Crypto News: Here are the most popular stories from across the cryptosphere as featured in BeInCrypto this past week.

Top 5 IOT Projects in 2023

One of BeInCrypto’s most popular articles over the past week featured our top 5 Internet-of-Things (IOT) projects for 2023. IOT refers to systems of smart devices that use internet connectivity and artificial intelligence to collect and analyze data.

Smartphones are the most common IOT devices, but they also range from household appliances to sophisticated sensory devices. The integration of blockchain technology into the internet with Web 3.0 first required the spread of the internet to our everyday devices with Web 2.0.

Several IOT companies have had significant developments recently that portend a prosperous new year. Using its new type of distributed ledger, the Tangle, IOTA has recently established partnerships with Bosch and Fujitsu. It has plans to help them create a new ecosystem of connected devices that can process payment transactions.

Helium is creating a decentralized network of wireless devices powered by a cryptocurrency called HNT. The decentralized network enables a variety of applications, from supply chain management to agricultural monitoring. Ambrosus is also developing a decentralized platform for supply chain development, powered by its own crypto AMB.

WISE and Atonomi round out the list. The former intends to be a one-stop-shop for IOT devices, while the latter provides a blockchain-based infrastructure for secure device identification.

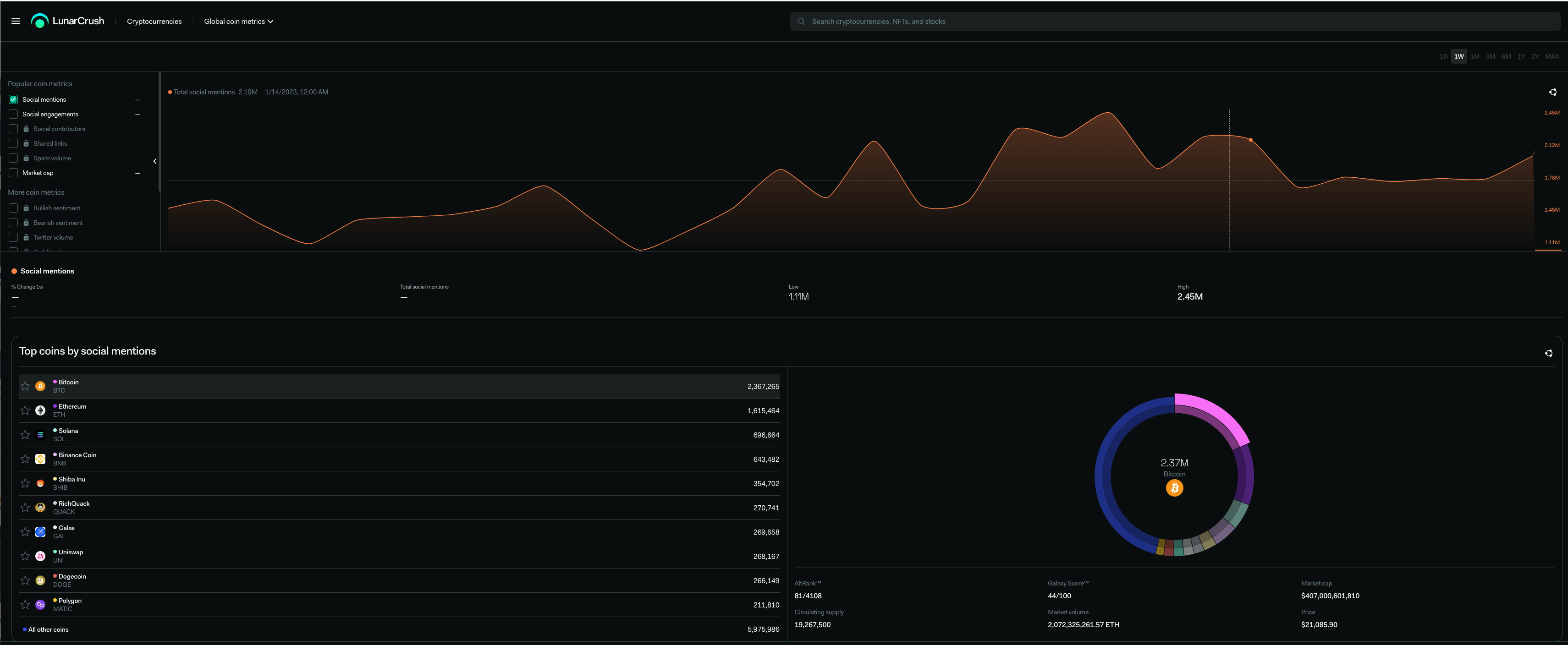

Crypto – Socially Speaking

Tether Settlement Volume

The next stories all feature a relative return to form for several top cryptocurrencies, starting with stablecoin Tether (USDT). The largest stablecoin by trading volume achieved a milestone last year, according to a recent tweet. Tether transactions amounted to a total settlement volume of $18.2 trillion, surpassing both Mastercard and Visa. The latter two payment giants processed transactions worth $14.1 trillion and $7.7 trillion, respectively.

