This week, significant news in the crypto space includes the Federal Open Market Committee (FOMC) meeting on interest rates, the Jupiter (JUP) token supply proposal, and several major launches and updates across various blockchain platforms.

These events are poised to influence the crypto market and investor sentiment.

FOMC Interest Rate Decisions on July 31

The Federal Open Market Committee (FOMC) is scheduled to meet on July 31 to discuss potential changes to interest rates. Federal Reserve Chair Jerome Powell has previously indicated the possibility of interest rate cuts in 2024. However, such measures have yet to be implemented.

The minutes from the FOMC’s June meeting revealed steady US economic activity, strong labor market conditions, and low unemployment rates. However, inflation remains a concern, with consumer prices not yet meeting the Fed’s 2% target.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

The FOMC’s decisions are critical as they directly influence economic conditions, inflation rates, and monetary policies. Therefore, investors across all markets, including in the crypto sector, highly anticipate this meeting.

Historically, interest rate changes have had a profound impact on Bitcoin (BTC) and the broader cryptocurrency market. Higher interest rates often lead to reduced investor risk appetite, increased opportunity costs, and heightened margin calls, resulting in lower crypto prices. Conversely, lower interest rates stimulate borrowing, increase economic liquidity, and boost consumer spending and investment, potentially driving up crypto asset prices.

Jupiter DAO to Vote on Token Supply Reduction Proposal

Jupiter, a prominent decentralized exchange (DEX) on the Solana network, has announced a significant proposal to reduce the total supply of its JUP token by 30%. This proposal includes reducing team allocations and annual airdrops, aiming to increase token scarcity and potentially drive up its value. The community is set to vote on this proposal this Thursday.

“This will cut the fat off the FDV, activate the community to really understand JUP tokenomics, as well as address concerns around high levels of emissions and motivate everyone towards growing the meta together,” Meow, founder of Jupiter, explained.

Despite this proposal’s benefits, some Jupiter community members speculate it may lead to short-term sell-offs. Moreover, they see that the plan could potentially reduce user participation due to lower rewards.

