Best Crypto Tokens Powering DePIN Projects in 2026

Written & Edited by

Nikita Valshonok

Editorial note: Some links in this article are affiliate links. We may earn a commission if you take action, at no extra cost to you. Our recommendations remain independent and unbiased.

👉 Learn more in our Advertiser Disclosure

Memecoins, GameFi tokens, RWAs, DePIN, and many other types of crypto assets—does the success of an investment depend on choosing the right crypto category? Each of them may represent unique value or utility, or simply gain popularity due to news. In this article, you will learn about the best tokens from the rapidly growing DePIN category, and explore their tokenomics, features, mechanisms, and other important details.

5 results found

Best for a wide range of valuable utilities

Chains where deployed

Ethereum, Solana, Polygon, Base, OptimismDeflationary mechanism

YesMax. supply

13,931,216,938 XYOToken utility

Staking, user rewards, data validation and verificationBest for its gradual token vesting

Chains where deployed

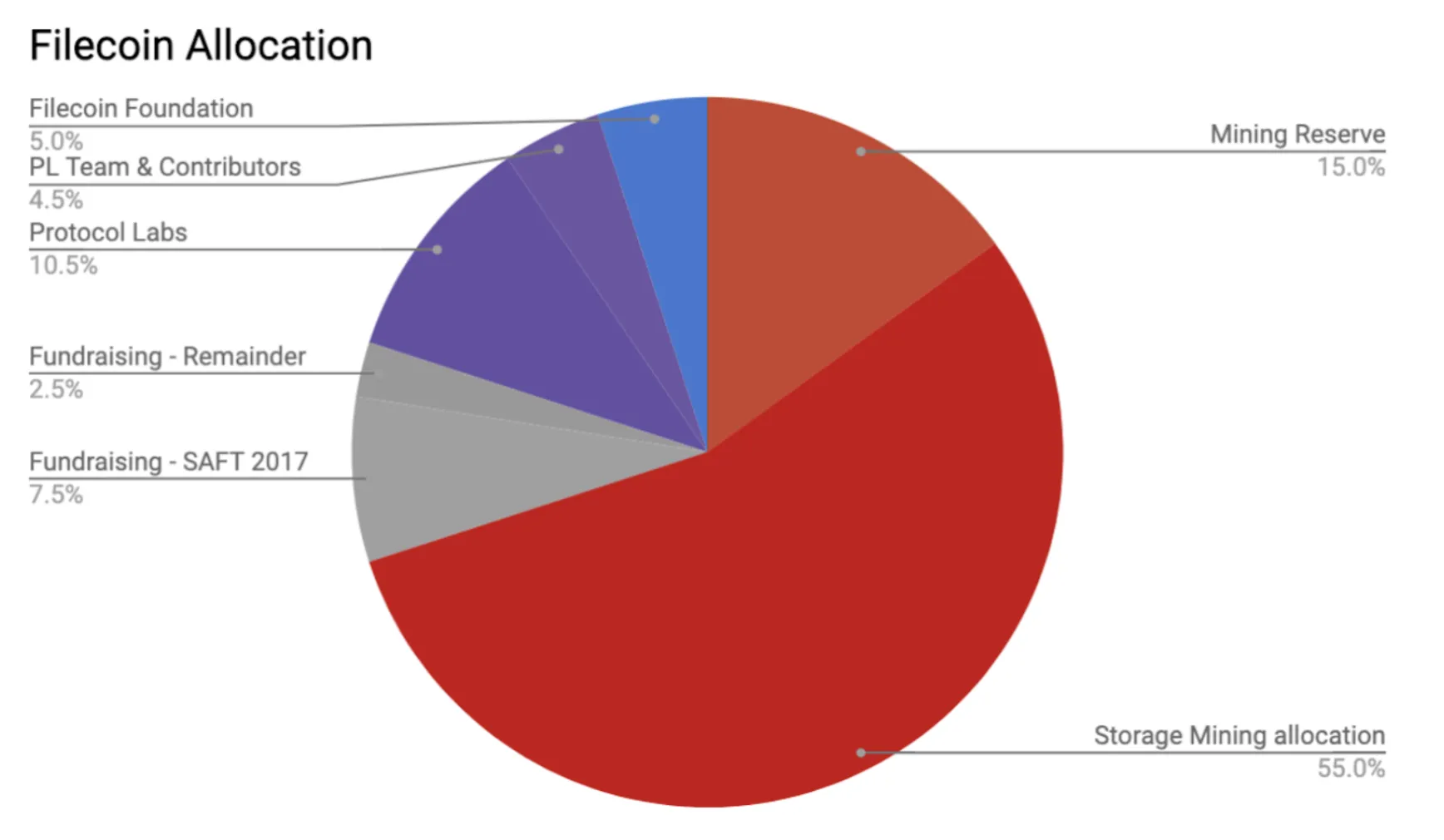

Filecoin, Binance Smart ChainDeflationary mechanism

NoMax. supply

2,000,000,000 FILToken utility

User rewards, network payments, governance, stakingSummary of the Best Crypto DePIN Tokens

What are DePIN tokens?

DePIN (Decentralized Physical Infrastructure Networks) tokens are the native assets of DePIN projects, which use digital technology to connect real-world infrastructure with decentralized networks in a third-party-free and more efficient way. These tokens play a crucial role in decentralizing DePIN projects through an incentivization system.

