Nexo

Best for daily payouts

Offers up to 16% APY on 38+ assets and daily rewards

-

Availability countriesWorldwide (except for US)

-

Supported crypto for staking38

-

Interest rateup to 16%

-

Lock-up periodNo

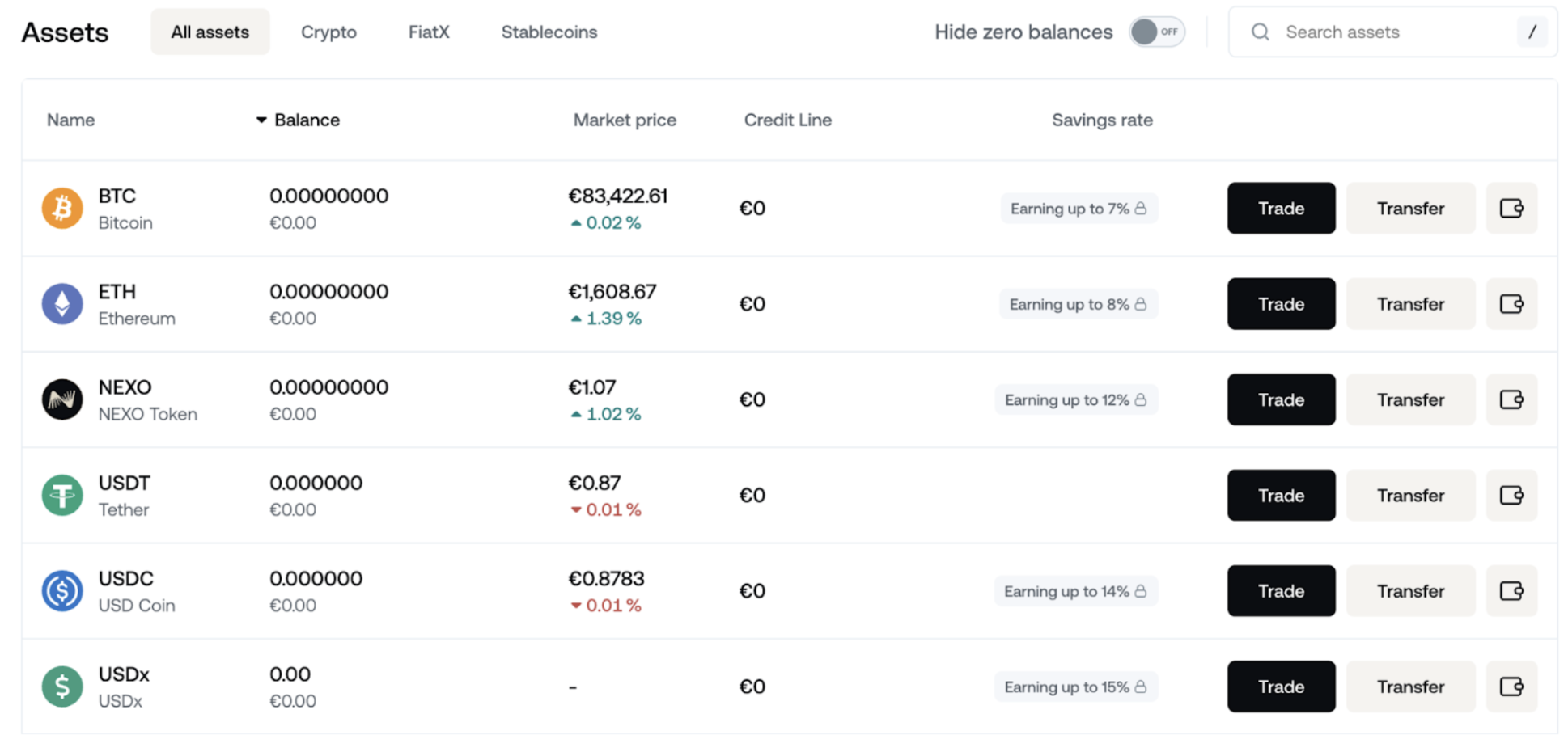

Nexo is recognized as one of the leading crypto staking platforms with no lock-up and fixed-term options for higher rates. It offers competitive yields of up to 16% APY and a wide range of assets for staking.

