Toncoin (TON) price has faced a persistent downtrend over the last four months, with multiple attempts to recover falling short.

Despite these setbacks, recent market conditions indicate a potential recovery, as medium-term holders (MTH) now appear to be driving the price. This shift could mark a turning point for Toncoin’s price action.

Toncoin Investors Seem Confident

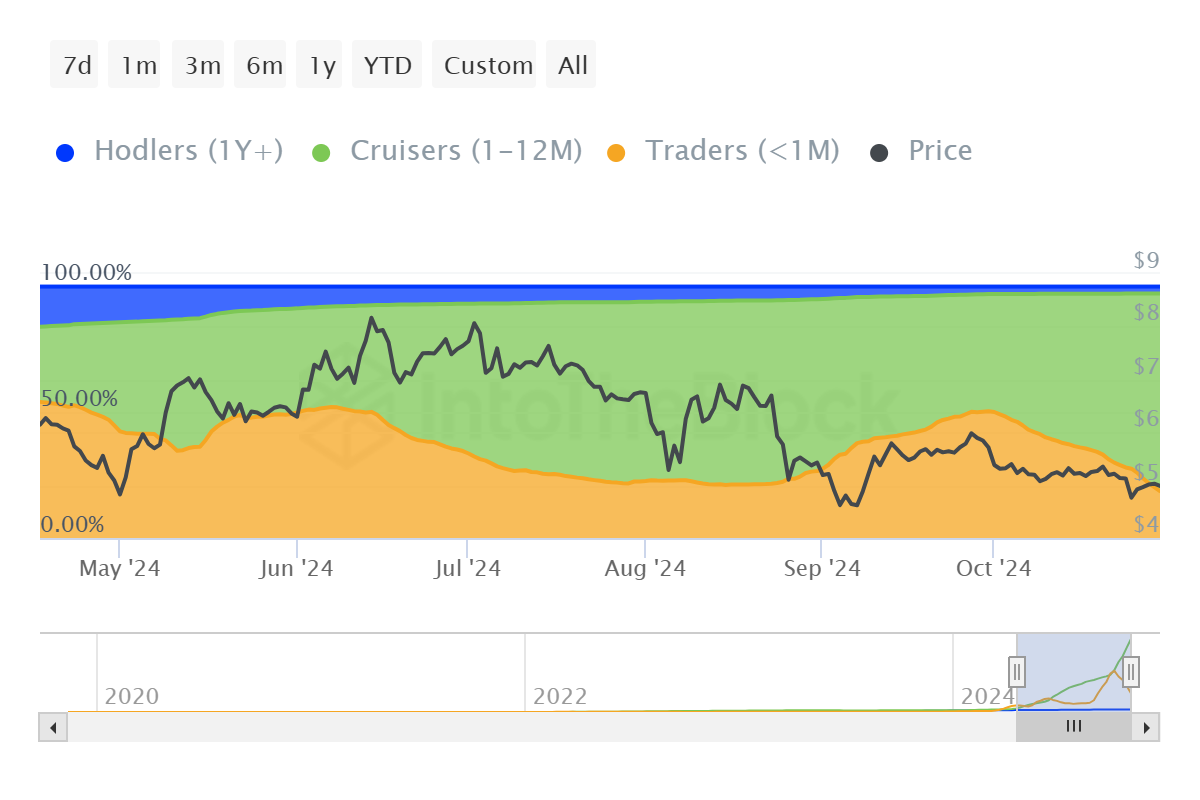

Toncoin’s market sentiment shows promising signs of stability as short-term holders (STH) transition into medium-term holders (MTH). In the past two months, MTH dominance has grown by 32%, with 77% of all TON addresses now holding their assets for more than a month. This shift from short-term to medium-term holding suggests an increase in investor confidence and commitment, a positive indicator for price stability.

A larger proportion of MTH reduces market volatility, as these holders are less likely to react to minor price fluctuations. This increased holding period may support a steadier price foundation, giving Toncoin a better chance of maintaining upward momentum.

Read more: What Are Telegram Bot Coins?

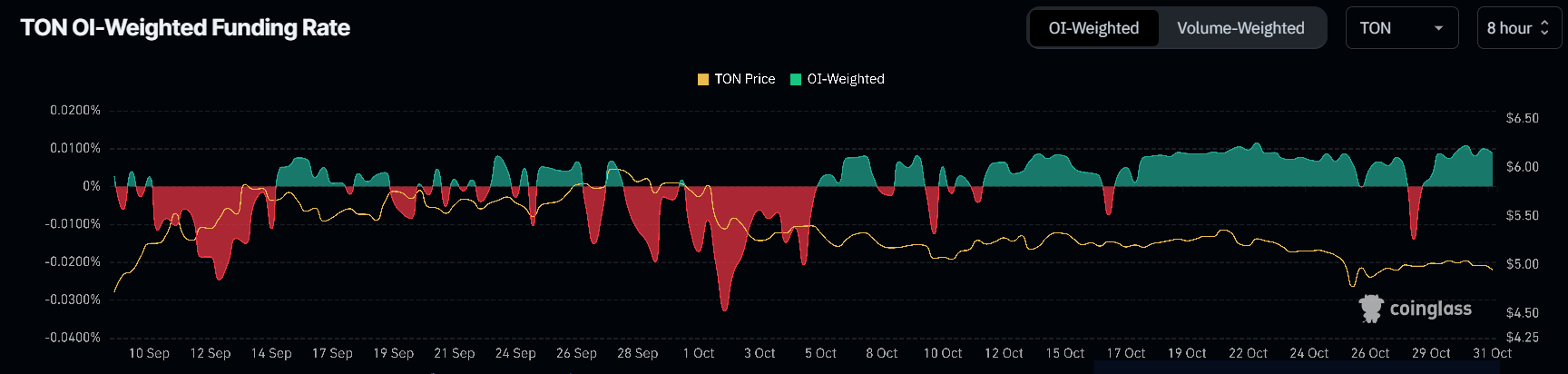

Toncoin’s macro momentum is reinforced by a positive Funding Rate, suggesting that traders are largely betting on a price rise. When the Funding Rate is positive, it indicates that traders are willing to pay a premium to keep long positions, reflecting an optimistic outlook on Toncoin’s potential for growth. This sentiment could act as a catalyst for TON’s price, with traders’ bullish positions signaling confidence in the asset.

With most traders betting on a Toncoin rally, the overall market sentiment tilts toward optimism. Positive Funding Rates often serve as indicators of anticipated price movement as traders invest in the asset’s upward momentum. For Toncoin, this trend could further support the altcoin’s attempt to break out of its current downtrend.

TON Price Prediction: Breaking Downtrend

Currently, the Toncoin price is trading at $4.91, with a focus on establishing $4.86 as a solid support level. Securing this floor is crucial for TON, as it provides a base from which the asset could aim to recover. Holding above $4.86 would signal the strength necessary for further bullish action.

While breaking the downtrend line is essential, Toncoin must also flip $5.37 into support to confirm a genuine breakout. Achieving this would demonstrate a stronger commitment to the upside, enhancing the possibility of a sustained rally toward $6.00. A successful flip of $5.37 would mark a significant step for Toncoin, reflecting growing investor confidence.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

However, if Toncoin fails to hold the $4.86 support level, it risks sliding to $4.61. Falling below this point would invalidate the bullish outlook, potentially leading to further declines. This scenario would challenge Toncoin’s upward trajectory, forcing investors to reassess the potential for recovery.