What is a crypto launchpad?

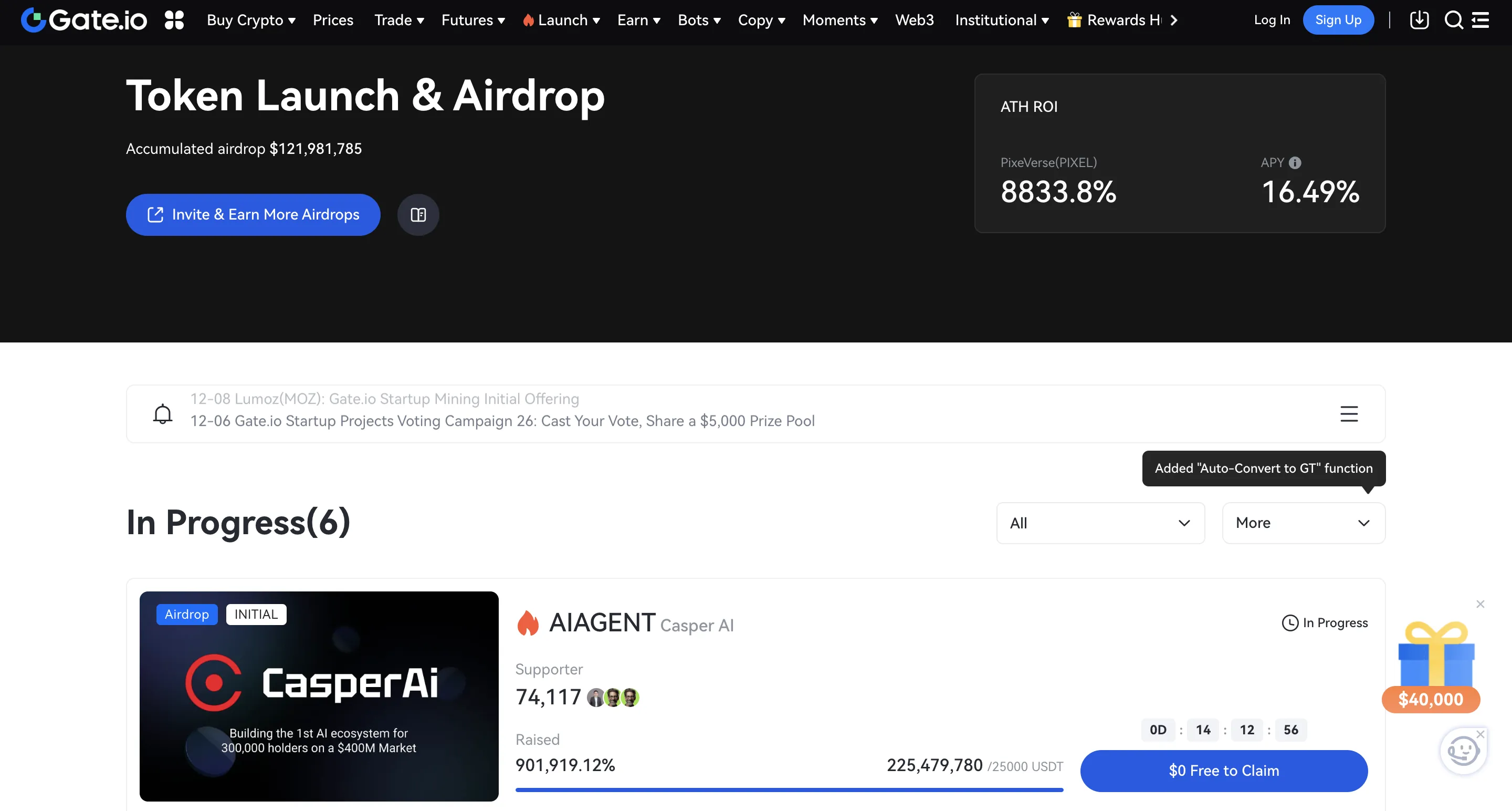

A crypto launchpad is a platform that helps crypto projects attract investments from investors who are willing to invest in their token or coin at an early stage, before its launch.

