What is Crypto P2P

Peer-to-peer, or P2P,is a way of buying or selling cryptocurrencies without involving third parties such as banks or exchanges. Users trade digital assets directly with each other, choosing the best offers.

Cryptocurrency bought through a P2P deal is not different from digital assets that users trade on centralized or decentralized exchanges.

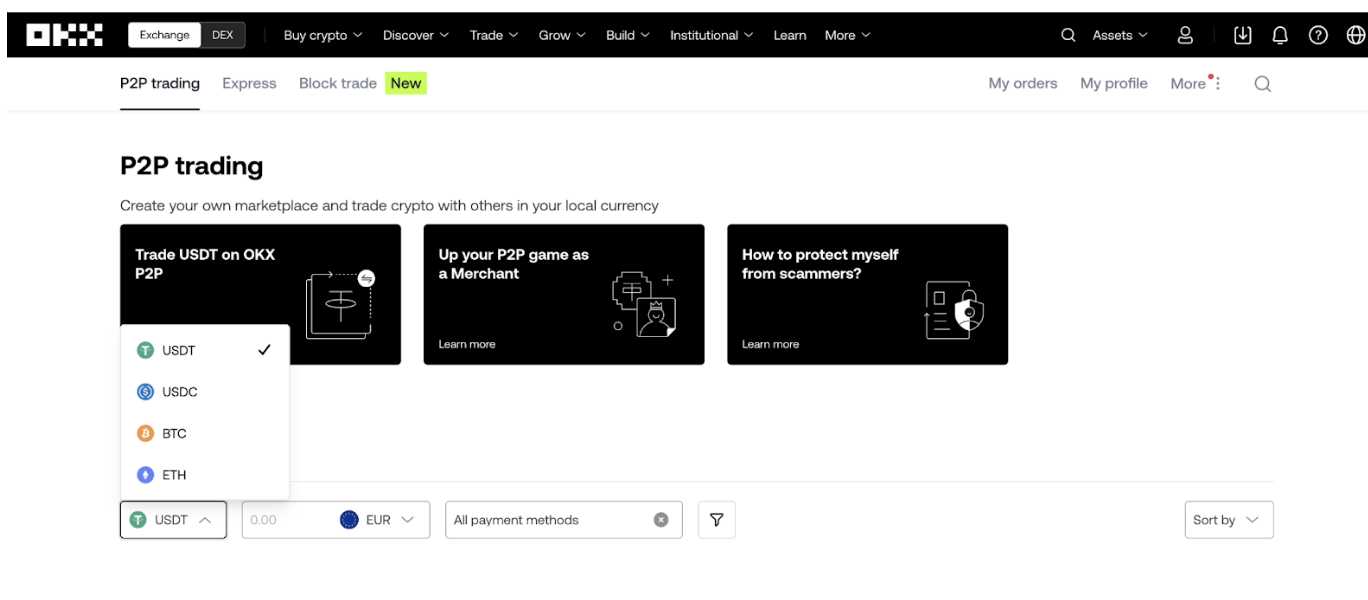

The process takes place on specialized online trading platforms known as P2P exchanges. These rely on something other than order books to meet demand. Instead, buyers and sellers directly post their offers on the P2P exchange.

How to choose the best P2P crypto exchange

Choosing the best P2P crypto exchange doesn’t have to be confusing or tiring. Users should select platforms based on their needs. However, there are a few general aspects to bear in mind. Let’s take a closer look at them.

- Security and Reliability

When picking a P2P exchange, pay attention to the level of security the platform provides. Ensuring your funds and personal data are safe is the most important thing to consider. So, look for platforms that employ:

- Two-factor authentication (2FA);

- Encryption;

- Secure escrow services.

