Traditional finance is gloating as cryptocurrencies crash. But there’s so much more to cryptocurrencies and decentralized finance than just dips and highs. Here’s why the blockchain has the potential to change the world.

Salaries are inflated away. Banks are getting bigger. And the gap between rich and poor is widening from year to year. What do these things have to do with DeFi, banks, and the Internet of Things?

Traditional Finance: The Current Situation

For several years now you may have been working on your goal to finally buy a house. From year to year, you can afford less as the goods become more expensive. Inflation, banks and our current financial system may be a thorn in your side. But then, you discover cryptocurrencies and Decentralized Finance (DeFi)!

This situation is symbolic of all the hard-working workers who can afford less and less ‘luxury’ from their salary.

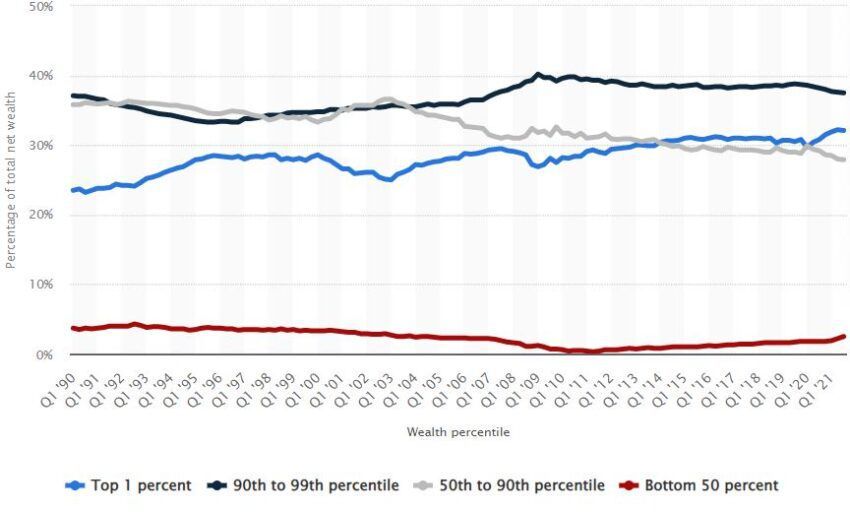

The chart shows the wealth distribution in the US, where the richest 10 percent of all people (blue and black lines) hold over 70 percent of total wealth. It becomes even more curious when we use global figures:

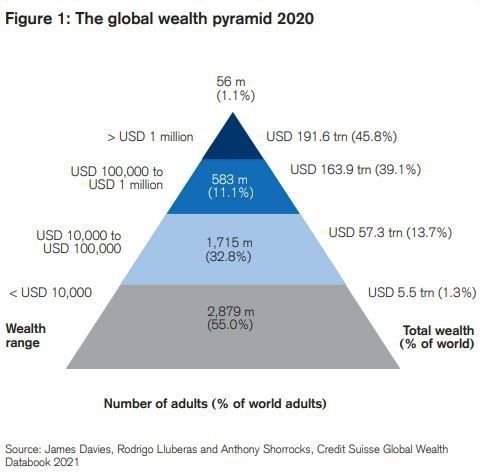

According to Credit Suisse, 1.1 percent of the population worldwide owns 45.8 percent of the assets. But how can DeFi or the Internet of Things replace this system?

Traditional Finance: Banks and states invented the game

In our financial system run by intermediaries (banks), everything is based on turning debt into more debt. This can be seen, among other things, in the annual inflation rates, which mean an overhang of demand to supply.

Let’s use Europe as an example. The money printed during the corona pandemic is now seeping into the economy and is now leading to 7.5% inflation in the euro area (April 2022). Year after year, money saved by Europeans for their house is currently worth 7.5% less.

In the European system of reserve holding, a common commercial bank can create €100,000 out of thin air from a €1000 deposit at a reserve rate of 1%. The demand for credit is controlled solely by the key interest rate, which can make the borrowed money more expensive through interest on it. At a current key interest rate of 0%, the demand for loans is very high.