In particular, Nexo supports staking for over 38 cryptos like BTC, ETH, USDT, DAI, SOL, BNB and more. APYs vary from 2% to 26%. Users can earn higher yields by holding NEXO tokens.

- Go to the Nexo’s official website using this link, create an account completing KYC or just log in if you have one.

- Deposit or purchase crypto.

- Navigate to the Wallet menu on mobile or the Assets section on desktop and click on the selected asset to see Earn options.

- Choose the preferred terms and monitor your staking rewards.

dYdX

Best for liquid staking

Combines native and liquid staking, along with USDC vaults

-

Availability countries198

-

Supported crypto for staking1

-

Interest rateup to 11.5%

-

Lock-up period30 days

dYdX is one of the largest DEXs, with daily trading volume exceeding $350 million. It leverages the Cosmos SDK Staking module, which supports a PoS blockchain. While dYdX offers trading for over 200 cryptocurrency markets, including BTC and ETH, staking is exclusively in $DYDX.

Staking DYDX involves locking tokens with a 30-day unbonding period. Users stake at least 1 DYDX via the interface, Keplr or Metamask, choosing a validator like Kiln. Rewards, around 11.15% annually, come in USDC and need manual claiming. There is no flexible option—funds stay locked until unstaked. This locked structure incentivizes long-term commitment, offering higher engagement through governance voting rights alongside financial returns.

dYdX also supports liquid staking and restaking of DYDX through Stride.

Another passive yield generation opportunity that dYdX provides is MegaVault. This feature enables dYdX Chain users to earn through depositing USDC. By doing so, they provide liquidity to different markets and get rewards in return. Yields come from trading fee revenue shares, PnL on vault positions, etc.

You can deposit and withdraw USDC into MegaVault at any time–there are no lock-up periods. As of this writing, the estimated APR is 29% over a 90 day period.

- Sign up to dYdX using this link

- First, you need to purchase $DYDX, or earn them through trading activity, and send them to your dYdX Wallet.

- Then you need to install and open the Keplr wallet and go to the dYdX staking page.

- Search for a validator from whom to delegate your tokens under “All Validators” and click “Stake.”

- Enter at least 1 DYDX to stake, then confirm the transaction in your wallet.

