Speculators have bought up huge volumes of positions in oil. However, many investors are downplaying the uncertainty facing the industry. The oil market has rarely seen such two-way risk, and the oil price could go anywhere from here.

The oil industry is in for either a price squeeze or stronger global growth. It’s a two-way risk that could go either way, according to analysts.

Oil Price and The US-China Trade War

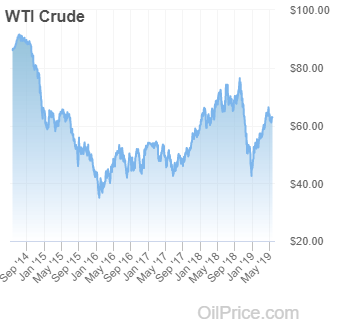

Currently, the trajectory for crude oil hinges on what happens with the U.S.-China trade war. The global business cycle is also at a serious impasse, with investors unsure if we are due for a major correction. Coupled with the ongoing trade war, a global downturn could push oil prices downwards to $50 per barrel. Alternatively, however, a weaker USD and a return of business confidence could propel the price up to $90 per barrel. Bob McNally, President of Rapidan Energy Group, put the situation just as grimly. “China, trade, and macroeconomic weaknesses could send crude prices at least $15,” he told Axios. The tense situation with Venezuela and Iran could inevitably also impact this market which is currently tittering on the edge. In short, the oil sector is at an impasse — which could go either way. The problem is, speculators are not seeing the two-tailed risks. Instead, if recession fears end up being true, we could see investors rush to get out of a market leading to a significant price collapse due to limited liquidity.

In short, the oil sector is at an impasse — which could go either way. The problem is, speculators are not seeing the two-tailed risks. Instead, if recession fears end up being true, we could see investors rush to get out of a market leading to a significant price collapse due to limited liquidity.

Fair Oil Price and Tokenization

Unlike the stock market, commodities markets — like oil and gold — have always been plagued by limited liquidity. Although digitization has greatly improved the movement and trading of commodities, investment is limited and becoming too crowded. The crude oil price is largely dictated by major players and speculation by institutional investors. Oftentimes, however, their failure to calculate risk can cause crashes disproportionate to how much thought is given to these possibilities. The tokenization of crude oil is an intuitive next-step for an industry looking to boost liquidity and expand its investor base. Tokens recorded on distributed ledgers would not only allow for near-instantaneous settlements and movement of the value, but it would also provide a clear record for the purposes of transparency. Boosted liquidity would likely allow for crude prices to respond to events closer to real-time with less volatility. Perhaps through tokenization, the crude oil sector could finally reach its “fair price” rather than be fraught by over-speculation and poor risk assessments. Do you believe the crude oil price is in for a collapse? Does the market need more liquidity and can that happen with tokenization? Let us know your thoughts below.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored