Data on Dune suggests a hidden layer of manipulation using trading bots in the booming Solana meme coin launchpad, Pump.fun.

Pump.fun pioneered the Solana meme coin market. However, rival launchpads are emerging, and the market will face growing competition over time.

Bot-Driven Volume on Solana’s Pump.fun Tokens?

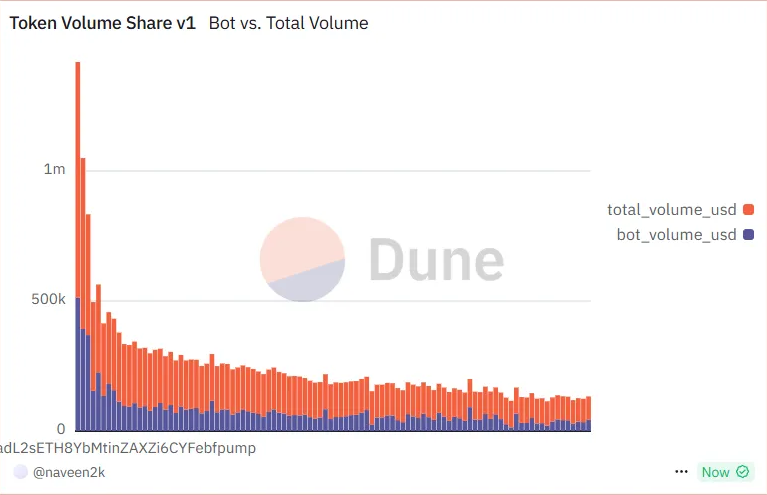

Analysts describe how “Proxies” are flooding Pump.fun token markets with volume-farming bots. High-frequency trades seem to be faking momentum to exploit retail traders’ fear of missing out (FOMO).

On-chain data, which tracks the bots in action, presents these bots as proxies acting as standard market participants. Specifically, they execute dozens of small trades on new token launches, often within seconds, creating the illusion of surging interest.

Based on the data, these bots generate 60–80% of trading volume on some Pump.fun tokens.

The result is a self-reinforcing feedback loop, where fake volume sparks real FOMO. This fuels price pumps, which the bots can exploit for exit liquidity.

DeFi researcher Naveen, in a post on X (Twitter), called this practice “Proxy Paradox.” He cited broader implications, noting that the practice artificially distorts market signals and undermines the reliability of volume-based indicators. Further, it potentially leads to unsustainable price movements.

To some, however, the influx of bot-driven trades stress-tests Solana’s scalability and adds temporary liquidity. Meanwhile, critics warn that it jeopardizes the ecosystem’s long-term health.

Sustainability Concerns Beneath the Meme Coin Mania

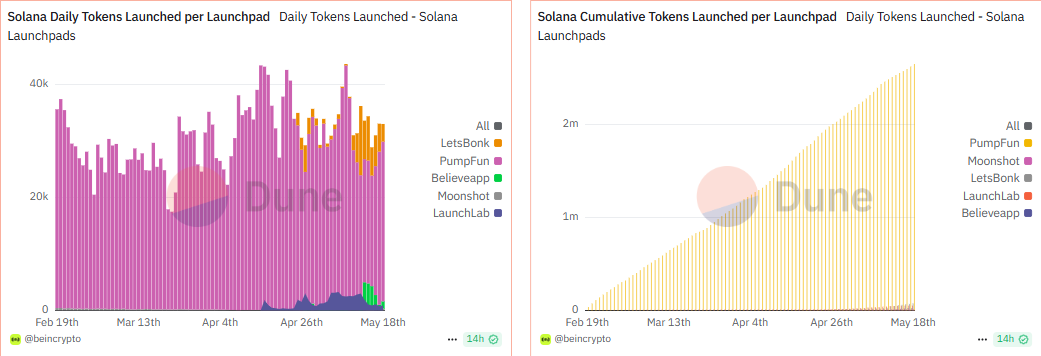

Elsewhere, the meme coin sector is growing. Pump.fun, once Solana’s dominant launchpad, is losing ground.

BeInCrypto reported that the platform’s market share is slipping amid rising competition from new launchpads. LetsBonk has gained momentum by offering faster listings, better user engagement, and broader developer participation.

This evolution comes during a volatile yet pivotal moment for the Solana ecosystem. According to Solana’s Q1 2025 report, network revenue surged while transaction fees dropped, indicating efficiency gains.

However, DeFi total value locked (TVL) declined, raising concerns about sustainability beneath the meme coin mania. These findings serve as a wake-up call for traders and developers alike.

“Not all volume = real demand. Next time you see explosive volume on new meme coins, ask yourself: Is this hype… or Proxy farming?” analyst cautions.

As Solana’s meme coin ecosystem matures, transparency and smarter system design will be critical. Volume farming bots may temporarily boost metrics. However, long-term resilience requires data over deception.

Solana’s infrastructure is under strain, and competition among launchpads is intensifying. Thus, the race is on to launch the next viral token and ensure the system beneath it remains credible.