However, we as private individuals have to deposit a security in order to get a loan in the first place. Suppose your house would cost €500,000 and you have €100,000 in your bank balance. So you could borrow €400,000 – but as collateral, you could pledge your house to the bank. Usually, however, people who can deposit a security are those who are already wealthy. Therefore, they can continue to increase their wealth. This view is also shared by Kevin Owocki, of Gitcoin DAO:

“Traditional finance is getting richer and richer!”

Collateral

If you already own a house, you can deposit it as collateral, take out a loan and continue to invest with it. Plus, the whole system is based on the fact that this asset – the house – gains in value, since goods become more expensive due to annual inflation. In the case of real estate, this effect is of course even more pronounced.

States have become the biggest beneficiaries of the banking monopoly in recent years. They benefit directly from the creation of money. Since the financial crisis of 2008, commercial banks have increasingly bought government bonds of the over-indebted countries in the euro area. This is with money created out of nothing and thus it finances the national debt. The states become the first beneficiaries of the freshly printed money.

Not all people have access to the banking system

According to Owocki, the blockchain offers a way to completely bypass the intermediaries, i.e. banks:

“The blockchain creates trust through its protocol. We no longer need banks. The blockchain is for the average person.”

If we look at where blockchain is already being used everywhere, this goal has already been partially achieved. About 2 billion people in the world do not have access to banking. Transactions from foreign family members often arrive with a few days’ delay. And, they lose about 20% to commission charges.

The workaround is to instead use cryptocurrencies to send funds directly from one wallet to another.

In the real world, using the blockchain INSTEAD of traditional finance has direct benefits that affect people’s lives in a profound way. This can be seen particularly well in the high blockchain adoption rates in Nigeria.

It’s no wonder that using blockchain technology works well for them. 55 percent of Nigerians don’t have a bank account. However, almost all of them have a mobile phone, which makes the adaptation even easier. In other countries, citizens have almost no choice but to use crypto assets, as inflation reduces the value of money by 50 percent within a year. The best-known examples of this are Argentina and Venezuela – where hyperinflation has prevailed for years.

DeFi and the Blockchain – A Way Out

Do you remember the stories of grandfather and grandmother, how they were finally able to buy a house after 20 years of work? What normal worker can claim this today without having to take out a lifetime loan?

For the first time, DeFi gives us the opportunity to turn the blockchain into a bank. While today’s DeFi is not yet in its final form, there are many indications that the potential is enormous. One possibility today is to lend or invest your money on the numerous platforms and at least escape the annual inflation rate. The second, much more interesting option will probably only develop in the future.

Example: Instead of spending your savings on an entire house, you decide to invest in real estate. You buy a share of a house as an NFT on a decentralized market – with this investment you officially own a tenth of the house. You don’t know the other 9 investors. As is already customary with real estate investors, you rent out the entire house and receive one-tenth of the rental profits each. At the same time, you also benefit from the increase in value. This was not possible before blockchain technology. If you don’t feel like it anymore, you simply sell your tenth back on a decentralized market.

You could also deposit your share of the house on a decentralized market as collateral and take out a loan in Bitcoin. If you become insolvent, the trading venue can automatically monetize your security (the house).

From the Internet of Things to Web 3.0

“Everything in financial institutions is made to increase our trust. People walk around with suits; the floor is made of expensive marble and no one understands their technical terms. Blockchain is trust. We need the Internet of Value.”

Owocki sees the Internet of Value (Web 3.0), rather than the Internet of Things, as a way to give something back to the masses. “Web 3.0 creates trust through the protocol and allows us to own the assets we use,” he says. On the whole, this means more self-determination and possibilities for all users. Wouldn’t it be quite profitable if you got a loan in exchange for your NFT painting?

Furthermore, he explains how the blockchain can help us in other ways. During Covid, several stimulus payments have flowed through the U.S. government to U.S. citizens. Owocki believes that millions of dollars have been burned for the bureaucratic effort to bring this money to the citizen. Money that you could have used for your house, for example.

“With a digital money based on blockchain, the responsible authority could have simply transferred money to all citizens at the push of a button. Distributing wealth becomes easier.”

The extent to which decentralization and blockchain will change our world will ultimately depend on we humans. Do we embrace this technology? Or miss the boat?

Are you a decentralized finance newbie? Here are some tips to get you started.

Got something to say about traditional finance or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.