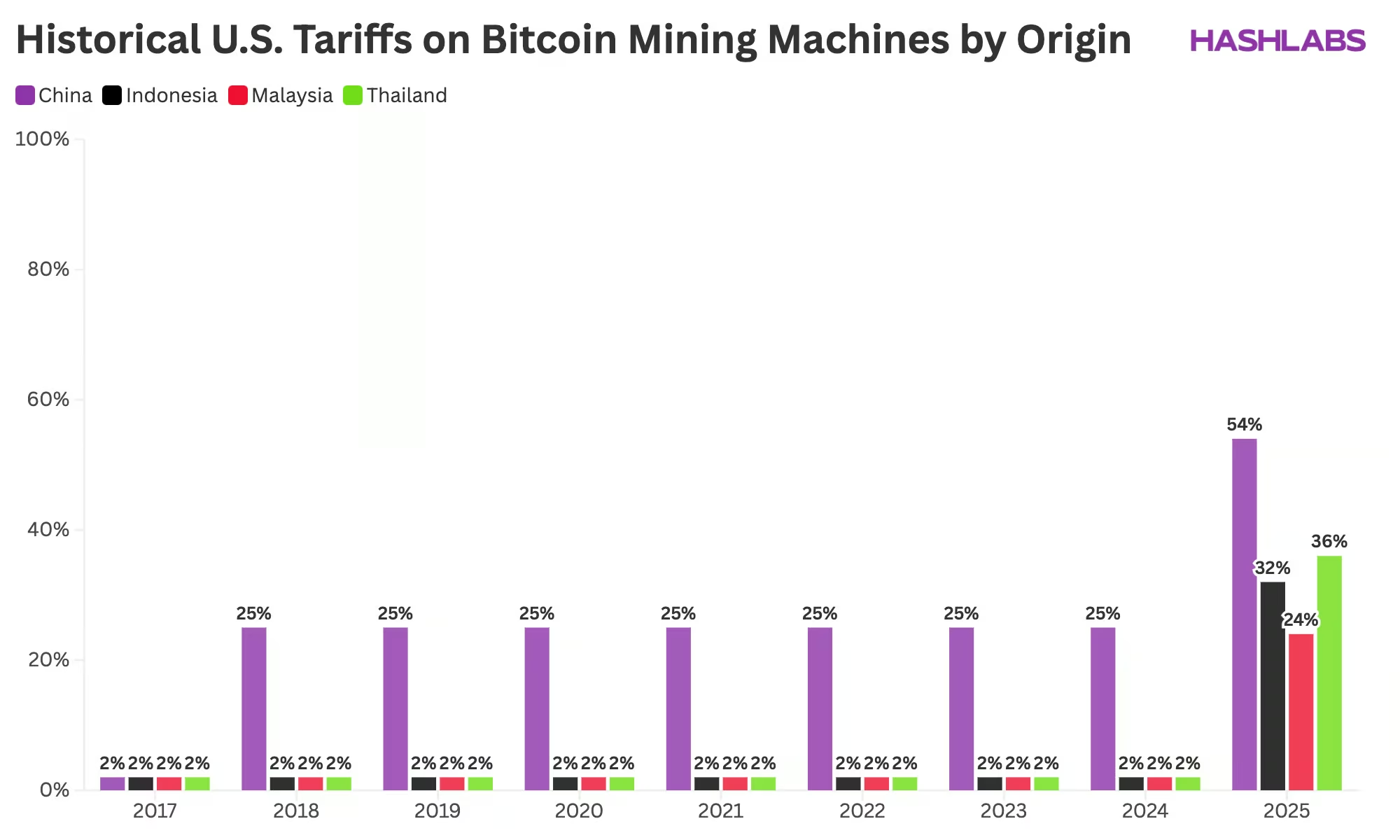

Notably, the US is heavily reliant on Bitcoin mining hardware produced in Southeast Asia, especially by companies like Bitmain, MicroBT, and Canaan. He explained that while a 25% tariff on machines imported from China has been in effect for several years, manufacturers managed to sidestep it by relocating production to Southeast Asia.

“This strategy was effective until earlier this month when Trump raised tariffs on goods imported from Indonesia, Malaysia, and Thailand to 32%, 24%, and 36%, respectively,” Mellerud stated.

As a result, these manufacturers can no longer fully avoid these steep tariffs. Therefore, the demand would decrease, and in turn, manufacturers may find themselves with surplus equipment. To clear this excess inventory, they may be forced to lower prices to appeal to buyers in other regions.

“While it’s difficult to predict exactly how much machine prices will fall—since mining profitability also plays a role—we can confidently say that, based on basic economic principles, a decrease in demand for an asset typically leads to a drop in its price,” the report read.

