The Tellor (TRB) price is barely holding on above the support line of a parallel channel. A breakdown from this channel is expected, which would take TRB towards the support levels outlined in the article.

Channel Support

Since reaching a low of $12.78 on Oct. 7, the TRB price has been trading inside what looks like a parallel ascending channel.

TRB fell below the midline of the channel on Nov. 24 and has been declining since, currently trading just above its support line. The line also coincides with the minor $22 support level.

Due to the significant overlap of the movement inside the channel (red lines) and the fact that parallel channels are usually corrective in nature, a breakdown from this pattern is likely.

Furthermore, technical indicators on the daily time-frame are decisively bearish, supporting this possibility.

Possible Breakdown

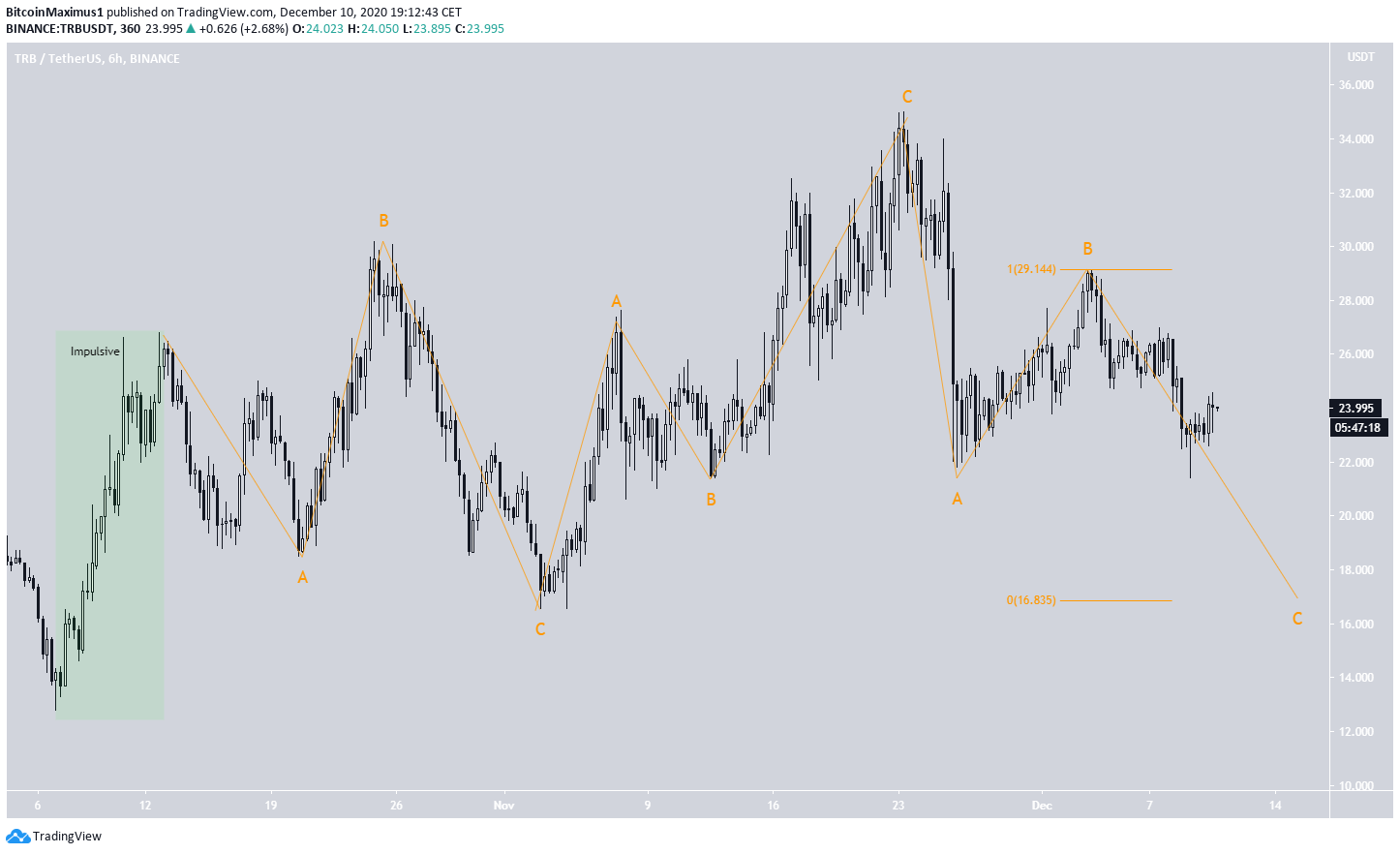

The shorter-term six-hour chart reveals that TRB has been following a descending resistance line since reaching a high of $34.99 on Nov. 23. Combined with the minor $22 support area, this creates a descending triangle, which is a bearish pattern.

