In the artificial intelligence (AI) sector, the demand for high-performance computing resources, especially Graphic Processing Units (GPUs), is skyrocketing. This demand is shaping a new frontier for the Decentralized Physical Infrastructure (DePin) projects, which focus on decentralizing access to GPUs.

These platforms facilitate broader Web 3 adoption and offer a cost-effective alternative to traditional cloud services.

What Are Top GPU-Powerhouse DePin Projects?

Operating through several key stages—data collection and processing, model training, fine-tuning, and model inference—these platforms support a wide range of AI applications. These applications include deep learning, autonomous driving, robotics, and other use cases.

Crypto researcher Layergg notes that DePin projects can provide GPU resources “over 4 times cheaper” than giants like Google Cloud and Amazon Web Services (AWS).

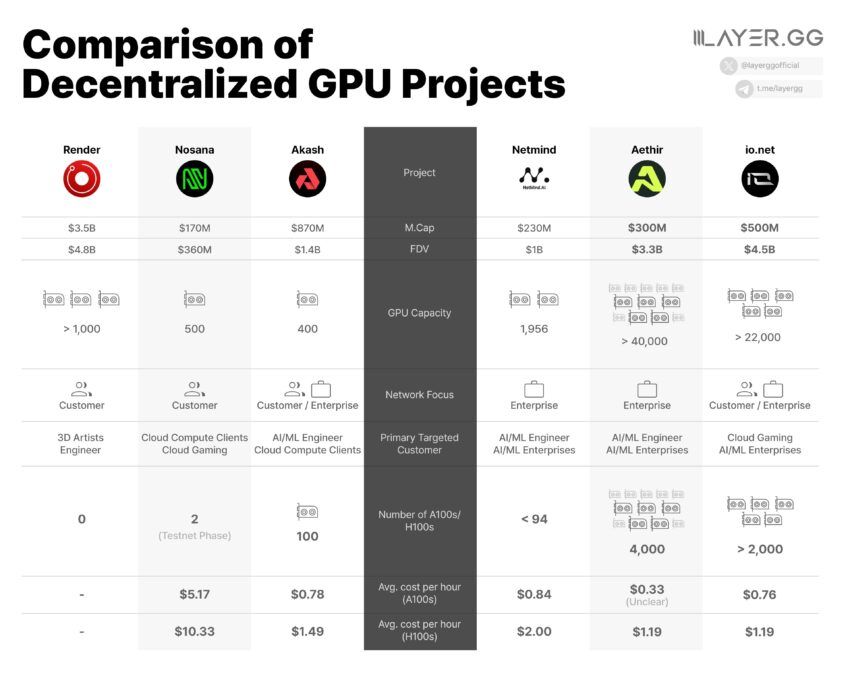

Layergg highlights six leading projects in this space.

- Render (RNDR) boasts a fully diluted valuation (FDV) of $4.8 billion and over 1,000 GPUs.

- Io.net (IO) has over 22,000 GPUs and an FDV of $4.5 billion.

- Aethir (ATH) has a GPU capacity topping 40,000 and an FDV of $3.3 billion.

- Akash (AKT) has an FDV of $1.4 billion and 400 GPUs.

- Netmind (NMT) has 1,956 GPUs and a $1 billion FDV.

- Nosana (NOS) has an FDV of $360 million and 500 GPUs.

Read more: Render Token (RNDR): A Guide to What It Is and How It Works

The decentralized computing model provides a significant cost advantage, thus making it an attractive option for AI/ machine learning enterprises that struggle with the high costs of GPU resources. Consequently, there is an increased emphasis on computational power as the primary bottleneck to AI progress.

However, challenges such as transparency in GPU power claims have raised concerns. This points to a broader issue of credibility and accountability in the decentralized computing space.

“It’s CePIN.. not DePin if you really can’t prove your GPU count on-chain,” on-chain analyst Hitesh Malviya critiqued.

Despite these challenges, the potential for decentralized platforms to dominate the market remains high. Furthermore, another analyst, Prithvir believes that among the projects, Aethir, Akash, and io.net are best positioned. However, he notes that Akash, despite being a stalwart in the space, faces challenges in expanding its GPU capacity compared to its counterparts.

Read more: Which Are the Best Altcoins To Invest in June 2024?

In terms of market dynamics, IO and ATH are viewed as potential high performers.

“I believe that IO and ATH could both see massive runs. I think these could be similar trades to Celestia (TIA). $10 billion FDV could be a reasonable ceiling for IO and ATH. The upper limit would be $20 billion,” Prithvir said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.