BloFin

Best for intuitive interface

Offers different options for staking BTC, ETH and USDT

-

Availability countries151

-

Supported crypto for staking3

-

Interest rateup to 3.20%

-

Lock-up periodfrom 30 to 180 days

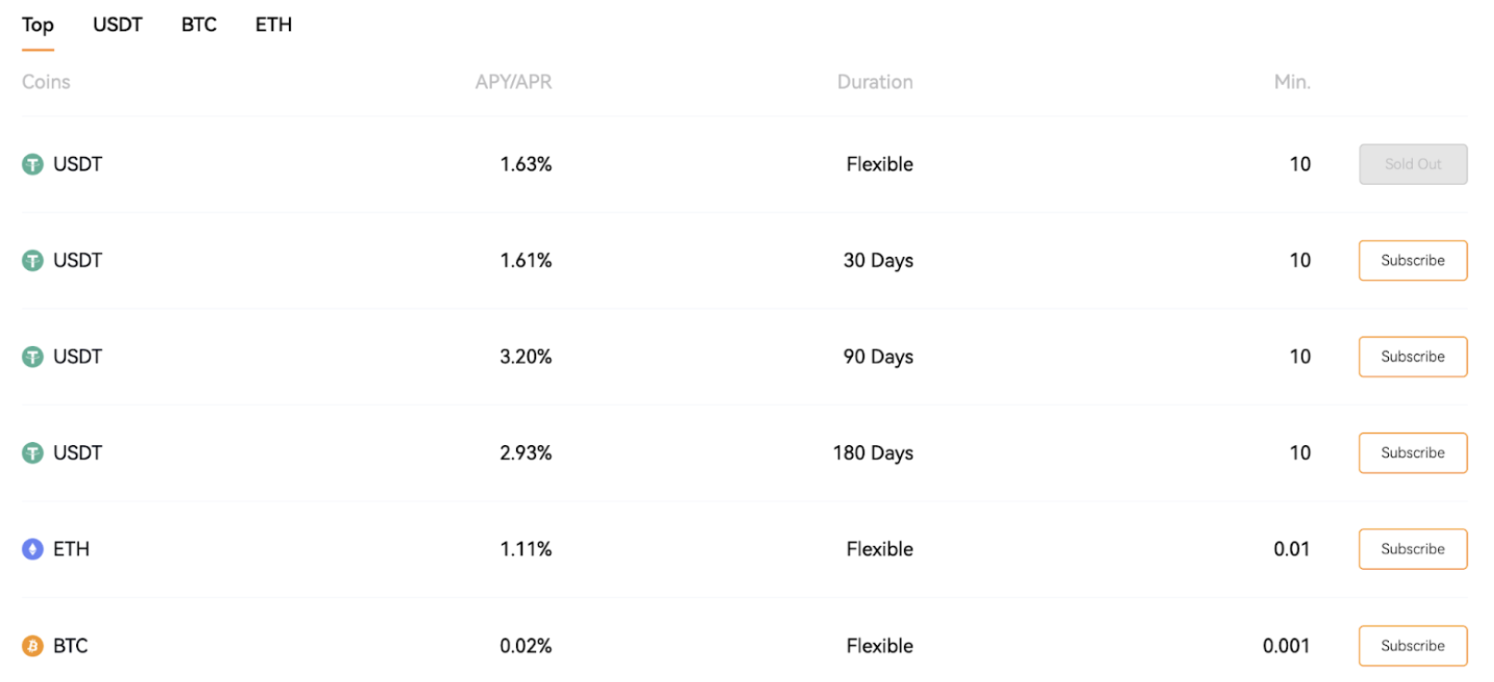

BloFin is a popular crypto exchange that provides a wide range of services–from perpetual and futures trading to staking. Currently, it supports three cryptocurrencies for staking: BTC, USDT and ETH. However, as BloFin continues to evolve and expand its services, more tokens are expected to become available.

The platform offers two kinds of staking products that let users earn yield–flexible and locked. In case of the flexible option, you can redeem your staked assets at any time while still earning interest on them. Locked products suppose that you deposit your assets, keep them on the platform for a fixed period and get higher returns.

BloFin’s services are available in 151 countries. However, the platform does not work in such jurisdictions as the USA, Canada, Singapore and China.