A breakdown that travels the entire height of the pattern would take TRB all the way down to $10, creating a new all-time low below the current one at $12.78.

However, there is strong support at $17 and $13.5, areas that are likely to initiate bounces before TRB could possibly reach a new all-time low.

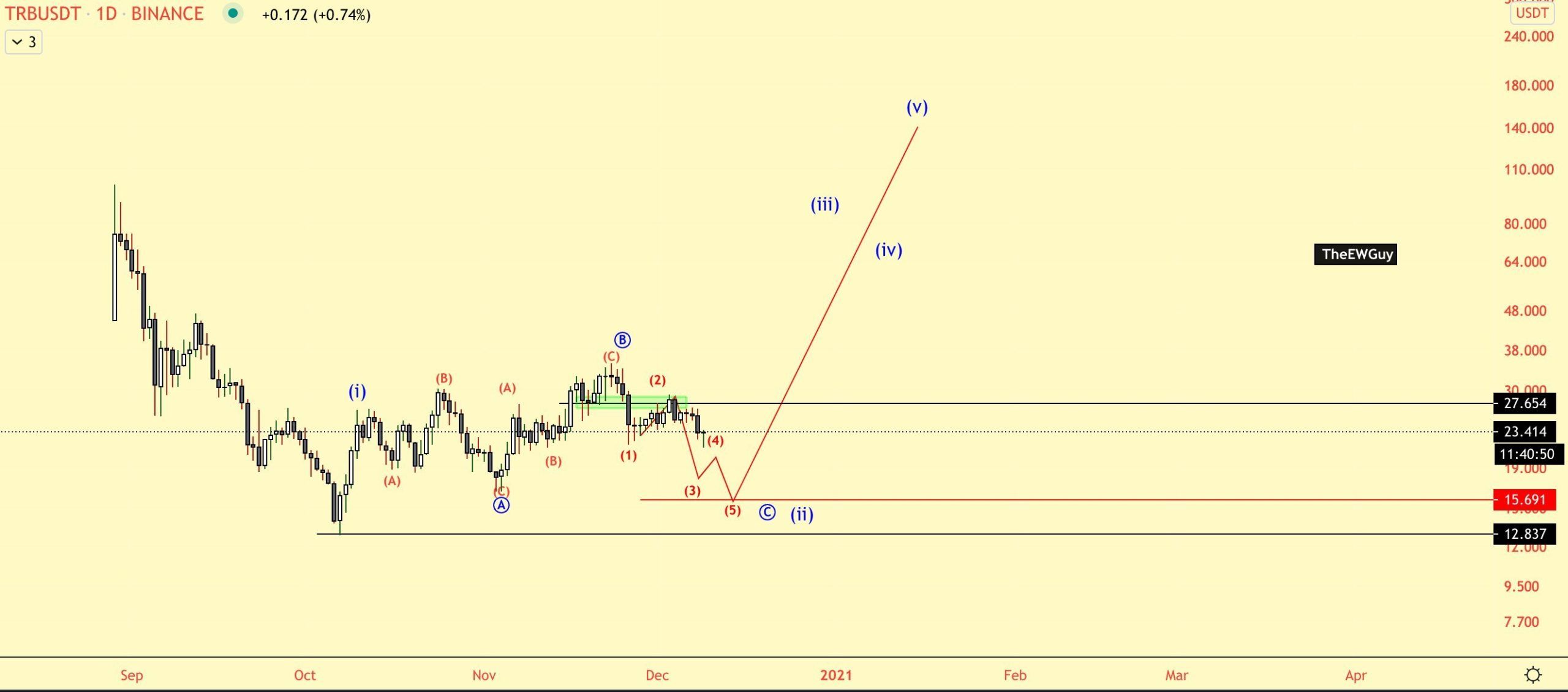

Wave Count

Cryptocurrency trader @TheEWguy stated that he expects one more downward move for TRB, which would complete wave 2 of a bullish five-wave impulse.

After the low is completed, he expects a significant upward move to unfold.

Measuring from Oct.7, the only portion of the move that looks impulsive is the five-day period which led to the $26.70 high on Oct. 12. The entire movement afterward looks like a series of A-B-C corrections, which likely created a complex corrective structure.

If the final C wave has the same length as the A one, TRB would reach a low of $16.80 before possibly beginning an upward move. This would also fit with the previously outlined $17 support area.

Conclusion

To conclude, the TRB price should break down from the current parallel channel and move towards the support areas at $17 and possibly $13.50. Afterward, another upward move could occur.

For BeInCrypto’s latest BNB analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.