On Monday, Toncoin (TON), the cryptocurrency linked to the popular messaging app Telegram, led market gains. Its value climbed by nearly 9% during the intraday session, bucking the general market downward trend.

However, there has been a spike in profit-taking activity over the past 24 hours, causing the altcoin’s value to drop by 2%. During that period, its trading volume has also declined by 17%.

Toncoin Witnesses Pullback but Remains in the Game

As of this writing, TON trades at $6.84. Readings from its daily chart reveal that the price dip is only temporary as the coin is still well positioned to resume its uptrend.

TON’s price is trending towards its Ichimoku Cloud from below. This indicator identifies an asset’s trend direction, gauges momentum, and defines support and resistance levels. At press time, TON’s price is spotted approaching this cloud in an uptrend.

The recent movement suggests that the coin is attempting to break out of its bearish trend. A rally above the cloud, which currently acts as resistance, would confirm a bullish breakout for TON’s price.

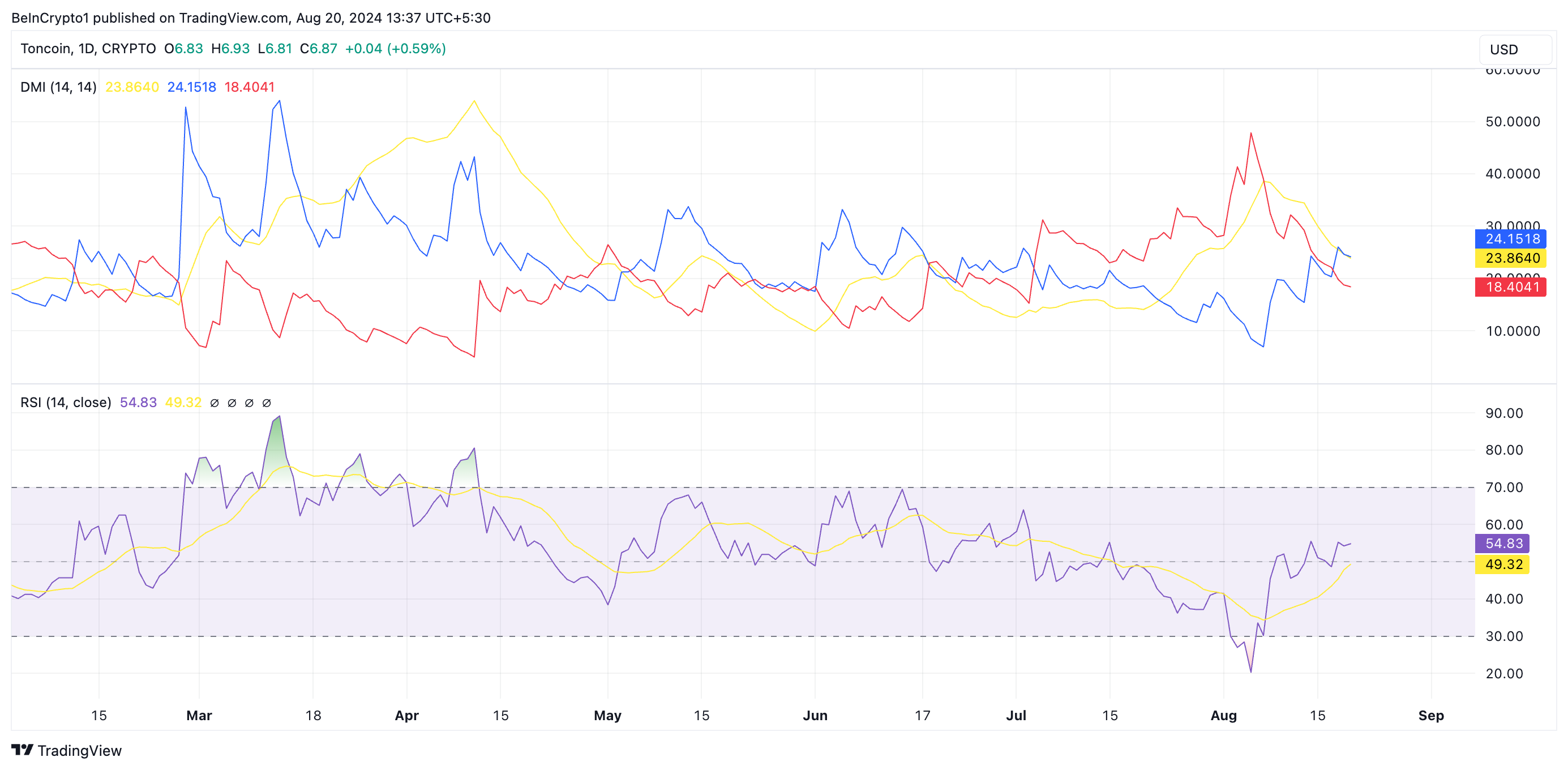

Despite the recent sell-offs, there remains significant demand for TON, as reflected by its rising Relative Strength Index (RSI). The RSI, which measures whether an asset is oversold or overbought, is trending upward at 54.83, indicating increased accumulation of the coin.

