Popular analyst Michaël van de Poppe shares a list of altcoins that could bounce off more strongly after the last dip. This comes as crypto markets reel from the recent correction that saw Bitcoin (BTC) test the depths of $49,000.

Portfolio rebalancing is a favored investment strategy among intentional traders, especially during periods of market volatility. To effectively manage risk, traders should diversify their investments across promising crypto narratives, establish a clear exit strategy, and maintain a disciplined dollar-cost averaging approach.

Analyst Top Altcoin Picks as Market Attempts Recovery

Van de Poppe observes how altcoins are doing after the correction. He notes that Ethereum (ETH) DeFi has been bouncing off more strongly than Solana DeFi tokens, which shows the potential of the respective ecosystem. He also observes the commendable performance among meme coins, AI, and DePIN categories.

“If we are looking at the data, then you want to be positioned at AI and DePIN, meme coins, or you want to be positioned into ETH DeFi. You want to be into the biggest bounces because those are likely going to continue with the momentum as traders are looking at the hype coins or the strongest bounces and start allocating toward those,” van de Poppe noted.

Bittensor (TAO)

An analyst has predicted a 5 to 10X potential for TAO, an AI-driven crypto coin, following its 70% rally from recent lows. This surge has caught the attention of many traders. Michaël van de Poppe is not alone in his optimism; other experts also foresee further gains for the Bittensor token, considering it a strong investment.

“If you’re aiming for a significant boost in your portfolio, TAO might be a compelling choice. Currently, the market cap stands at an impressive $2 billion, reflecting the strong performance and potential of TAO,” noted Lucky, a seasoned Bitcoin investor.

Meanwhile, TAO is a front-runner for the artificial intelligence (AI) sector, which has shifted market sentiment from bearish to bullish. This shift is attributed to the rising global demand for AI technologies. The Relative Strength Index (RSI) also indicates that bulls maintain control, as the RSI remains above the midpoint of 50.

Read more: What Is Altcoin Season? A Comprehensive Guide

Aave (AAVE)

Michaël van de Poppe has also pointed to AAVE as a promising asset, noting significant accumulation against Bitcoin and the formation of higher highs against the USDT stablecoin, both signs of growing bullish momentum. He observes that AAVE has been in horizontal consolidation, with no significant price drops, which he sees as a strong indicator.

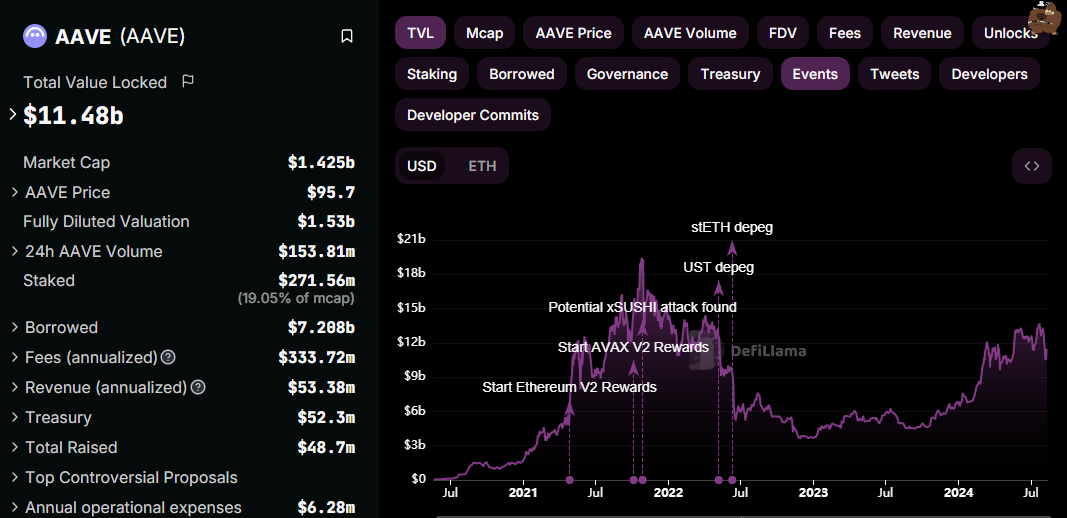

Beyond the bullish technical outlook, on-chain metrics for AAVE are also favorable. The Aave blockchain boasts a total value locked (TVL) of around $11.5 billion, against a market capitalization of over $1.4 billion. This valuation suggests considerable upside potential, according to van de Poppe.

Notably, the Aave DAO recently launched the first $100 million yield loan alongside key partners. The move, which exemplifies how tokenization and blockchain technology can revolutionize the issuance and management of bonds and securities, could bode well for the AAVE token.

Aevo (AEVO)

Michaël van de Poppe also highlights AEVO as a promising buy, pointing to its predictions and options market. From a technical perspective, he notes a bullish divergence in the Relative Strength Index (RSI), where the RSI shows higher lows against the price’s lower highs, indicating growing bullish momentum.

Van de Poppe further identifies a falling wedge pattern on AEVO’s one-day chart, which suggests a potential breakout to the upside. This pattern is widely regarded as a bullish reversal signal, confirmed when the price breaks above the upper trend line. The profit target for this pattern is typically calculated by adding the maximum distance between the upper and lower trend lines to the breakout point.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

The analyst did not highlight any projects on his radar for the DePIN category. Nevertheless, experts are already looking at Lumerin (LMR), Destra Network (DSYNC), AIOZ Network (AIOZ), StorX Network (SRX), and Storj (STORJ).

Investors are actively preparing for an altcoin season despite skepticism that the capital rotations will happen. Notwithstanding, getting ahead of things is a safer option than succumbing to the fear of missing out. Nevertheless, traders and investors must also conduct their own research.