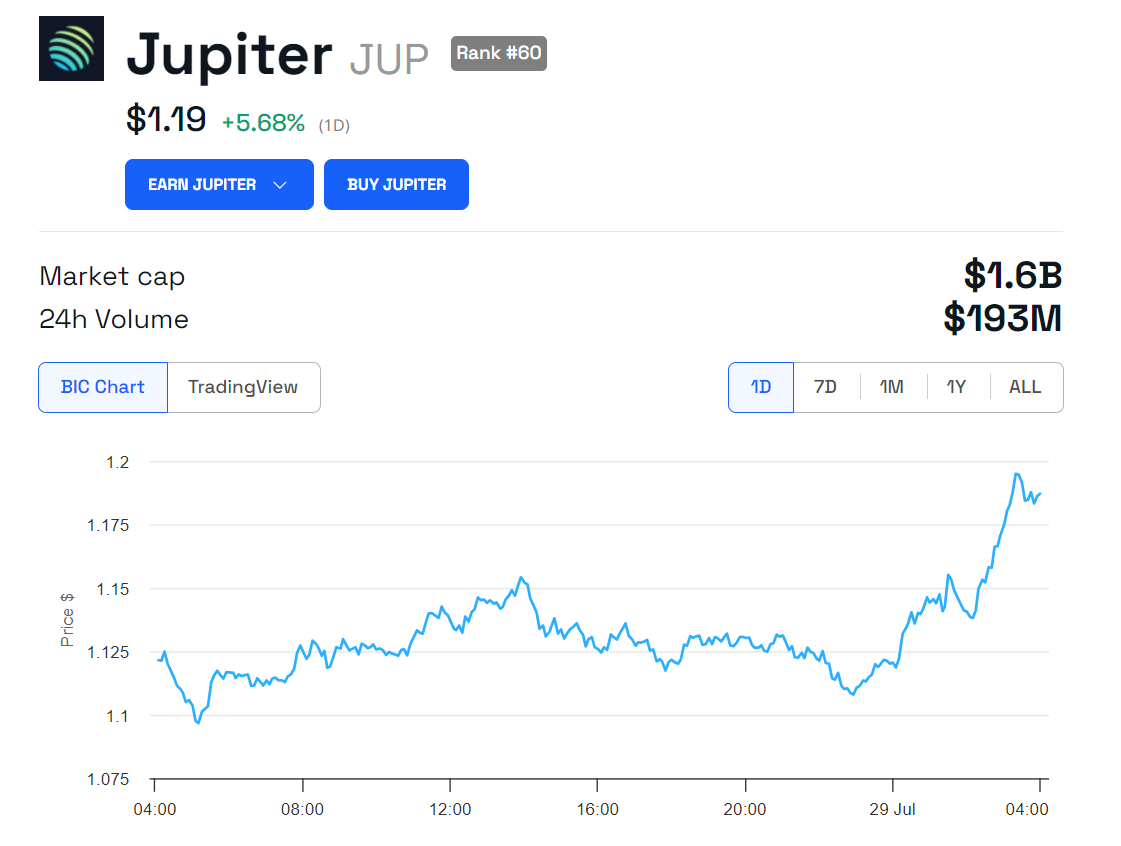

Amid the anticipation of the vote, JUP has seen a significant increase. At the time of writing, it is trading at $1.19, representing a 5.68% surge in the last 24 hours.

pSTAKE BTC Liquid Staking v1 Set to Launch

pSTAKE is launching its BTC Liquid Staking v1 on July 29. This platform allows users to deposit BTC on the Bitcoin Network into pSTAKE, with subsequent deposits into Babylon, a security-sharing protocol.

Babylon enables BTC holders to stake their tokens to secure proof-of-stake (PoS) blockchains and earn rewards. This approach offers a way to earn yields while maintaining custody of BTC and avoiding the need to bridge assets.

The pSTAKE SatDrop campaign, launching in August 2024, will offer boosted pSats (points) and additional rewards from Babylon. Due to protocol security measures, pSTAKE initially had a 50 BTC cap, with BTC withdrawals expected to go live in the coming weeks.

Router Chain to Launch Mainnet for Chain Abstraction

Router Chain, a layer-1 blockchain designed to enable chain abstraction, has announced the launch of its mainnet on July 30, 2024. This platform aims to connect over 150 blockchain ecosystems, including Ethereum Virtual Machines (EVMs), non-EVMs, Rollups, and layer-2 (L2) or layer-3 (L3) chains.

The Router Chain team has indicated that integrations with major blockchains like Bitcoin, Solana, and Osmosis are underway. The platform’s native token, ROUTE, will be instrumental in securing the permissionless PoS network.

Drift Protocol to Launch Prediction Market on Solana

On July 26, Drift Protocol announced plans to launch a prediction market on the Solana blockchain. Although the team has not specified the exact launch date yet, many believe that this new product will be available very soon.

This new product uses Solana’s high-speed and low-cost infrastructure to provide users with an efficient and seamless prediction market experience. Launching this prediction market aligns with the broader trend of expanding decentralized finance (DeFi) services. Moreover, this new development will attract many users interested in DeFi and blockchain-based prediction markets.

Eclipse Mainnet Launches After Successful Audit

Eclipse, an Ethereum L2 solution, has successfully audited with OtterSec and is set to launch its mainnet this week. However, the Eclipse team has not yet disclosed the specific launch date.

Eclipse aims to become the fastest and most universal L2 solution by combining multiple technological layers, including Ethereum as the settlement layer, Celestia for data availability, RISC Zero for zero-knowledge fraud proofs, and Solana’s SVM for execution.

Read more: Layer-2 Crypto Projects for 2024: The Top Picks

In September 2022, Eclipse raised $15 million in funding, including a $6 million pre-seed round led by Polychain and a $9 million Seed round co-led by Tribe Capital and Tabiya. The project also received a development grant from the Solana Foundation.

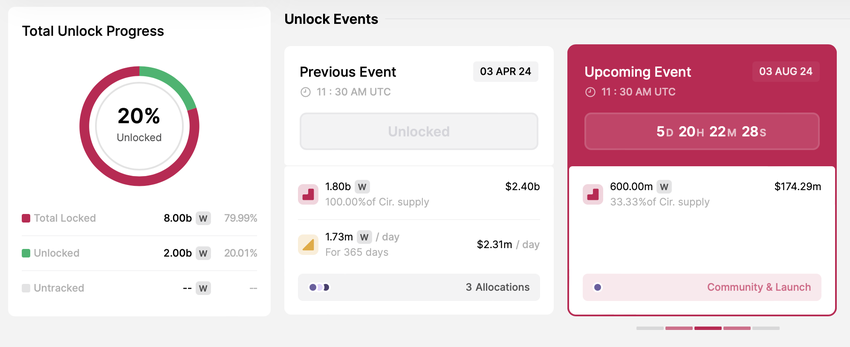

Wormhole (W) and Other Major Token Unlocks This Week

On August 3, 2024, Wormhole (W) is set to unlock 600 million W tokens, valued at approximately $176 million. This unlock represents 33.33% of the token’s circulating supply.

Other significant token unlocks this week include Optimism (OP) and Sui, which could impact market liquidity and valuation. Read this article for further detailed information on major crypto token unlocks this week.