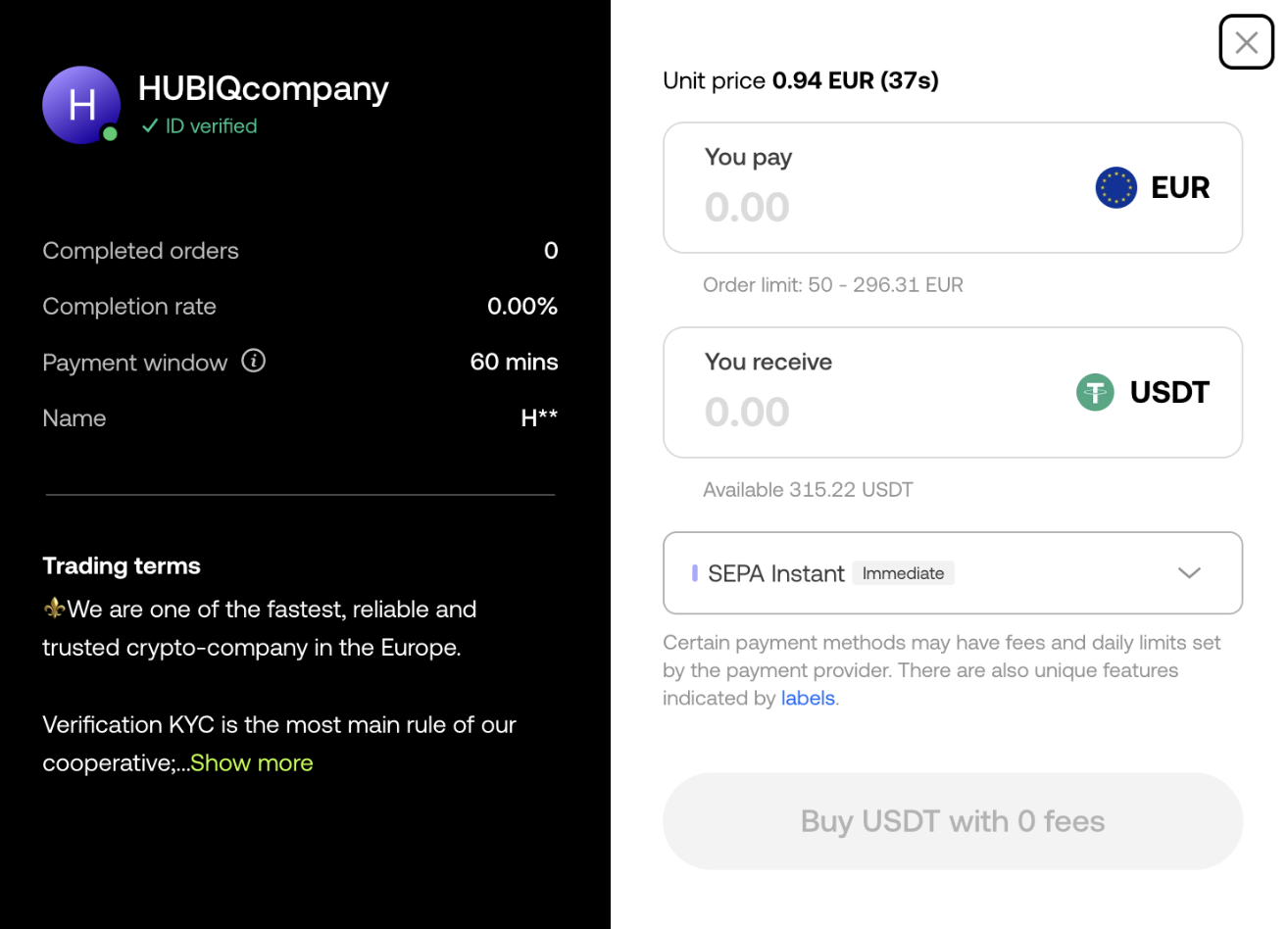

Fraud protection is another critical point. Check if the P2P exchange you select has systems to detect and prevent scams. Such systems include KYC and AI monitoring to detect suspicious activity.

