As the crypto market continues to evolve at a breakneck pace, several key developments are set to shape the industry this week.

From earnings announcements to major launches and significant legal proceedings, here’s an overview of what market watchers anticipate.

Ethereum’s Resurgence and Investment Opportunities

Ethereum (ETH) has shown signs of strength this week, suggesting a bullish outlook for ETH beta plays. ETH beta refers to other high volatility altcoins that are based on the Ethereum ecosystem.

Some of the popular examples of this category are Lido (LDO), Optimism (OP), and Etherfi (ETHFI). Therefore, whenever Ethereum’s value increases, all the ETH beta coins are expected to follow suit and increase in value.

As a result, investors are closely monitoring the ETH market for potential gains. Positive momentum could lead to lucrative opportunities in Ethereum-related tokens.

Coinbase’s Anticipated Earnings Report

Coinbase, a leading cryptocurrency exchange, will release its Q1 earnings on May 2. Analysts are optimistic, forecasting an increase in earnings propelled by the recent crypto market recovery.

This follows a positive adjustment by JPMorgan in mid-February. The Wall Street giant upgraded Coinbase’s COIN stock from underweight to neutral. This decision came following the approval of spot bitcoin ETFs in the US.

At the time of writing, COIN recorded a closing price of $236.32 as of April 30.

Read more: The 7 Hottest Blockchain Stocks to Watch in 2023

Theta Network’s Innovative Edge

The Theta Network aims to revolutionize the 3D rendering industry by launching new jobs for its Theta edge nodes on the Windows platform. Dubbed EdgeCloud, this hybrid cloud computing platform will facilitate a complete 3D development pipeline. It will integrate the widely-used open-source Blender technology.

This move could significantly impact industries ranging from entertainment to education, enhancing Theta’s footprint in the tech ecosystem.

Federal Reserve’s Rate Decision Amidst Hong Kong Spot ETFs Launch

This Wednesday, the US Federal Reserve will announce the interest rate decision.

This development is crucial for the financial markets, including cryptocurrencies. While rates are expected to hold steady, the crypto community is buzzing about the recent launch of spot Bitcoin (BTC) and ETH ETFs in Hong Kong. They will closely monitor their performance in the debut week.

Token Unlocks and Their Market Impact

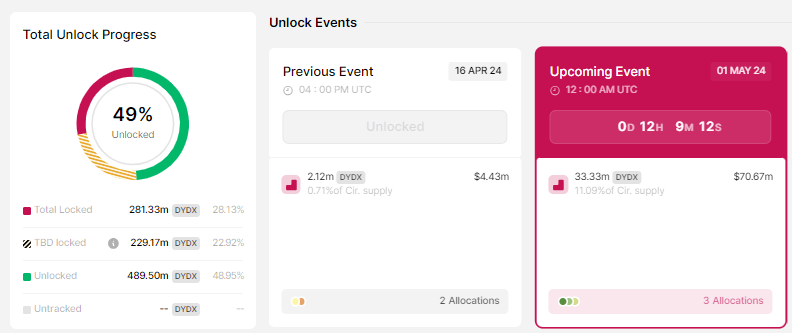

May 2024 witnesses a significant event in the crypto calendar with approximately $3.58 billion in token unlocks scheduled across various projects. The unlock of $70.67 million worth of DYDX tokens on May 1 is particularly interesting.

The token unlocks represent 10.7% of the DYDX circulating supply.

Such events are likely to introduce considerable liquidity into the market. Other token unlocks that might also be worth watching include Pyth Network (PYTH), Aevo (AEVO), and Avalanche (AVAX).

Renzo Protocol’s Expansion and Airdrop

Renzo Protocol, currently the second-largest liquid restaking protocol, is making headlines with the launch of its REZ token on April 30. Following a surge in interest after Binance’s Launchpool program, Renzo is set to distribute 7% of the REZ supply in its first airdrop.

Recently, Renzo Protocol became the talk of the crypto community as its liquid restaking token (LRT) ezETH experienced depeg last Wednesday. ezETH’s price experienced a momentary fall to as low as $688 on the decentralized exchange (DEX) Uniswap. However, the price of ezETH managed to recover several hours after the depeg.

Kamino’s Community Focused Token Distribution

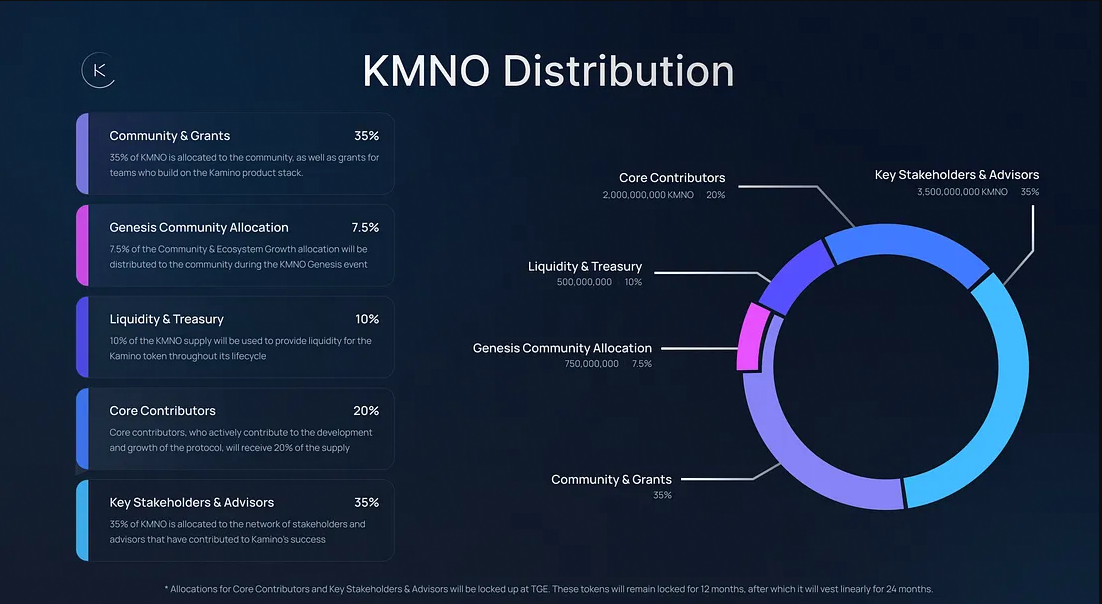

Another significant development comes from Kamino. The leading Solana-based money market will release its KMNO token on April 30.

35% of the supply is dedicated to growth initiatives, and a considerable portion is allocated to core contributors and advisors.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens

Legal Spotlight: CZ’s Sentencing

In legal news, Changpeng Zhao (CZ), the CEO of Binance, faces sentencing in a US court in Seattle for violations of the Bank Secrecy Act. With federal prosecutors recommending a three-year prison sentence and a substantial fine, the outcome could have far-reaching implications for regulatory practices within the cryptocurrency industry.

As we navigate these pivotal events, the crypto market remains a hotbed of activity. Each development will influence individual investments and shape the broader financial sector.

Therefore, stakeholders need to stay informed and agile with the market updates.