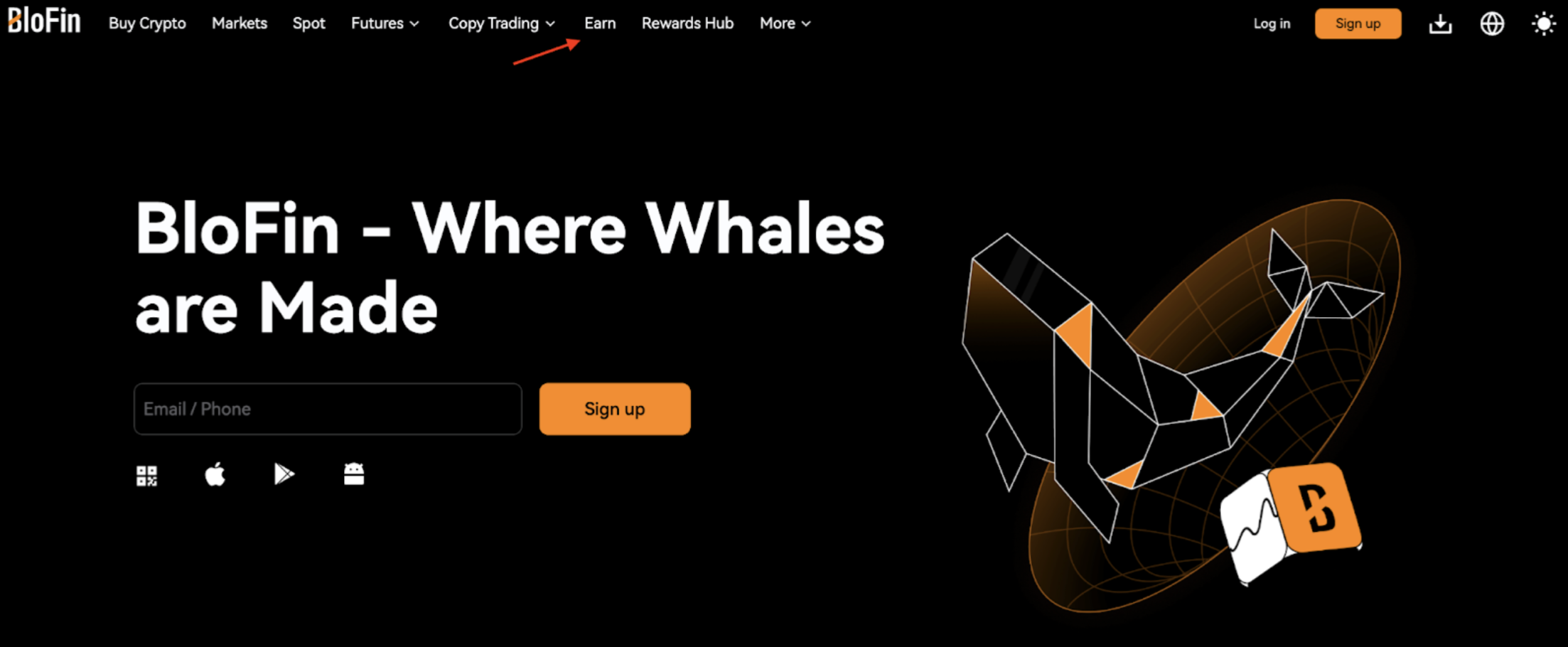

- Go to BloFin’s official website, log in or create a new account.

- Top up your balance with the asset you want to stake (BTC, ETH or USDT)

- Navigate to “Earn”, which you can find in the upper menu.

- Choose the currency and preferred conditions for staking.

- Click “Subscribe” and start earning interest.

Binance

Best for highest APYs among all crypto staking platforms

The biggest global crypto exchange in terms of trading volumes

-

Availability countries100+

-

Supported crypto for staking60+

-

Interest ratefrom 1% up to 100+%

-

Lock-up periodDepends on asset

Binance is one of the best platforms for cryptocurrency staking, offering various options for earning passive income from assets. The platform provides flexible staking conditions, including flexible staking, locked staking and DeFi staking, each with its own features and benefits.

Binance supports over 60 cryptocurrencies for staking, including major tokens such as ETH, ADA, DOT, and its native token, Binance Coin (BNB).

The staking yield on the platform ranges from 1% to over 100% APY, depending on the chosen cryptocurrency and conditions. For example, staking BNB can yield between 0.05% and 14.25% APY, while staking USDC can offer up to 3.06% APY. Some promotional campaigns may provide even higher yields for a limited time.

Here are all staking options that Binance provides:

- Flexible Staking: Allows users to deposit and withdraw funds at any time, maintaining asset accessibility but with lower yields compared to locked staking.

- Locked Staking: Offers higher yields by locking funds for fixed terms, such as 15, 30, 60, or 90 days. This is suitable for investors willing to lock their funds for a specific period.

- DeFi Staking: Enables users to interact with decentralized finance (DeFi) protocols directly through their Binance accounts, providing additional opportunities to earn rewards.

Binance also offers a unique auto-staking feature, which automatically reinvests rewards, allowing users to earn compound interest without manually performing these operations. This simplifies the process and helps maximize returns.

- Go to the Binance website and select the “Earn” dropdown tab

- Choose Binance Earn, Simple Earn or any other Earn product

- Pick an asset and start staking

Coinbase

Best for beginners

The best crypto staking platform for users from the US

-

Availability countriesMost jurisdictions

-

Supported crypto for staking136

-

Interest rateup to 12%

-

Lock-up periodDepends on asset

Coinbase is one of the largest crypto exchanges in the market, established in 2012. In addition to spot and derivative trading, the platform offers earning opportunities through staking.

Currently, Coinbase supports staking for 136 cryptocurrencies, including ETH, ADA, SOL, XTZ, ATOM and ALGO.

Staking rewards on Coinbase vary depending on the asset. For example, as of March 2025, the yield for Ethereum is 2.49% APY, while for ATOM, it is 14.99%. These rates may change depending on the network and the number of participants.

Staking rewards are distributed to users daily or weekly, depending on the chosen asset.

One of Coinbase’s main advantages is its ease of use. Users can start earning on their cryptocurrencies with minimal investments—starting from just $1. The platform handles all technical aspects of staking, including managing and distributing rewards, making the process accessible even for beginners.

Coinbase also offers liquid staking for Ethereum through LsETH, allowing users to earn rewards without locking their assets. For institutional clients, a more advanced staking system is available through Coinbase Prime, which includes personalized support and additional features.

Coinbase charges a standard commission of 35% of the rewards earned for most supported cryptocurrencies (e.g., ADA, ATOM, AVAX, DOT, MATIC, SOL and XTZ). For Coinbase One users, there is a discounted commission rate of 26.3% for the same assets.

To start staking on Coinbase, users must complete an identity verification process using a valid Taxpayer Identification Number (TIN). Additionally, they must be located in a region where staking is available. Coinbase supports staking in over 100 countries, though there are some geographical restrictions.

- Go to the Coinbase website, log in or create a new account

- Select “My assets” and choose an asset to stake

- Pick the “Stake more” button

- Enter the amount of assets you want to stake

- Review the details and choose “Confirm and stake”

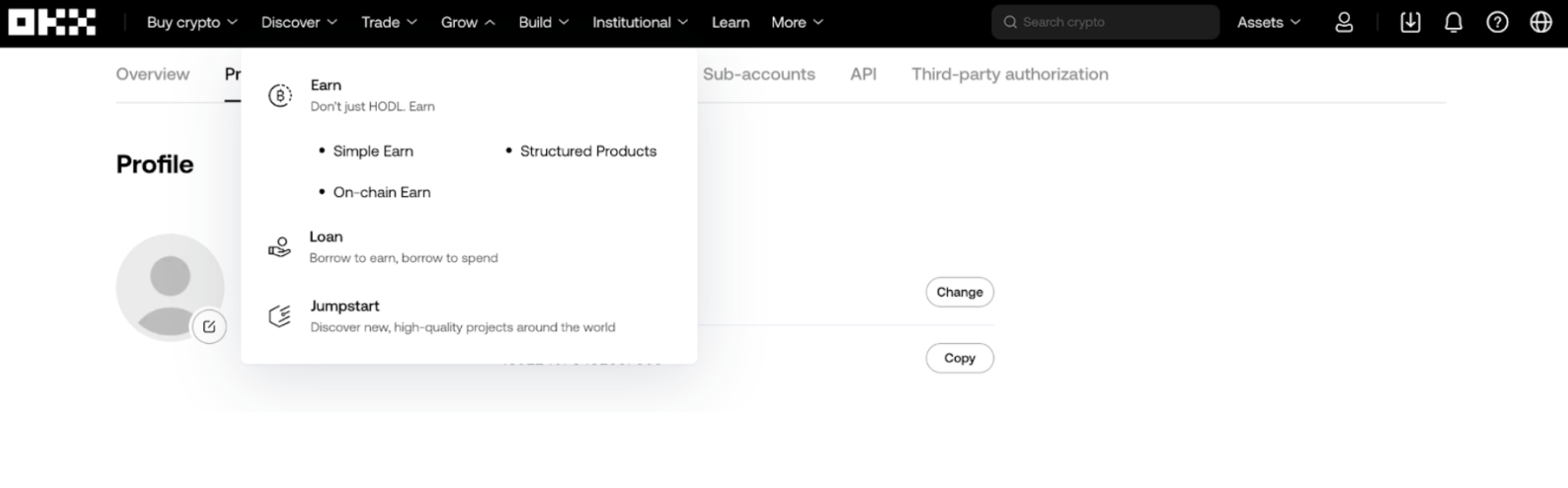

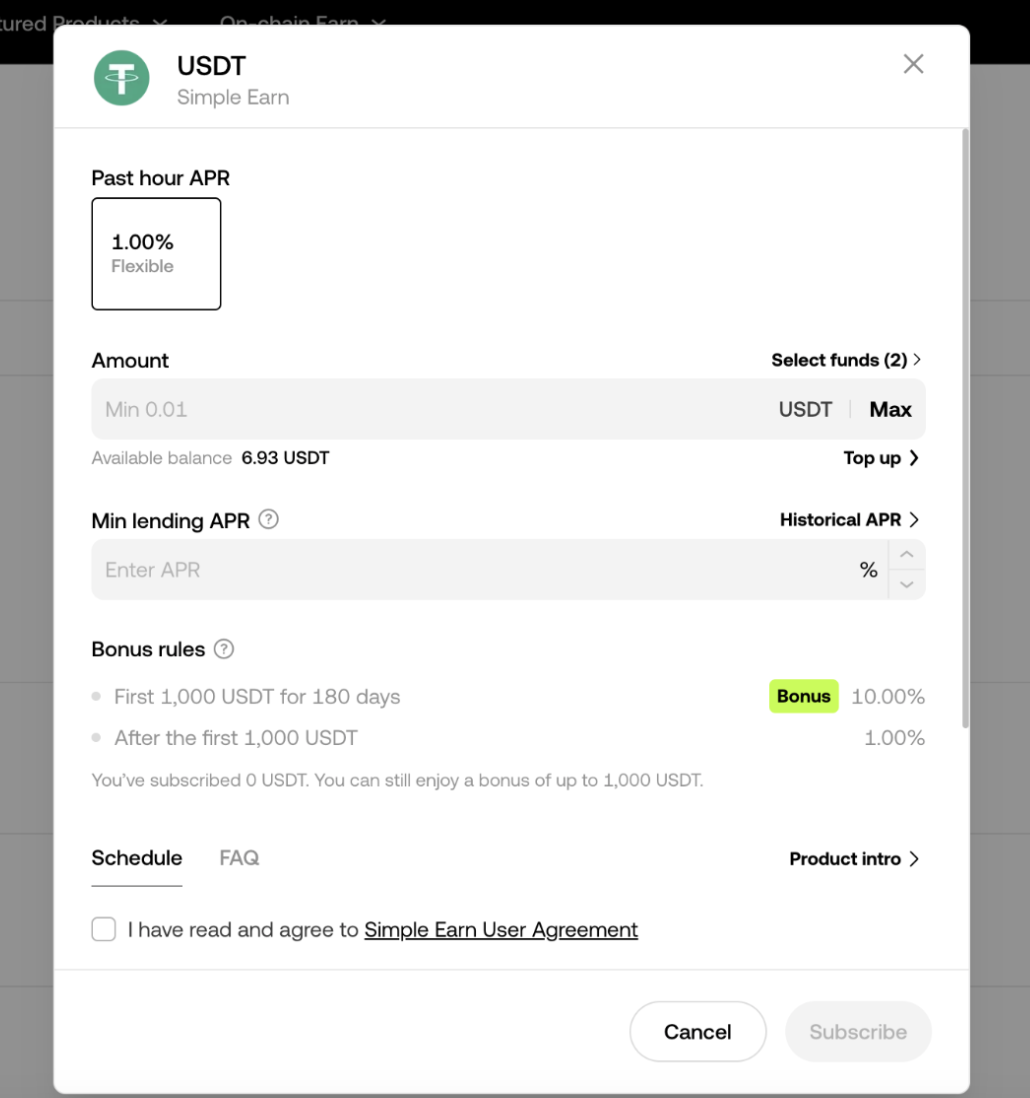

OKX

Best for staking BTC

One of the leading CEXs that supports different types of staking

-

Availability countriesWorldwide

-

Supported crypto for staking38

-

Interest rateup to 21,14%

-

Lock-up periodDepends on asset

OKX, formerly known as OKEx, is one of the top 5 largest cryptocurrency exchanges in the world. The platform is used by over 60 million users globally.

In addition to its core trading services, OKX also offers earning opportunities. Through the OKX Earn product, users can stake various cryptocurrencies, including ETH, SOL and BTC, and earn rewards. This feature is available to all verified clients of the exchange.

OKX Earn supports different types of staking:

- Simple Earn: Users can unstake their assets at any time. The APR is calculated based on the highest interest rate among loans issued in the last hour. This flexible-term staking option generates income by lending to margin traders and supports two earning methods: staking in Proof-of-Stake (PoS) networks or liquidity pools.

- On-chain Earn: Users stake crypto assets not on the exchange but directly in the token’s network or decentralized finance (DeFi) protocols. OKX directs deposits into decentralized financial networks or protocols, where these funds become part of the liquidity used to support various markets, participate in yield farming, or provide loans.