- Supported Cryptocurrencies and Currencies

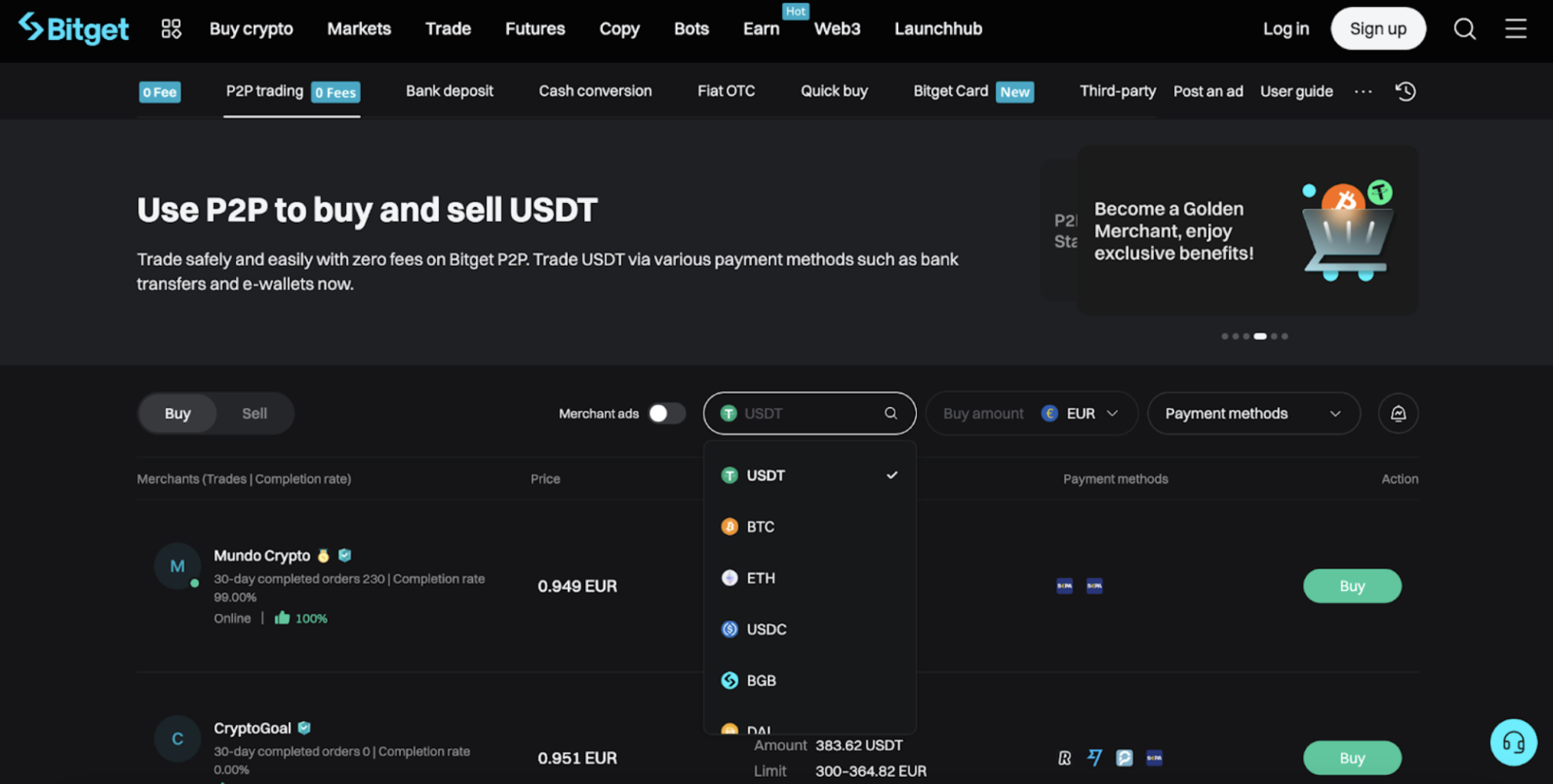

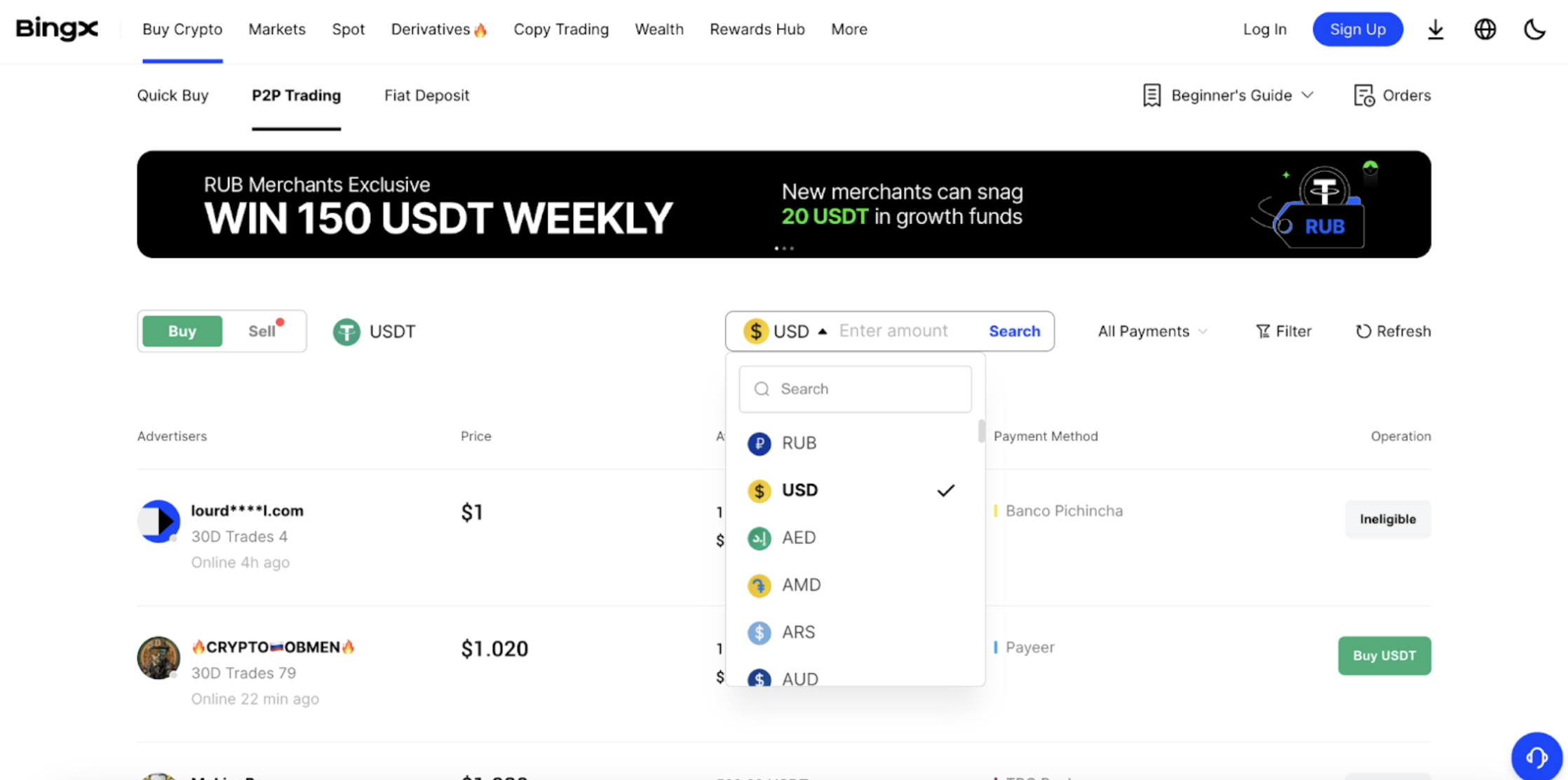

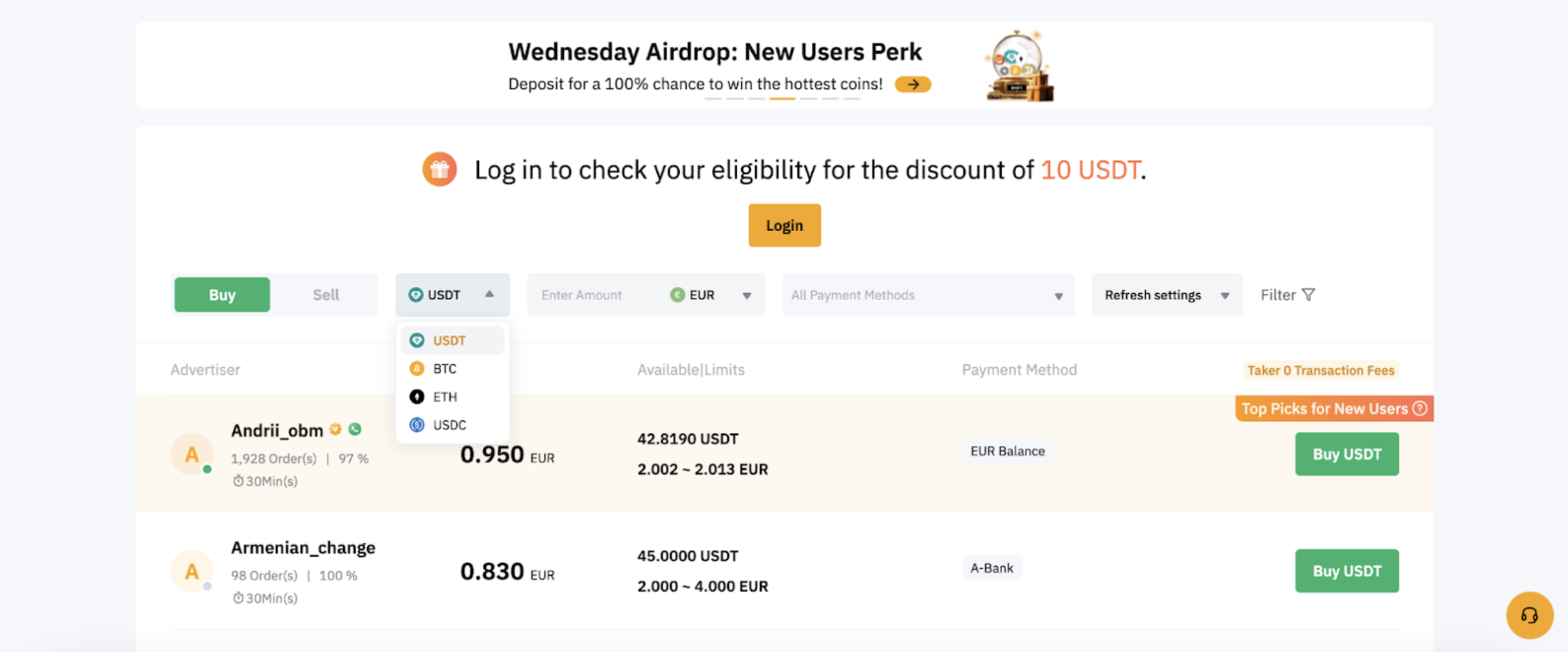

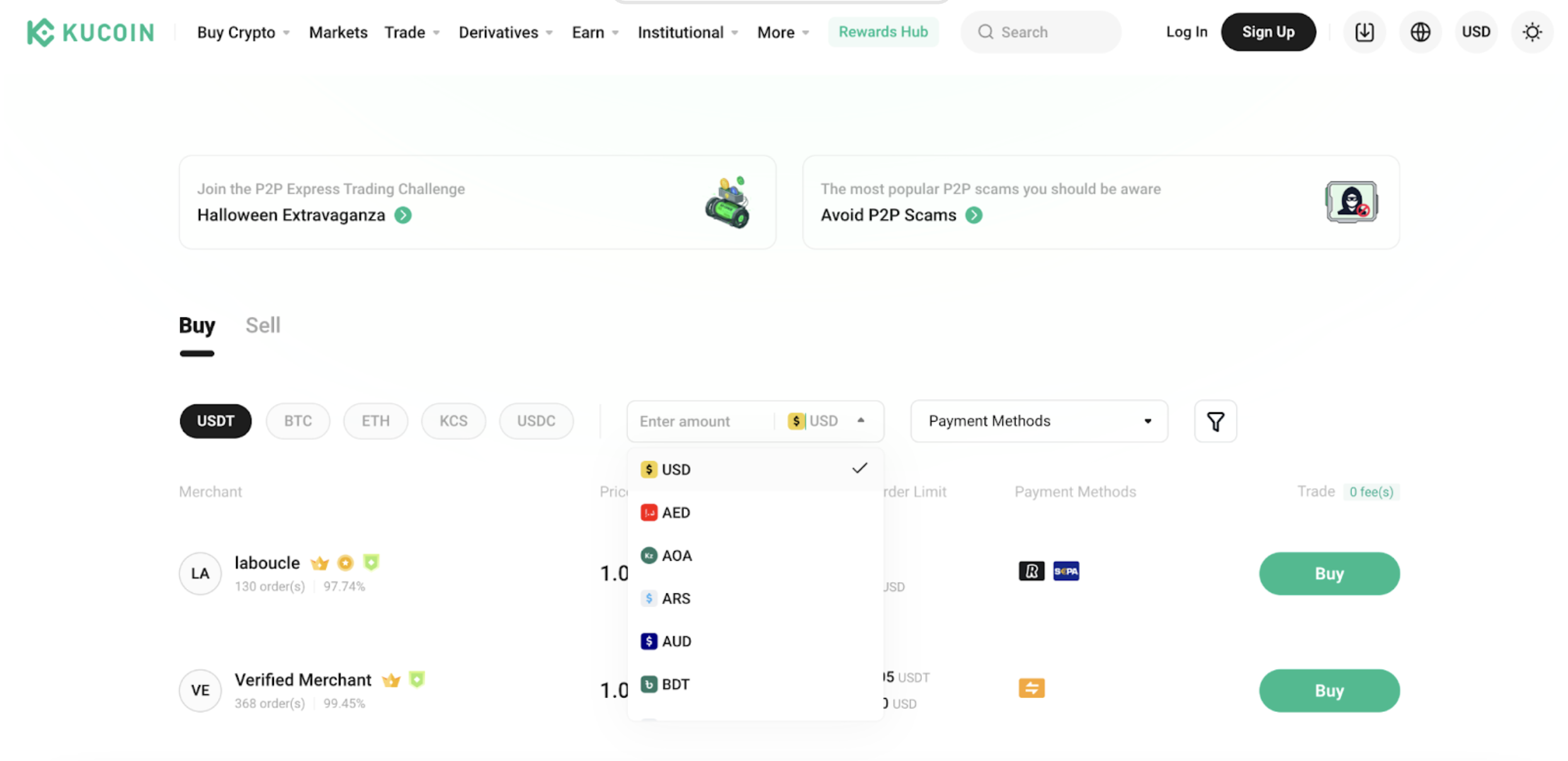

The range of cryptocurrencies supported can make or break your trading experience. Some P2P platforms support a wide variety of digital assets, while others allow you to trade with only a few of them.