Bitcoin Hashrate Redistribution Likely as US Mining Costs Rise

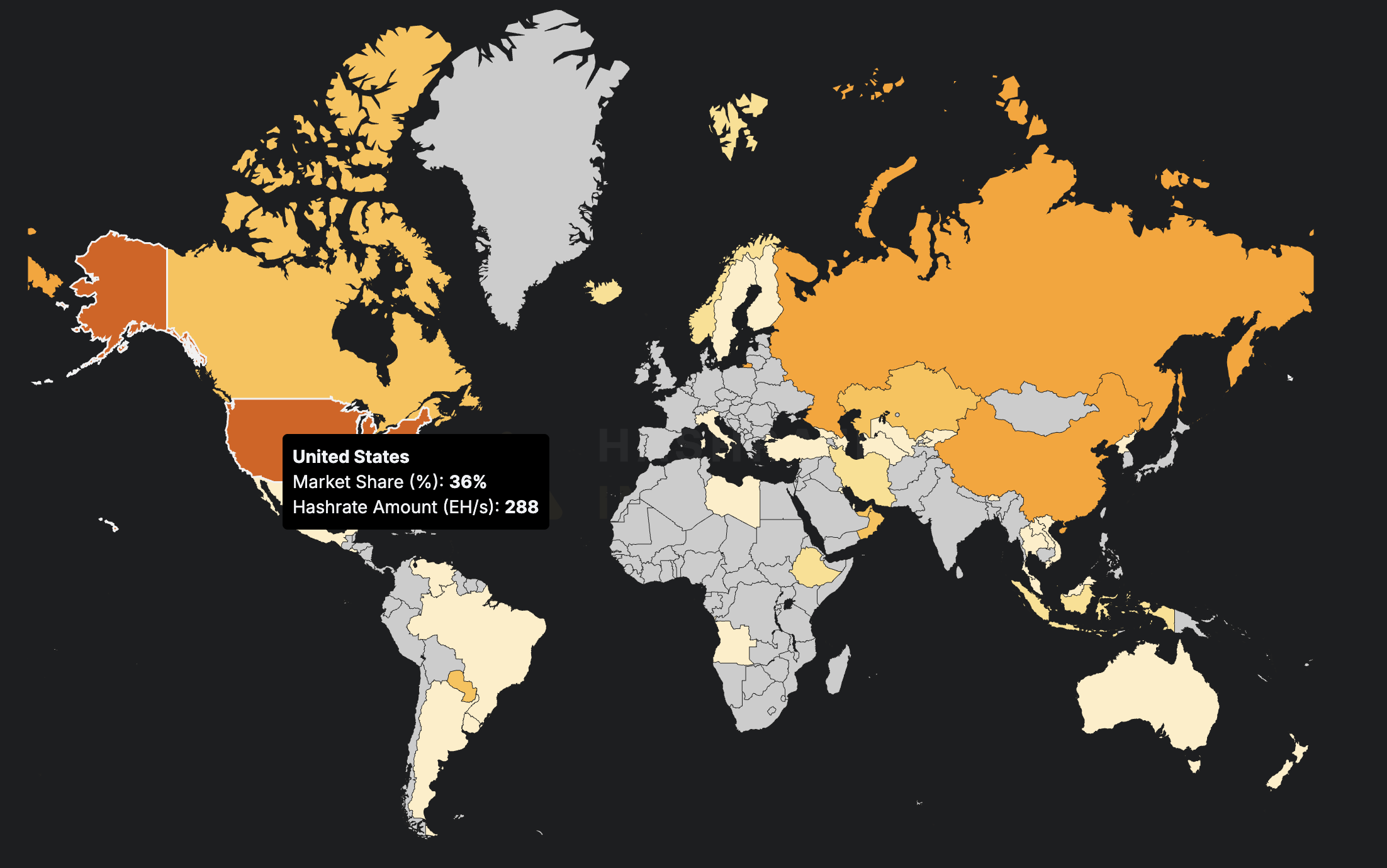

Meanwhile, the repercussions of Trump’s tariff hikes go beyond just rising Bitcoin mining equipment prices. The US, which currently accounts for approximately 36% of the global Bitcoin mining hashrate, is at risk of seeing its share of the market shrink.

Higher operational costs in the US will make it less attractive for miners to expand their operations. Nonetheless, miners in countries unaffected by the tariffs could gain a competitive edge.

“In the broader picture, this may lead to a more geographically diverse Bitcoin mining landscape than ever before. While the US will remain a major player, its dominance will fade, giving rise to a more globally distributed hashrate,” Mellerud remarked.

In addition, the absence of significant US expansion could reduce the global growth rate. In the short to medium term (the next 1-2 years), global hashrate growth could be slower than anticipated. However, the report emphasized that it’s unlikely that the US mining sector will stop growing completely.

“The assumption of a 36% reduction in global hashrate growth should be seen as an absolute upper limit— the actual impact will likely be somewhat lower,” Mellerud stated.

Moreover, in the longer term, if US mining growth slows, miners in other countries may increase their expansion to fill the gap.

Mellerud also pointed out that even if Trump reverses the tariffs, the damage to long-term investor confidence cannot be undone. The sudden implementation has made it harder for investors to commit to large-scale, long-term investments in the US mining industry. This unpredictability creates a challenging environment for attracting the capital needed for sustained growth.

“In an industry as capital-intensive as bitcoin mining, policy stability is crucial—and right now, that’s in short supply,” he said.

President Trump’s decision to impose reciprocal tariffs has triggered a broader stock and cryptocurrency market crash. According to BeInCrypto, the President’s move to implement a 104% tariff on imports from China led to a significant downturn in Bitcoin. The largest cryptocurrency fell briefly below $75,000.

Furthermore, the total global cryptocurrency market capitalization fell by 6.0% over the past day, highlighting the far-reaching consequences of this policy.