Key Metrics to Evaluate DePIN Tokens

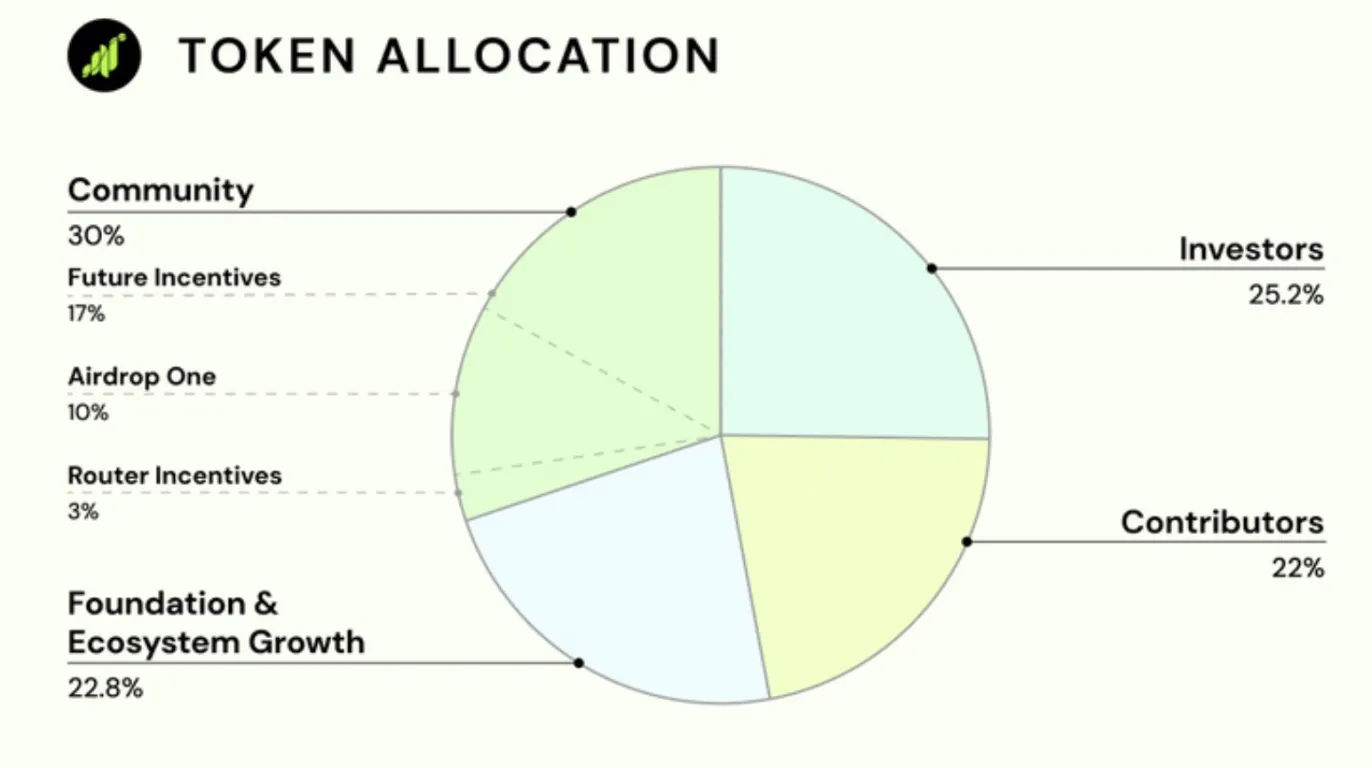

- Transparency of Tokenomics: Clear allocation distribution and easy-to-understand tokenomics.

- Long-Term Token Value: Smooth, long-term vesting, and opportunities for holders to participate in governance.

- Token Accessibility: Availability not only through trading on major exchanges but also through earning rewards by participating in network activities.

- Additional Rewards: Staking options for token holders to earn more rewards and increase position size.

- Absence of High Inflation: Deflationary mechanisms or a capped maximum supply are valuable for the long-term sustainability of the token.

- Project Analysis: Understanding the project behind the token through thorough research.

How DePin Tokens Power Decentralized Infrastructure

DePIN tokens empower decentralized infrastructure by enabling projects to reward users for their contributions. This incentivization attracts more participants, making the network more decentralized and efficient. For example, XYO, a decentralized location data network, uses its token to reward users for sharing location data and validating information, which has the potential to achieve digital sovereignty and create a more autonomous, community-governed ecosystem.

Investment Outlook and Growth Potential

DePIN tokens have been gaining significant popularity, supported by their increasing position in the top-10 categories by market capitalization according to CoinMarketCap. As of the time of writing, the total market cap of DePIN tokens exceeds $16.5 billion, highlighting the growing demand and adoption of decentralized infrastructure networks. Below are the key points highlighting the potential of DePIN tokens:

- Real-world use cases, including decentralized storage, data sharing, GPU power, and other valuable functions.

- Strong token utilities that potentially provide long-term value and community-driven growth.

- Attractive incentives for users to participate and contribute to the network.

Conclusion

DePIN tokens are undoubtedly an essential part of the projects they power, as they are rewarded to users for providing specific resources, offering them the opportunity to build an investment position and participate in governance. DePIN tokens could have an advantage over other crypto asset categories due to their real-world applications, but it’s important to always assess the risks and perform comprehensive research (DYOR). In this article, you have explored a list of the best DePIN tokens, with detailed descriptions and insights that can significantly simplify your analysis.

Frequently Asked Questions

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.