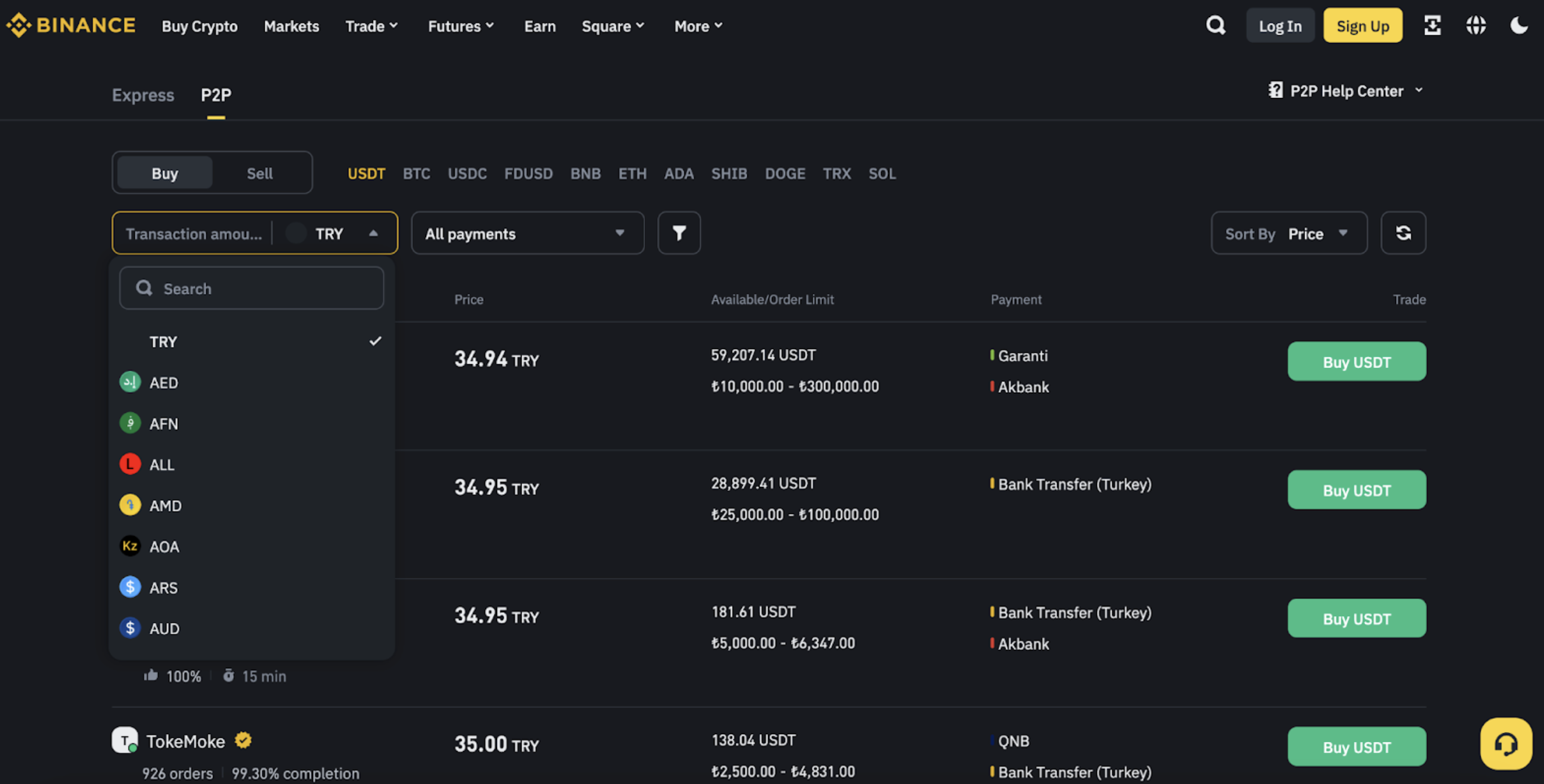

The best platforms support popular options like Bitcoin (BTC), Ethereum (ETH) and stablecoins such as USDT or USDC. If you’re trading in a specific region, check whether the platform supports your local currency. This feature can simplify transactions and help you avoid unnecessary conversion fees.

