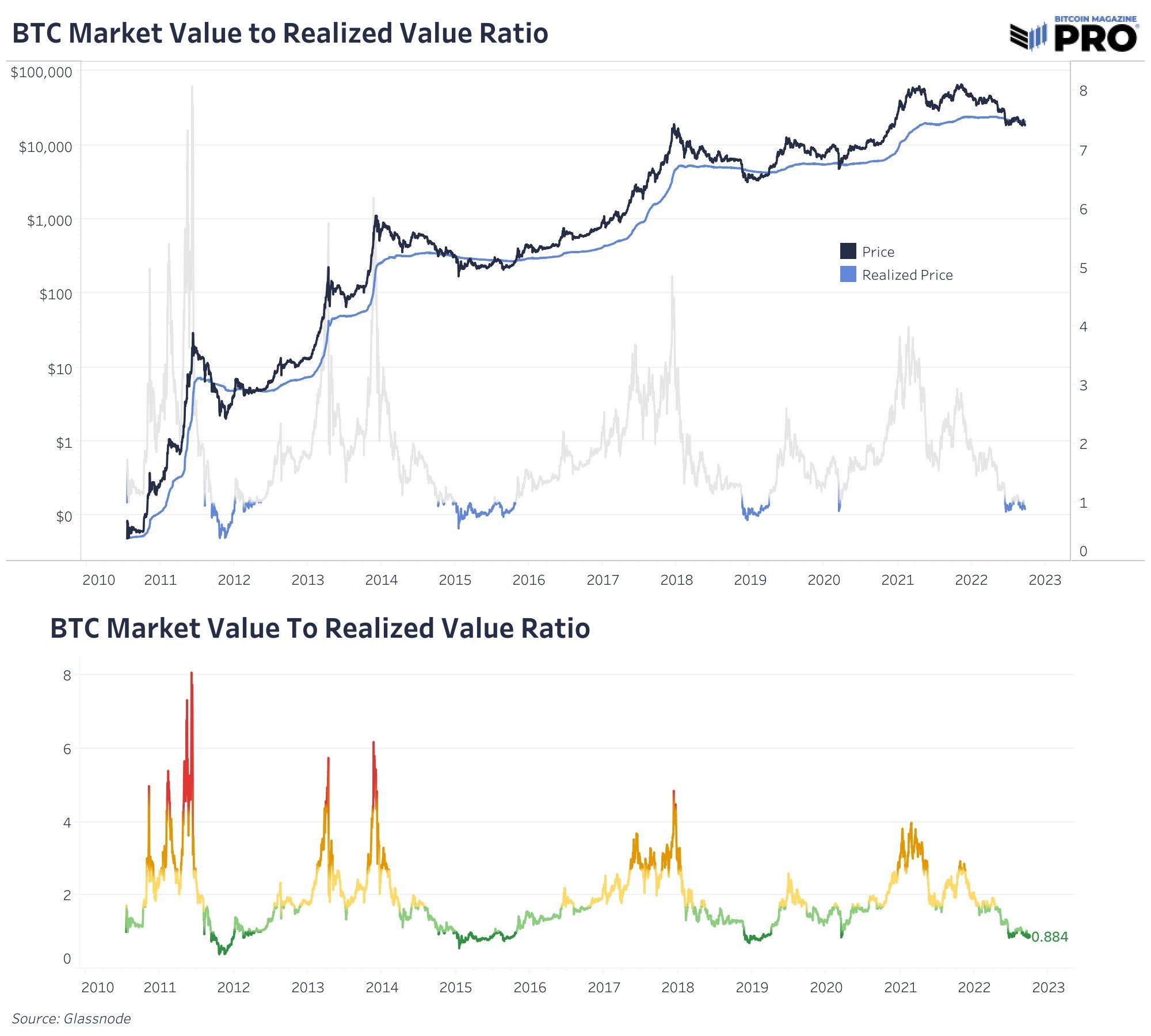

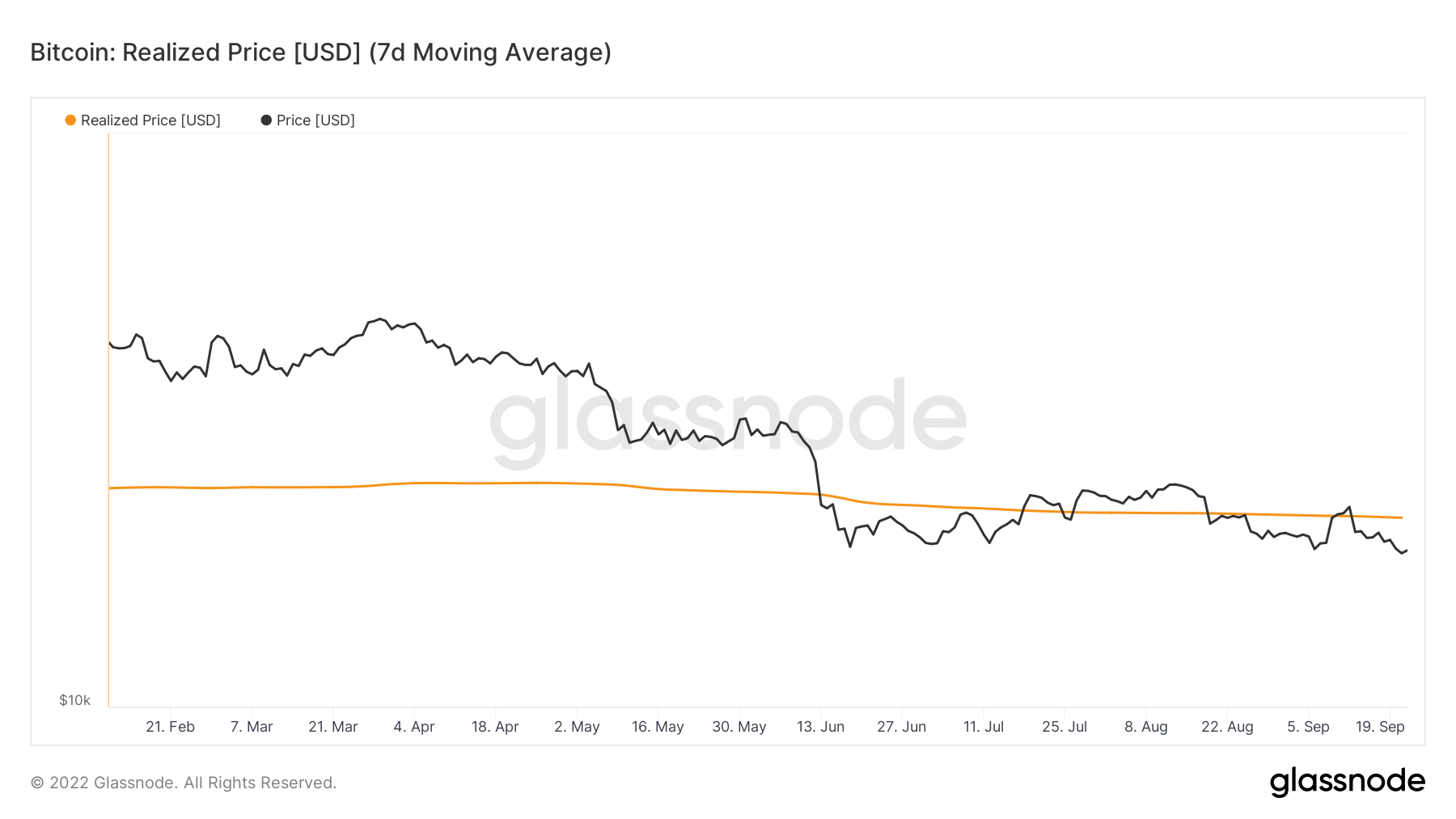

Bitcoin (BTC) is trading below its realized price indicator which is currently at $21,400. A decisive reclaim of this level would be likely to mark the market bottom.

The realized price is an on-chain indicator that measures the price of BTC at the time it last moved instead of the current price. In turn, it devalues lost coins and coins that have not moved in a long period of time.

Well-known analyst and trader @DylanLeClair_ tweeted a chart of the price and the realized price, showing that the former has fallen below the latter. This means that a considerable amount of buyers are at a loss and is a sign that is associated with bear markets.