Additionally, TON’s Directional Movement Index (DMI) setup confirms a bullish bias. The Positive Directional Indicator (+DI), responsible for tracking the strength of upward price movements, is currently above the Negative Directional Indicator (-DI), measuring downward trends.

Read more: What Are Telegram Bot Coins?

This signals that TON buyers are in control and bullish momentum dominates the market.

TON Price Prediction: Futures Traders Adopt a Different Approach

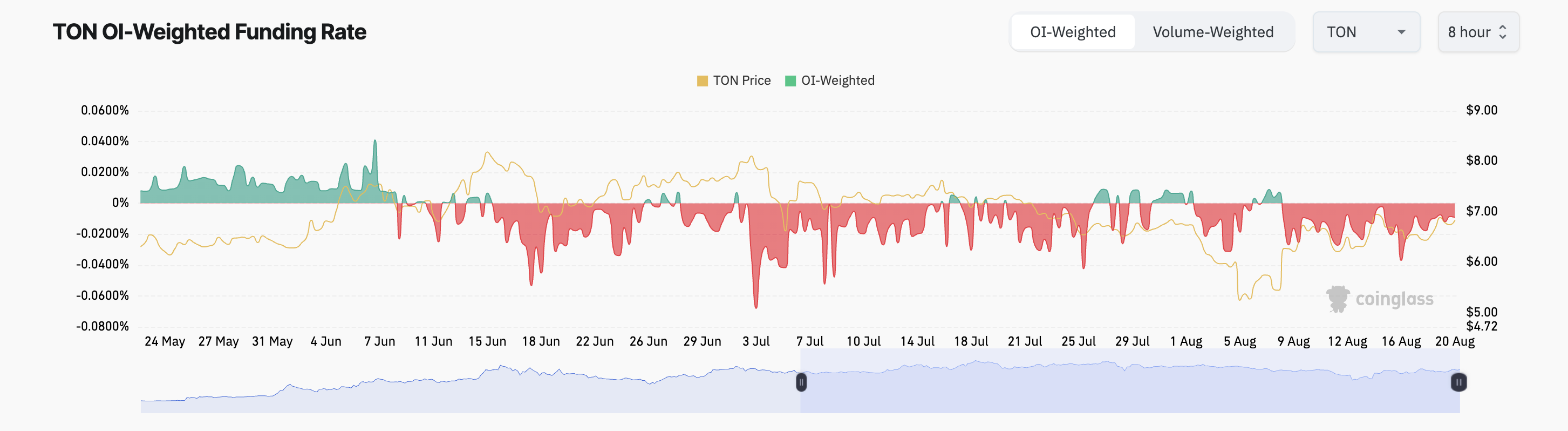

This bullish trend is missing from TON’s derivatives market as its futures traders continue to demand short positions. Coinglass’ data shows that the coin’s funding rate across cryptocurrency exchanges has been mostly negative since the beginning of the month.

As of this writing, it is -0.0091%, suggesting that more traders are betting against a price rally than are buying the altcoin in anticipation of a rally.

If the predicted decline ensues, TON’s value may plunge to $6.51.

Read more: 6 Best Toncoin (TON) Wallets in 2024

However, if the current trend continues, the price could resume its rally and move above the cloud at $7.52.