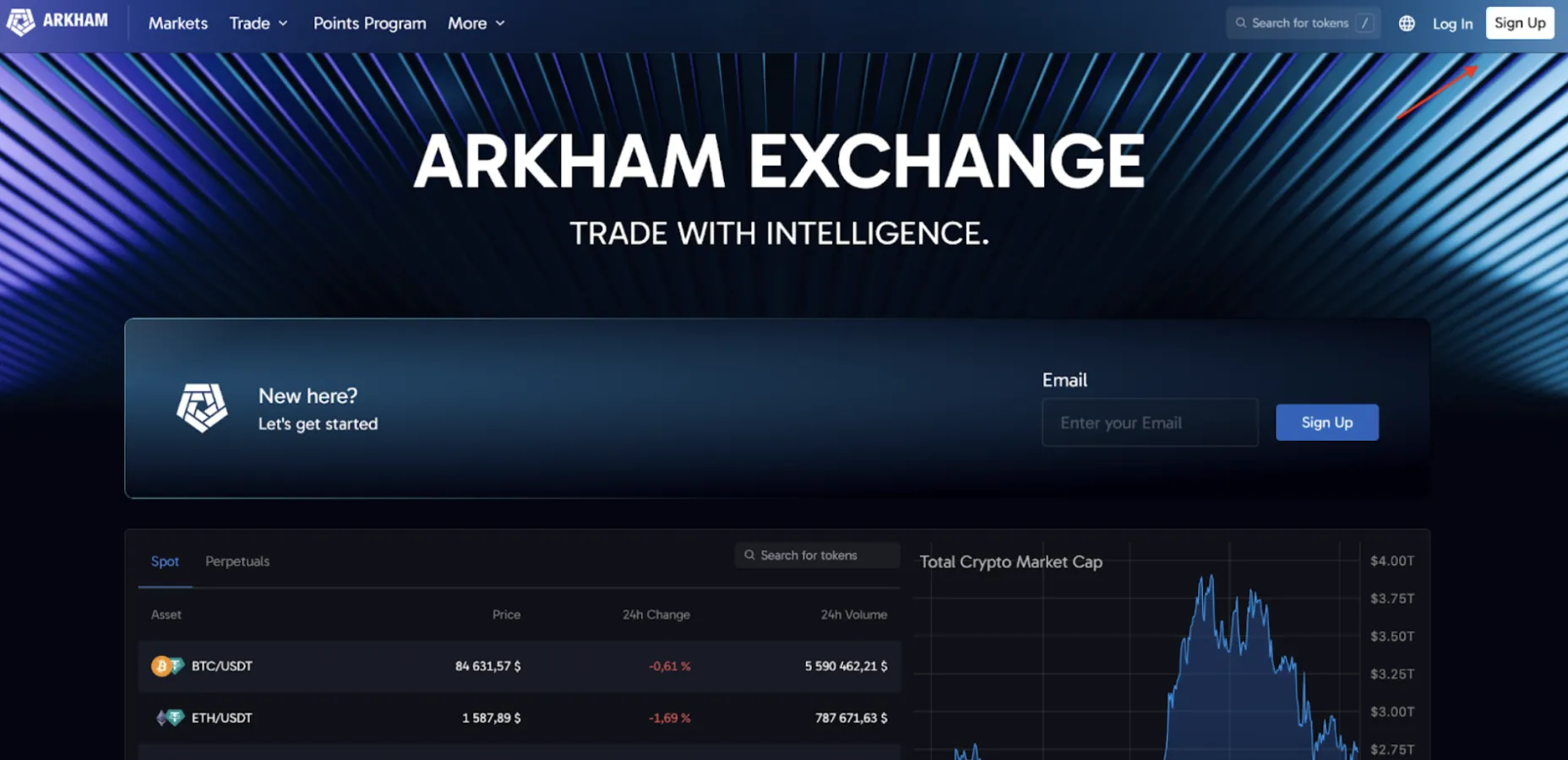

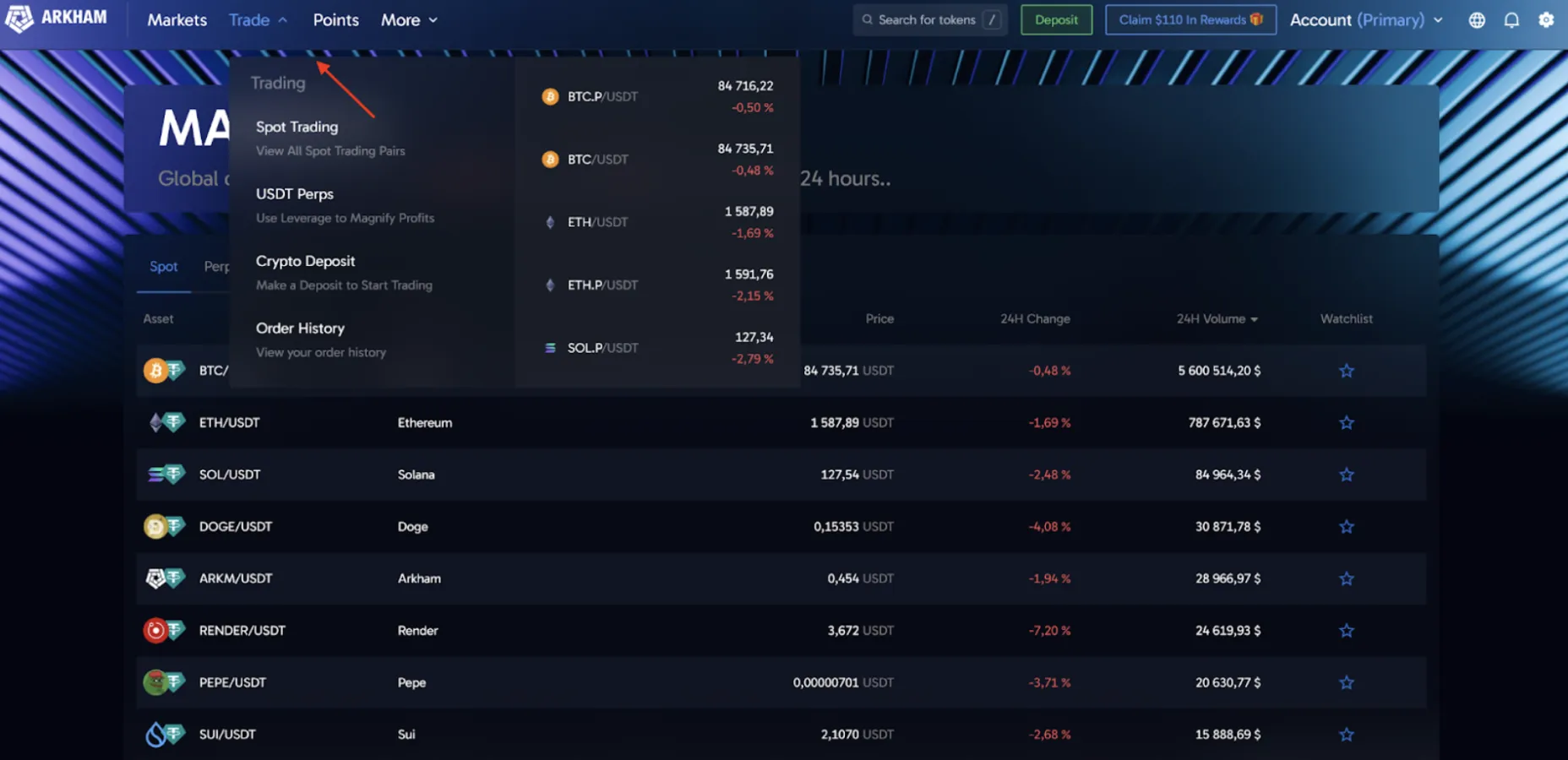

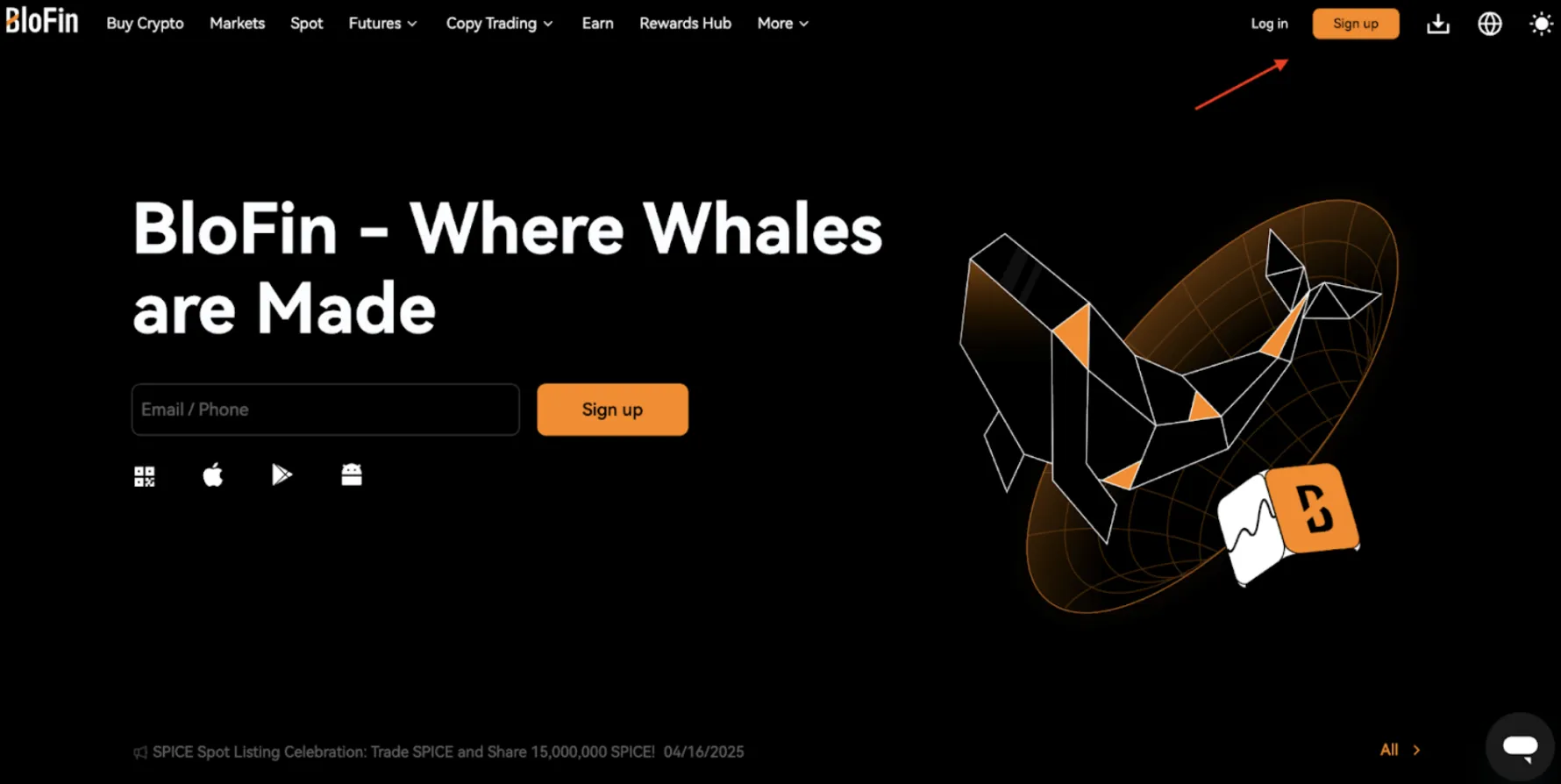

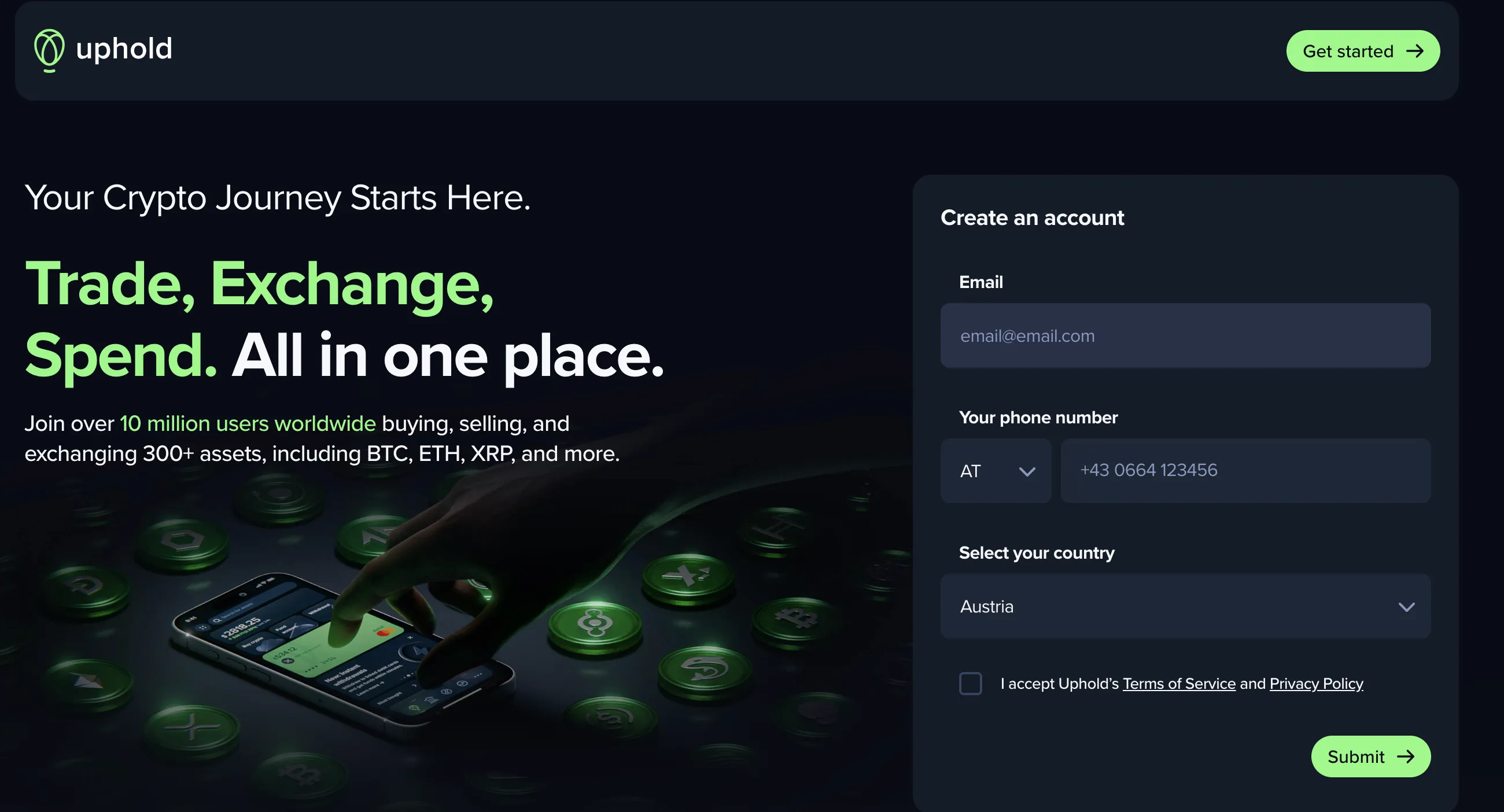

Best Crypto Exchanges for Spot Trading Bitcoin & Altcoins in 2025

Written & Edited by

Nikita Valshonok

Editorial note: Some links in this article are affiliate links. We may earn a commission if you take action, at no extra cost to you. Our recommendations remain independent and unbiased.

👉 Learn more in our Advertiser Disclosure

Spot trading is the simplest way to buy and sell cryptocurrencies like Bitcoin and altcoins at current market prices. In 2025, with the crypto market booming and new investors joining daily, choosing a reliable spot exchange is a top priority. We have prepared top picks for you to explore the best and safest crypto exchanges for trading crypto.

We have prepared top picks for you to explore the best and safest crypto exchanges for trading crypto. To choose platforms, we have considered several important aspects like:

- Fees

- Number of trading pairs

- KYC

- Trading volume

- Fiat support

9 results found

Summary of the Best Crypto Exchanges for Spot Trading

| Yes | Yes | $3.7B | 0.10% maker | taker (VIP0) | 4,000+ | Explore | |

| Optional (limits apply) | Limited (region-dependent) | ~$600M | From 0.10% maker/taker | Explore | ||

| Required | No | $8.8M | 0% maker | 0.05% taker | 24 | Explore | |

| Required | Yes | $2.4B | 0.08% maker | 0.1% taker | 500+ | Explore | |

| Optional | No | $26M | 0.1% maker | taker | 230+ | Explore | |

| Optional | No | $26M | 0.1% maker | taker | 230+ | Explore | |

| Required | Yes | N/A | 0% maker | taker | 100+ | Explore | |

| Optional | Yes | $230M | 0.1% maker | taker | 800+ | Explore | |

| Required | Yes | N/A | 1% maker | taker | 25+ | Explore |

What is crypto spot trading?

Spot trading in crypto means buying or selling digital assets at the current market price with instant settlement and ownership transfer. For example, you buy Bitcoin, and it shows up in your wallet right away, or you sell it and get the cash immediately.

Key features of spot trading include:

- No leverage: You are only trading with your own money (unless you’re separately using margin trading).

- Instant execution: Trades go through right away at the current price (unlike futures or margin trading).

- Actual ownership of assets: The crypto you buy lands in your wallet (in case you do not keep it on the exchange).

- Simplicity: No need for complicated strategies like with derivatives.

Common Mistakes to Avoid in Spot Trading

Traders are just regular people who make mistakes like anyone else, and spot trading is no exception. Let’s break down some common errors and how to steer clear of them.

Buying at the Peak of FOMO (Fear of Missing Out)

Mistake: A trader sees a sharp price spike (like Bitcoin or a meme coin) and buys out of fear of missing out, only to get caught in a correction.

How to Avoid: Don’t let emotions take over. Use technical analysis (support/resistance, RSI, MACD) and wait for pullbacks instead of buying at all-time highs.

Panic Selling During a Dip

Mistake: The crypto price starts dropping, so the trader sells at a loss, and then the price bounces back up.

How to Avoid: Set stop-loss levels in advance but avoid rigid stop-losses on spot trading if you believe in the asset. Stay calm and do not check your balance every five minutes (unless you are scalping). Remember, the crypto market is volatile, and corrections are normal.

Trading Without a Plan or Strategy

Mistake: Buying or selling crypto without clear rules, just thinking that it will definitely go up.

How to Avoid: Always define your strategy (swing trading, long-term holding, arbitrage). Set profit targets and acceptable loss levels, and review your mistakes.

Putting All Your Money Into One Asset

Mistake: Buying only Ethereum or dumping all your cash into a hyped-up meme coin, hoping for 100x returns.

How to Avoid: Diversifying your portfolio is one of the best strategies to survive any market. Do not put all your money into one asset. If it crashes, you could lose everything. Diversification ensures you will never be left with nothing.

Ignoring Fundamental Analysis

Mistake: Buying coins based only on charts without understanding the project (tokenomics, team, roadmap).

How to Avoid: Before investing, check out the project’s Whitepaper and website. See if the community is active. A token that skyrockets and makes a quick profit might just be a scam that only enriches insiders.

Overlooking Fees and Spreads

Mistake: Making frequent trades with a small deposit, where fees eat up your profits.

How to Avoid: Choose exchanges with low fees and factor in the spread (the difference between buy and sell prices).

Conclusion

Spot trading is a straightforward way to buy and sell crypto, perfect for long-term investors (HODLers) and those looking to avoid the risks of derivatives. It draws in a lot of market participants but comes with significant risks. To minimize them, keep your emotions in check, plan your trades, diversify and keep learning. By doing so, spot trading can bring you profits instead of losses and frustration.

Frequently Asked Questions

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.