- Payment Options

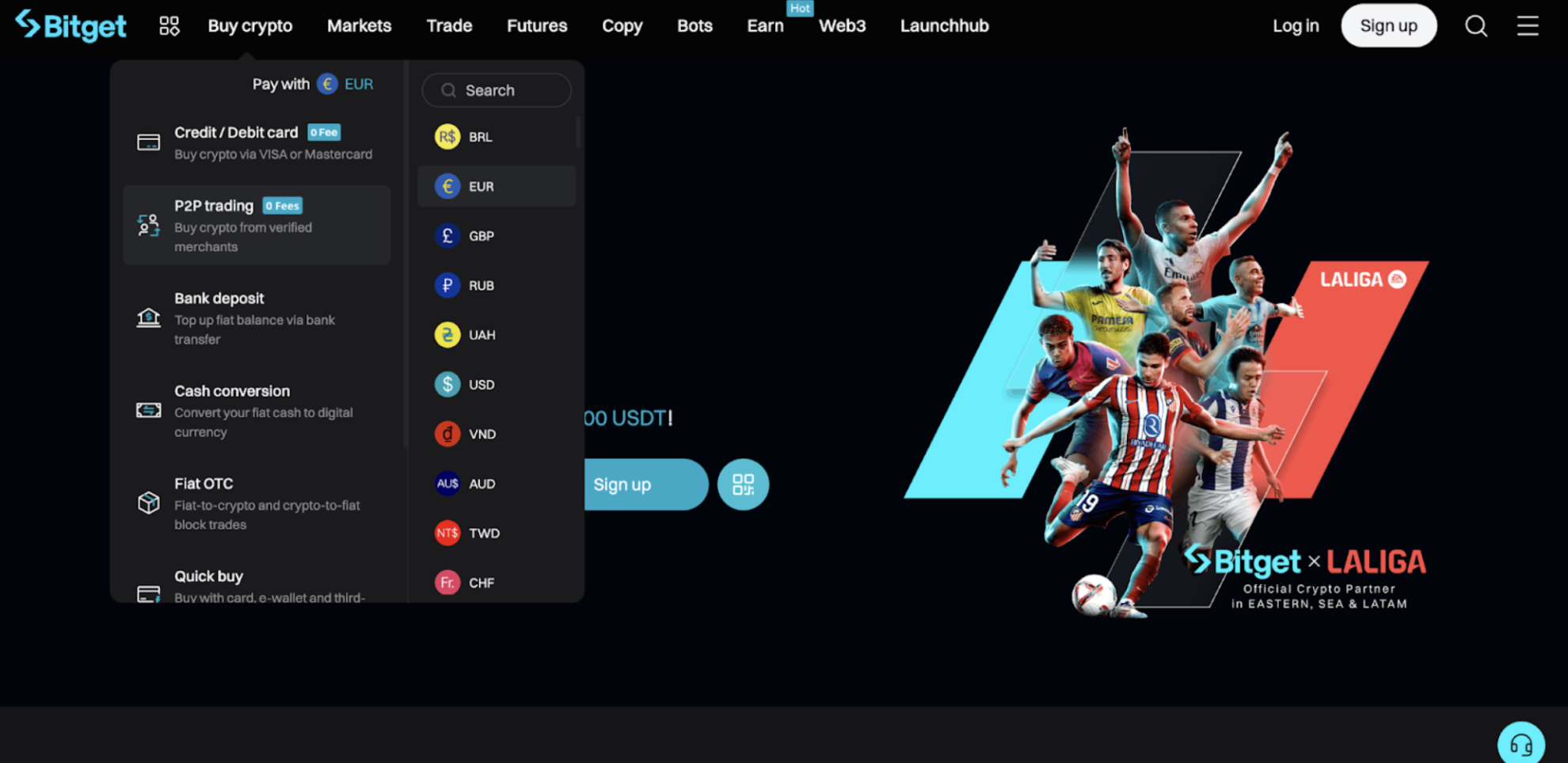

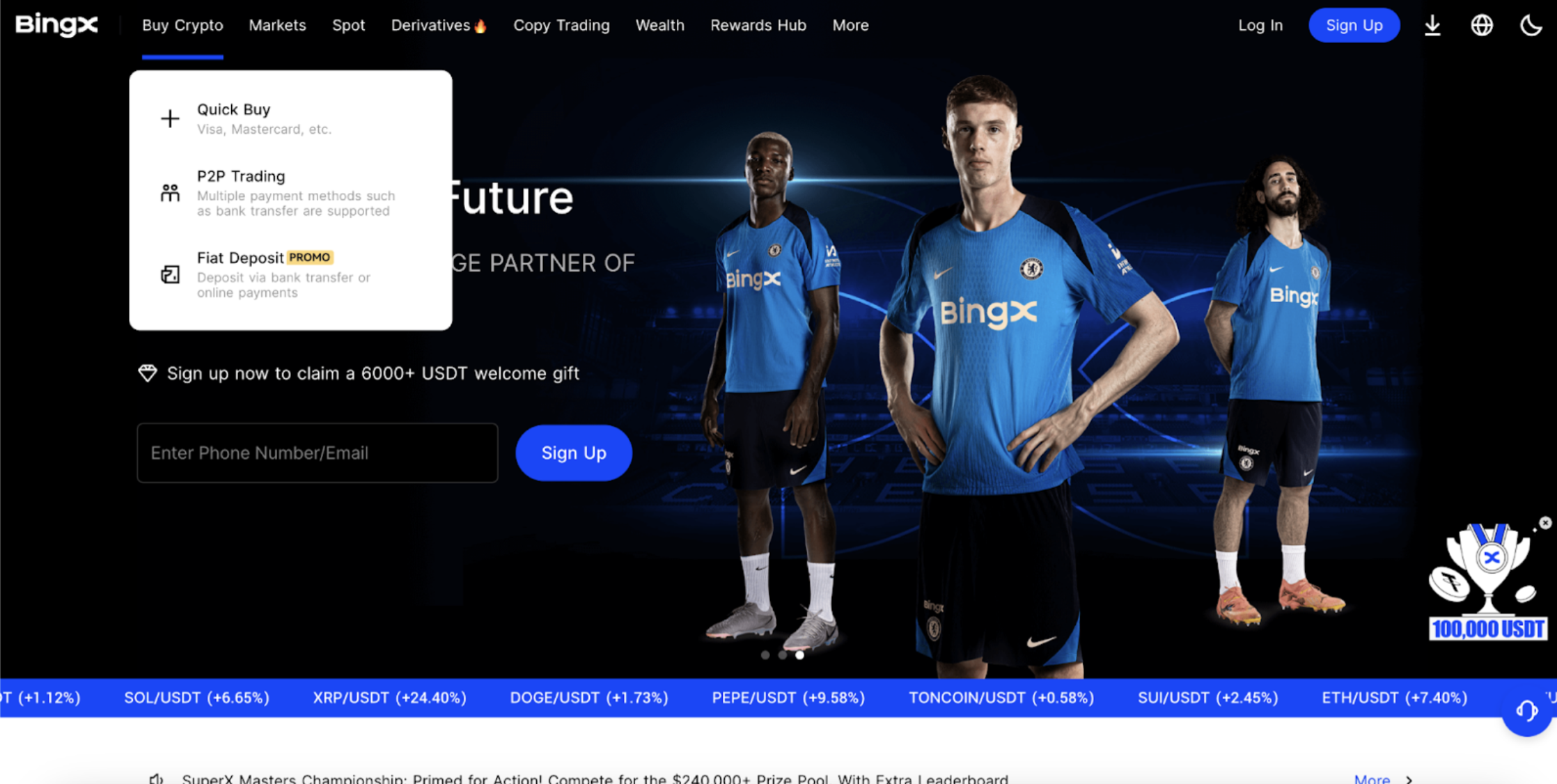

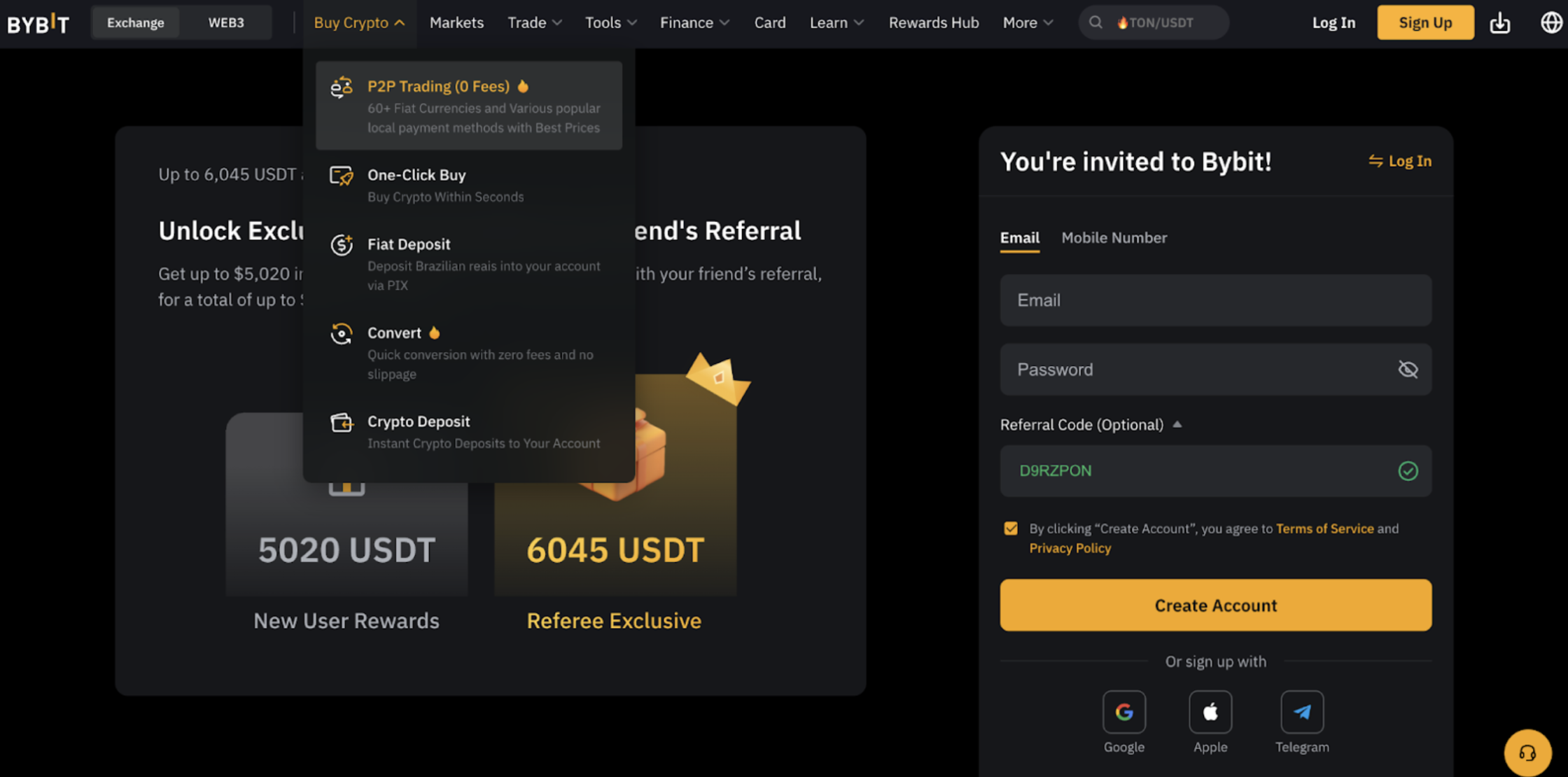

Payment options matter a great deal. P2P platforms usually support extensive forms of payment. Beyond traditional bank transfers, top exchanges may offer options like credit/debit cards, digital wallets, PayPal, mobile payment apps and even cash transactions.

Moreover, P2P exchanges also often provide access to localized payment systems. This freedom of choice ensures you pick the most suitable and cost-effective payment method.

- User Experience and Interface

Neat and easy-to-navigate UI/UX can save your nerves and time. This aspect is especially crucial for beginners–a complex interface may lead to financial losses or scare you off from crypto forever.

Look for P2P exchanges with straightforward processes for registration, order creation and communication. A properly designed interface will make your trading experience smoother, faster and nicer.

- Fee Structure

P2P crypto trading isn’t always free. Some platforms may impose commissions for trading, deposits, or withdrawals. It can significantly impact your profits, so you should clearly understand what you will be charged.

Compare the fees that different P2P exchanges apply. Look for the one that aligns with your trading goals. Most of the platforms listed above are fee-free.

- Reputation and User Reviews

To avoid scams and fraud, make sure that the P2P exchange you choose has enough user feedback and that most of the reviews are positive. A highly-rated platform is more likely to provide a reliable trading experience.

- Geographical Availability

Not all platforms are available worldwide. Some P2P exchanges cater to specific areas or markets. So, check whether the peer-to-peer service you liked supports your country or region.

- Trading Features and Modes