OKX’s key feature is that it allows users to stake BTC and BRC-20 tokens. This became possible through the implementation of the open BRC20-S protocol.

In addition to staking, OKX provides users with access to a variety of investment products, such as structured products designed for short-term and more aggressive investments. These include Shark Fin and Snowball, which offer users additional ways to generate income.

The OKX crypto exchange is highly secure and keeps users’ funds in cold wallets, which adds an additional layer of protection.

- Go to the OKX official website, log in or sign up

- Navigate to “Grow” section in the upper menu

- Choose whether you want to stake your assets with Simple Earn or On-chain Earn (we picked the first one)

- There, select the asset you would like to stake, specify the amount and set all the other filters

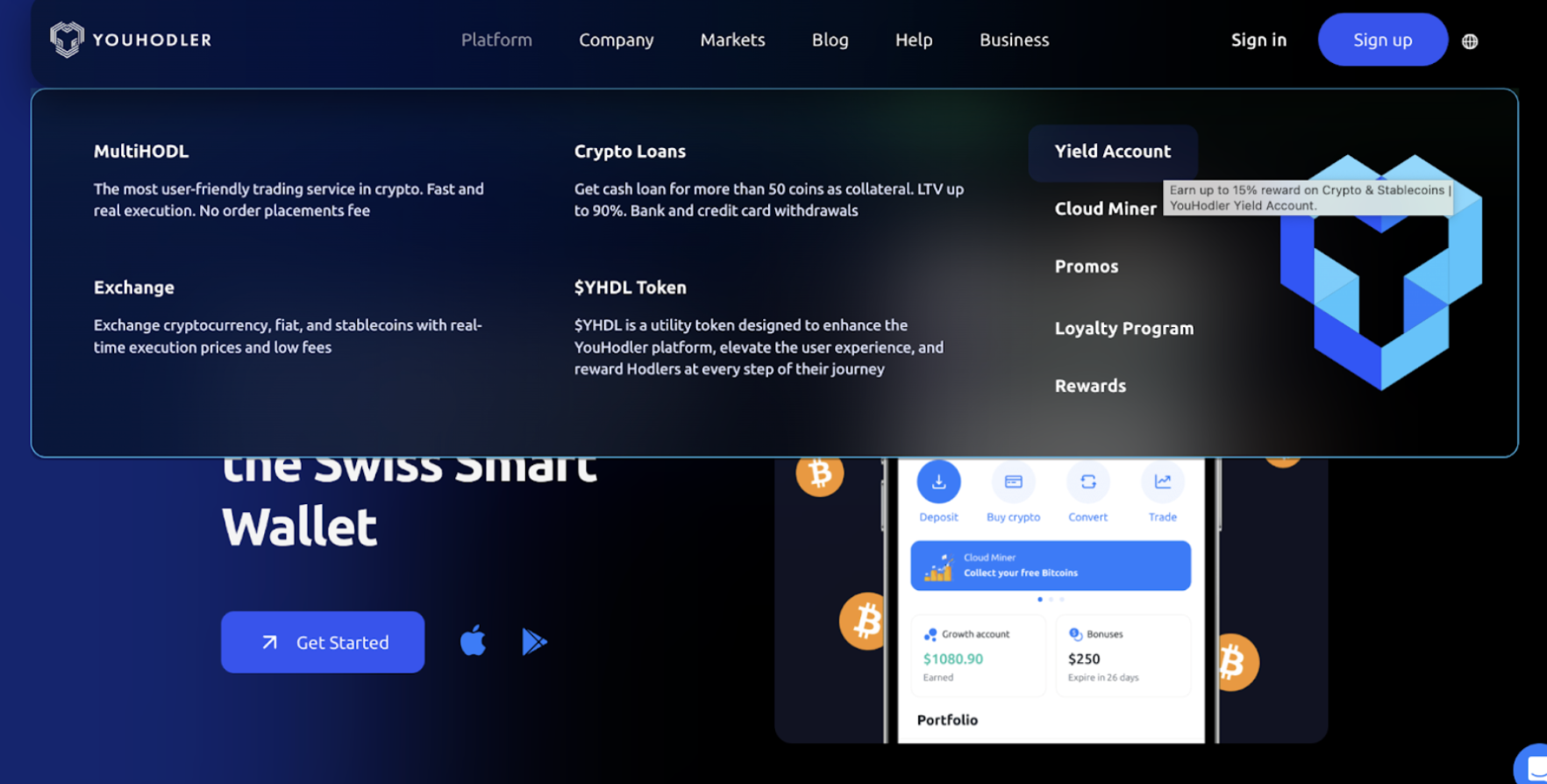

YouHodler

Best for no lock-up periods

Offers Crypto Savings Accounts with up to 20% APR

-

Availability countriesEurope

-

Supported crypto for staking58+

-

Interest rateup to 20% APR

-

Lock-up periodNo

YouHodler offers a variety of services related to digital assets, including loans, exchanges, and interest on deposits. Currently, the platform serves over 2.2 million clients from 110 countries, though it does not provide services to residents of the United States, Canada or China.

While YouHodler does not offer staking in the traditional sense, users can earn interest on their cryptocurrencies and stablecoins through Crypto Savings Accounts. One of the key features is that funds are not locked—users can withdraw them at any time. The platform offers deposit rates of up to 20% annually, with weekly payouts, and these funds remain on the platform to ensure internal liquidity.

Additionally, YouHodler provides tools like Multi HODL, which allows users to “multiply” their cryptocurrency during market fluctuations, and Turbocharge, which enables users to create collateralized loans for purchasing additional crypto.

Recently, the platform introduced its own token, YHDL. The development team is currently working on integrating it into the ecosystem, with a full rollout expected in the second quarter of 2025.

YouHodler prioritizes security by partnering with Ledger Vault and providing insurance coverage of up to $150 million through Arch UK Lloyds of London.

The platform is available via web version and mobile apps for iOS and Android, offering a user-friendly interface suitable for both beginners and experienced users.

- Go to the YouHodler website and navigate to “Platform” in the upper menu. Then pick “Yield Account”

- Once you are there, choose “Start Earning Now” and sign in or create a new profile

- Verify your account

- Deposit crypto or stablecoins you want to stake, set filters and start profiting

Wirex

Best for several staking options

Provides high staking yields of up to 400% APR

-

Availability countries200+ countries

-

Supported crypto for staking130+

-

Interest rateup to 400% APR for Wirex DUO and up to 16% AER for X-Accounts

-

Lock-up periodfrom 12 hours to 7 days; no for X-Accounts

Wirex is a Web3 payments firm that allows users to store different currencies, trade and exchange them. It was launched in 2014 and originally known as E-Coin.

The crypto platform offers various opportunities to earn rewards through staking. Users can stake not only cryptocurrencies but also fiat assets.

Currently, Wirex provides several staking options:

- Wirex DUO: This is an investment product that allows users to earn returns based on a pair of digital currencies, such as BTC/USDT. It offers high yields of up to 400% APR for short-term DUO with durations ranging from 12 hours to 7 days. The rewards are fixed, ensuring predictable earnings regardless of market volatility. Invested assets can be easily redeemed at any time and used for purchases via the Wirex card.

- Wirex Credit: A credit line that enables users to borrow stablecoins using cryptocurrencies like BTC and ETH. The borrowed funds can then be staked to earn rewards. The platform charges no fees for opening a credit line and does not require monthly payments.

- X-Accounts: This feature allows users to earn interest on their digital and fiat currency balances. The yield is up to 16% AER, with daily accruals and weekly payouts. No minimum balance or maintenance fees are required, and funds are available for withdrawal at any time.

The project also has its own token, WXT. It can be staked both on the Wirex platform and on major crypto exchanges. For example, on Gate.io, the annual yield for staking WXT is 39.42%.

Wirex’s interface is intuitive and provides users with a straightforward way to manage their assets and track their earnings. Additionally, the platform is highly secure as it employs encryption and measures like Strong Customer Authentication (SCA), which protects users’ funds from fraudsters. Wirex also keeps all assets in cold-storage multi-signature (multi-sig) vaults.

- Go to Wirex official website and log in or create a new account

- Choose the product you would like to stake your assets with. Wirex offers several options: Wirex DUO, Wirex Credit and X-Accounts

- Top up your balance with the asset you want to stake, set filters and start earning rewards