Tether’s high transaction volume demonstrates the growing trend of stablecoin use over the past few years. Stablecoin adoption is rising especially in countries struggling with economic and monetary instability. In spite of this, Tether had a difficult year overall. Successive collapses last raised concerns about its reserves and solvency, which also caused it to briefly lose its peg.

Solana Back in Top 10

As Tether started the year off with some good news, Solana also celebrated a recent achievement. Earlier this week, Solana (SOL) managed to flip Polygon as the 10th-largest crypto asset by market capitalization. This came after a seven-day rally that saw it rise by over 70%, according to CoinGecko data.

Solana had been negatively impacted following the collapse of cryptocurrency exchange FTX. The blockchain and crypto had been a favorite of Sam Bankman-Fried, and suffered from this close association with his downfall. However, since the beginning of the year it has recovered over 135%, making it one of the best performers so far.

Ethereum Hits 10-Week High

Finally, Ethereum prices surged to their highest levels in 10 weeks, skirting with $1,600 several times between Jan. 16 and 18. The second largest cryptocurrency reached its highest price since Nov. 8, hitting $1,598 on Jan. 18. It has since cooled off a bit, and is trading around $1,550.

Meanwhile, rising network demand has pushed Ethereum issuance back in deflationary territory, as momentum increases in anticipation of its Shanghai upgrade. This will enable the phased withdrawal of Ethereum that has been staked on the Beacon Chain for over two years.

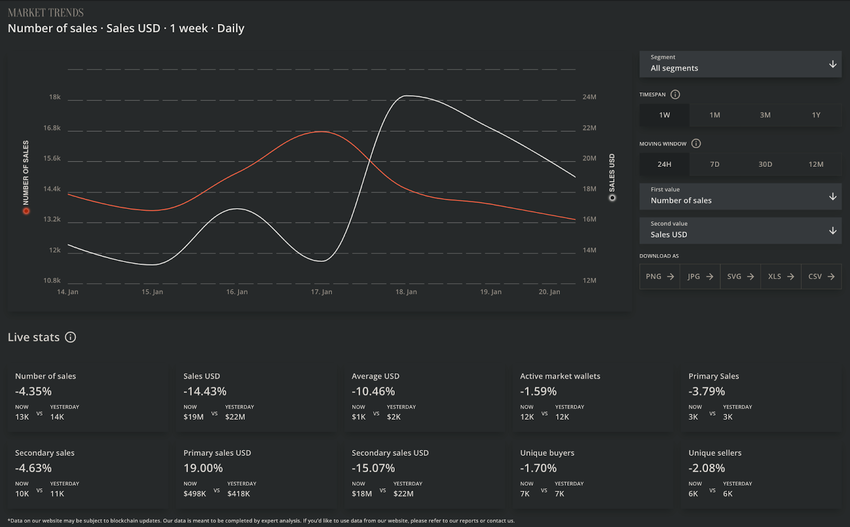

This Week in NFT Sales

Sales of non-fungible tokens were a bit erratic this week, although ultimately rising on the whole. Jan. 17 saw a lifting of the number of sales that corresponded to a low in daily sales. This however spiked the next day to over $24 million before declining again. Bored Ape Yacht Club remains the top NFT collection, this week with $64 million in sales.

Crypto Coin News

Frax Share (FXS) led the market in what was a buoyant week for altcoins, jumping 53%. While Decentraland (MANA) was up 43%, Convex Finance (CVX) by nearly 40% and Enjin Coin (ENJ) by 36%.

Master of the Multiverse

Our senior analyst, Valdrin Tahiri, explains why MultiverseX, the coin formerly known as Elrond, jumped 60%.