The week has been marked by a significant downturn in the cryptocurrency market. The values of leading assets such as Bitcoin (BTC) and Ethereum (ETH) have plunged by 12% and 17% in the past seven days, respectively.

Sharing a statistically positive correlation with Bitcoin, this decline has also impacted the values of several meme assets. All top 10 meme coin assets by market capitalization have experienced significant double-digit price declines over the past seven days.

Dogecoin (DOGE) Falls Under Key Moving Average

As of this writing, the leading memecoin, Dogecoin (DOGE), trades at $0.095. The coin’s value has plummeted by 24% in the last week. At its current price, DOGE exchanges hands at a price level last seen in February.

The coin’s price fell below its 20-day exponential moving average (EMA) on June 7 and has since traded below this level. An asset’s 20-day EMA measures its average price over the past 20 trading days.

When price falls below this level, it suggests a shift in momentum, with sellers overwhelming buyers. It signals a spike in selling pressure and indicates that the price decline will continue.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

If DOGE’s price decline continues, it will fall to $0.091.

Shiba Inu (SHIB) Battles Waning Buying Pressure

Shiba Inu’s (SHIB) price has dropped by 23% in the past seven days. At press time, the meme coin trades at $0.000013.

Also impacted by the general market downtrend, the demand for SHIB among market participants has plummeted. This is based on the readings from the coin’s declining Accumulation/Distribution (A/D) Line.

This indicator assesses the buying and selling pressure (accumulation and distribution) behind an asset’s price movement. When it declines, it suggests that selling pressure is increasing relative to buying pressure.

As of this writing, the value of SHIB’s A/D Line is 815.99 billion. This week alone, it has fallen by 86% from the 6 trillion recorded on July 1.

If an asset’s price also falls alongside a declining A/D Line, as in SHIB’s case, it strengthens the bearish signal and suggests that the downtrend might have more momentum.

Should this trend continue, SHIB’s value may dip to $0.000012.

Read More: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

If this projection is invalidated by a spike in buying activity, the meme coin’s price may climb to $0.000016.

Pepe (PEPE) Decline Puts Long Traders In Trouble

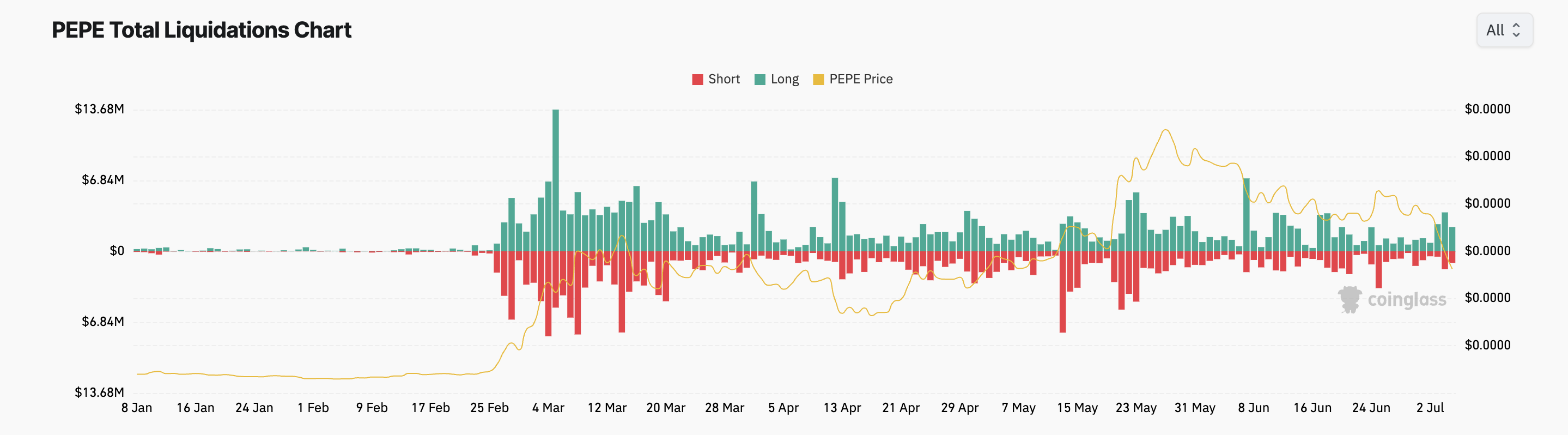

The value of the Solana-based frog-themed meme coin Pepe (PEPE) has dropped by 36% during the week in review. This has led to the liquidation of many long positions in the token’s derivatives market.

Liquidations occur in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations happen when the value of an asset suddenly drops, and traders who have open positions in favor of a price rally are forced to exit their positions.

The significant bearish bias that continues to trail the altcoin hints at the possibility of further long liquidations. According to readings from PEPE’s Parabolic Stop and Reverse (SAR) indicator, its dots lie above the meme coin’s price at press time.

This indicator measures an asset’s price trends and identifies potential price reversal points. When its dots are placed above an asset’s price, the market is said to be in a decline. It indicates that the asset’s price has been falling and may continue.

If this decline continues, PEPE may fall to $0.0000077.

However, if PEPE demand surges, the token’s price may be pushed to $0.0000090.