Sponsored

Previous history

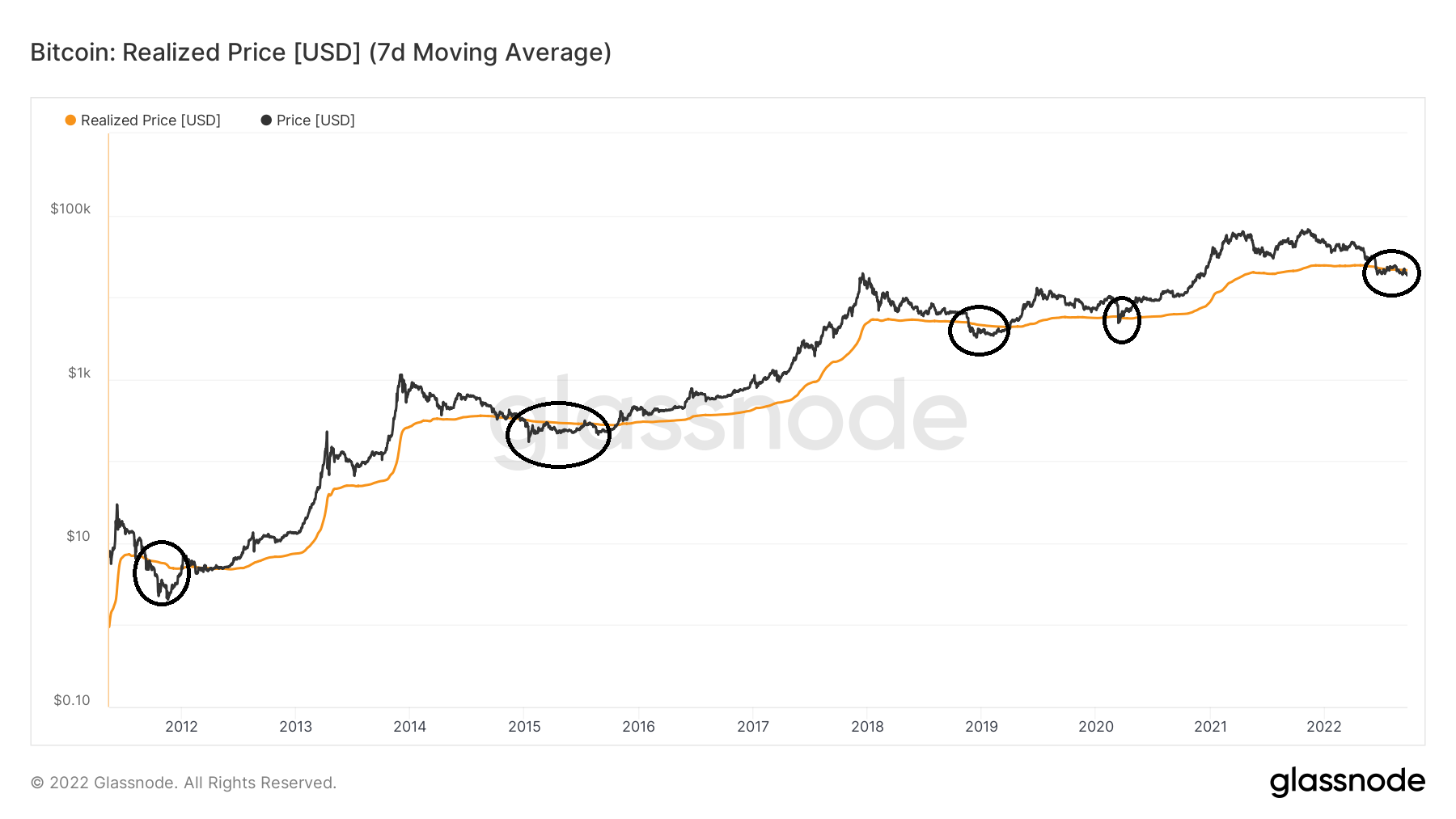

The actual BTC price has decreased below the realized price five times since 2011. It did so in Aug. 2011, Jan. 2015, July 2018, March 2020 and July 2022 (black circles).

These movements have been associated with Bitcoin market bottoms. However, the periods in which this bearish decrease occurred varied.

- 2011 – 110 days

- 2015 – 240 days

- 2018 – 115 days

- 2020 – 8 days

- 2022 – 100 days so far

While there has not been a consensus on the number of days the BTC price stays below its realized price, it seems that once Bitcoin reclaims its realized price, that is a sign that the bottom has been reached.

SponsoredAdditionally, with the exception of 2011, it always took less than 100 days after the first decrease for the bottom to be reached, even if that was not confirmed until BTC reclaimed the realized price.

Current reading

The BTC price has been below the realized price for 100 days now. Throughout this time, it made an attempt at reclaiming the realized price and even traded slightly above it but has fallen back below it since.

Therefore, if previous readings are anything to go by, the bottom has not been confirmed, but it might have been reached.

Sponsored

BTC movement

As for its price movement, BTC created a bearish candlestick with a long upper wick on Sept. 21 (red icon). The candlestick caused a breakdown below the $19,000 support area and negated all the gains coming from the bullish hammer on Sept. 19 (green icon).

So, while the daily RSI is still bullish, since its bullish divergence trend line is still intact, there is no horizontal support below the current price. On the contrary, the $19,000 area is now expected to provide resistance.

As for the short-term movement, it is possible that BTC is trading inside a descending wedge and completing an ending diagonal in the process. This is supported by the bullish divergence in the RSI and the extremely choppy movement.

If correct, Bitcoin would bounce towards $20,000 before another fall which would barely lead to a new yearly low.

This movement would fit with the long-term count and complete the correction that has been ongoing since the all-time high price (white).

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here