Projects use crypto launchpads to get more visibility, build a community of early supporters, and secure funding for development. Launchpads provide a safe and trusted space for projects to present their ideas and reach more people, increasing credibility and investor trust. For users, launchpads offer early access to promising projects, allowing them to invest in tokens before they are widely available. This helps users discover new opportunities, diversify their investments, and reduce the risk of scams through verified projects.

How to choose the best crypto launchpad?

When choosing the best launchpad, it’s essential to focus on several key factors. First, consider the platform’s security, including thorough audits and strong investor protection measures. An easy-to-use, intuitive interface can make a big difference in your experience. Transparency is also important, so look for platforms that provide clear statistics and performance tracking. A diverse range of projects ensures that you have opportunities to support startups in different sectors.

What are the different types of crypto launchpads?

Although all launchpads share the core mission of initial token launches and fundraising, they differ in the types of platforms represented and the themes of the projects whose tokens are launched. The types of crypto launchpads include ICO, IDO, IEO, IGO, and INO.

- ICO (Initial Coin Offering) is a method for raising funds by selling new crypto tokens to investors, often before the project is fully launched. The project runs the process on its website. A notable example is Ethereum’s 2014 ICO, which raised over $18.6 million at approximately $0.31 per ETH.

- IDO (Initial Dex Offering) launchpad is a platform where a project sells its tokens on a decentralized exchange (DEX) instead of a centralized one. In an IDO, participants interact with the launchpad directly through their own wallets.

- IEO (Initial Exchange Offering) launchpad is a platform on a centralized cryptocurrency exchange where new projects can sell their tokens to raise money. The exchange runs the sale, checks the project to make sure it’s legit, and helps keep the process safe for investors. All actions take place on the exchange, and users receive their token allocation directly in their exchange accounts.

- IGO (Initial Game Offering) launchpad is a platform where new blockchain-based game projects sell their tokens to raise funds. It operates similarly to an IEO or IDO but focuses specifically on gaming projects. These platforms are often associated with GameFi (Game Finance), which combines gaming with blockchain-based financial features.

- INO (Initial NFT Offering) launchpad is a platform through which projects or creators sell their NFTs (non-fungible tokens) to secure funding. An NFT refers to a non-fungible token, which means each one is unique and cannot be exchanged on a one-to-one basis.

Why you should use a crypto launchpad

A crypto launchpad can be a great way to earn for both beginners and experienced crypto enthusiasts. It allows you to make investments by purchasing promising new altcoins at an early stage when their market cap is still small.

Launchpad vs Launchpool: What’s the Difference?

Both launchpads and launchpools aim to introduce new crypto projects and tokens, but they follow different approaches:

- Launchpads focus on token sales, often through Initial Exchange Offerings (IEOs). Users can buy new tokens at a fixed or tiered price, usually before they’re listed on the open market. This method gives early investors direct access to promising projects.

- Launchpools, by contrast, allow users to stake existing cryptocurrencies like BNB, ETH, or USDT to earn newly launched tokens as rewards. It’s a way to support and access early-stage projects without making a direct purchase. If you’re interested in accessing new projects by using your existing assets, check out our Top Picks article on the Best Launchpools in 2025.

Conclusion

Launchpads can be a useful tool in the crypto market, potentially helping to expand positions in existing investments or build initial capital by investing in new, promising projects. With our Top Picks, you can choose the launchpads that suit you best and participate accordingly. However, it is crucial to always be aware of the risks involved. Regardless of the platform’s reliability, the project’s credibility, or market opinions, always do your own research.

Frequently asked questions

A platform where users can invest in projects by buying their tokens or farming an allocation at an early stage.

First, ensure the platform’s reliability and reputation. Then, choose based on the type of launchpad that suits you, regional availability, and the statistics of projects they have launched.

Yes, crypto launchpads are designed to create a secure environment for both users and projects. Reputable launchpads thoroughly review and verify each project before listing it.

Yes, it is. A launchpad token sale is organized by a platform and is often public, allowing a wider audience to participate, while a pre-sale is usually private and occurs before the launchpad token sale begins.

It’s impossible to determine exact earnings, as they depend on factors like your investment amount, market conditions, and how long you hold your position after receiving new tokens.

A launchpool lets you earn new tokens by staking your crypto, with earnings based on the total assets in the pool. In contrast, launchpad platforms allow you to obtain new tokens by purchasing them.