Top P2P exchanges offer flexibility in trading. Escrow services are a must. These secure users’ funds during transactions and ensure that parties can withdraw assets without completing their obligations.

Some peer-to-peer platforms also allow free listings for sellers; others charge a fee for premium visibility.

- Customer Support

Last, strong customer support can make all the difference when choosing a P2P exchange. Look for platforms that provide 24/7 support via multiple channels, such as live chat, email, or phone.

How to stay safe when P2P trading

Crypto trades are risky; users should always know that when entering the crypto space. Considering that fact, let’s take a look at some practical tips to stay secure:

- Before initiating a trade, verify buyer or seller credentials. Top P2P crypto exchanges often allow users to rate and review one another after transactions. Opt for high ratings, many completed trades and detailed profiles.

- Start small. If you’re new to P2P trading, don’t go all in. This will minimize the risk of losing all your funds in case you encounter scammers.

- When making or receiving payments, double-check every detail of deals. Minor errors can lead to significant delays or disputes.

- Make sure that your account password on a P2P platform is strong. Enabling 2FA adds an extra layer of protection.

- One of the main aspects of a good peer-to-peer crypto exchange is its escrow service. Only agree to conduct a trade within the platform’s escrow system. If a buyer or seller wants you to get around the escrow process, it’s a red flag.

- Keep all communication with your trading counterpart within the P2P platform. Best peer-to-peer crypto exchanges monitor users’ messages to see if there is any fraudulent activity.

- Always stay current on the latest scams and phishing accidents. This way, you won’t likely fall victim to fraudsters.

By following these precautions, you can enjoy the benefits of peer-to-peer cryptocurrency trading without fear of losing your assets.

P2P crypto exchanges: weighing pros and cons

| Pros | Cons |

| Lower fees compared to traditional crypto exchanges | Higher risks for scams and frauds |

| Comprehensive choice of payment methods and fiat currencies | Limited cryptocurrency support and liquidity for some coins |

| Faster trades | Sometimes trades can take longer than buying or selling cryptocurrency through traditional exchanges |

| High level of protection with escrow services | Less regulatory oversight |

| Buying and selling cryptocurrency at preferred rates | Lack of advanced trading features like margin trading, staking or automated trading tools |

| Decentralized transactions without intermediaries | Platform security risks |

| Direct communication with users you trade with | Reliance on trust leads to potential disputes |

| Perfect for certain countries with limitations on crypto | Regional payment barriers |

Conclusion

P2P crypto trading is a popular option for buying and selling cryptocurrency without third parties involved. There are many options for users seeking the best P2P crypto exchange.

Every platform has unique features and offers clients a getaway for fast and safe deals without third parties involved. However, the peer-to-peer crypto exchanges could be better. That’s why traders should consider their needs and preferences to find the best one.

Frequently asked questions

P2P stands for peer-to-peer or person-to-person. In crypto, it means a way of buying or selling cryptocurrency directly with other users without involving any third parties.

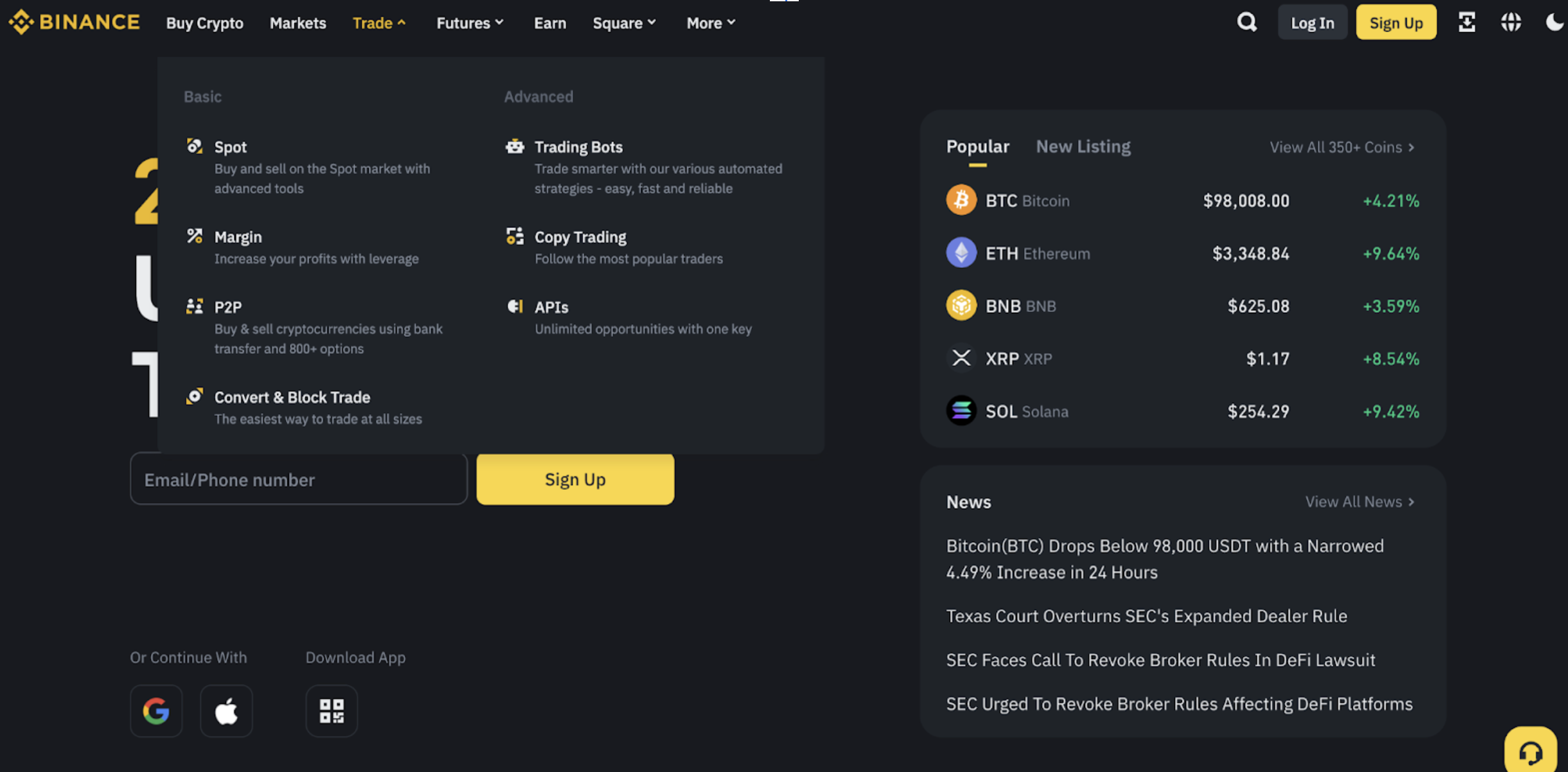

The top P2P crypto trading app is the one that best meets your needs. But you should definitely pay special attention to peer-to-peer platforms provided by worldwide known crypto exchanges like OKX, Binance, and Bybit.

Whether P2P is the best way to buy crypto or not depends on one’s needs. But peer-to-peer trading is obviously one of the most popular ways to purchase digital assets in the crypto market.

Yes, you can use fiat currency on P2P platforms. Every peer-to-peer crypto exchange offers different fiat options, so you will likely find the one you need.

Many crypto exchanges have their P2P platforms. The most popular ones include OKX, Binance, KuCoin, Bybit and Bitget.

The largest crypto P2P platform is Binance, with millions of users globally.

Yes, you can use certain peer-to-peer (P2P) cryptocurrency platforms without undergoing verification processes. But in this case, you should remember that it is more risky.

P2P payments are generally safe when conducted on reputable platforms with proper security measures.