Fear of missing out may be returning to the crypto space after over two years of relative absence. Several DeFi tokens are surging as protocol upgrades near and liquidity farming gathers momentum.

Another day heralds another all-time high for DeFi markets as total value locked reaches $1.82 billion. Over the past month, DeFi markets have grown by 90% as speculators and investors rush to deposit crypto collateral in exchange for high-interest rates and yield farming opportunities.

If the current trajectory continues, a milestone TVL of $2 billion should be reached this month. This figure is still tiny when compared to the total cryptocurrency market capitalization of $260 billion, but it is a testament to the rapid growth of this embryonic Ethereum-based financial landscape.

DeFi Tokens on Fire, 0x Leads the Pack

A number of DeFi-related tokens are surging and outperforming their crypto brethren which have mostly traded flat over the past 24 hours. Altcoins, in general, have done very little in 2020, with the total crypto market expanding by just 35% this year. Comparatively, DeFi has surged by 170% in terms of TVL since the beginning of the year.

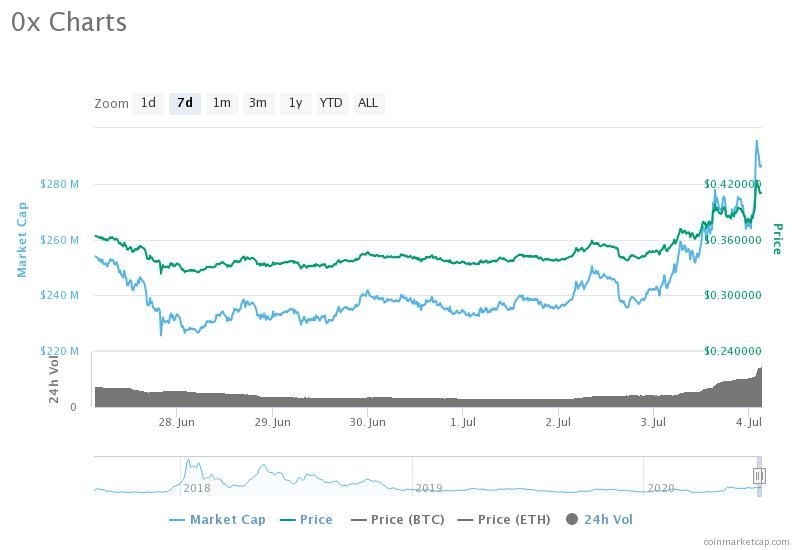

One of the digital darlings of the day is the 0x protocol, with its ZRX token surging 23% to reach a two month high above $0.40. 0x is a decentralized exchange-based protocol which enables the peer-to-peer exchange of crypto assets on the Ethereum network.

Momentum for the ZRX token, which pumped to $2.40 during the ICO boom, has been driven by this week’s launch of its own DEX, dubbed Matcha. The team is confident that a new breed of DEX with simple search functionality and a wide range of token swaps will serve traders that are new to DeFi.

Head of marketing at 0x, Matt Taylor, likened Matcha to the Robinhood of DEXes as it offers a much better design and user experience. The DeFi space clearly needs something simpler to use if it is to gain wider adoption and attract the masses.

Currently, systems and platforms can be clunky, requiring some level of technical expertise. The protocol blog admitted that most exchanges and DeFi products require users to be experts going in:

We heard time and time again from people who use DEX’s regularly, that they can still sometimes be scary. Whether it’s losing money due to extreme slippage, or fat fingering a trade.

Matcha aggregates prices by utilizing the 0x API, which uses smart order routing to split orders across several platforms and providers. Under the hood, Matcha splits trades across 0x Mesh, Kyber, Uniswap, Curve, Oasis, and its own proprietary liquidity sources to find the best prices.

The new DEX offers a variety of ERC-20 tokens in addition to stablecoin-based trading pairs and wrapped variants of Bitcoin. It is clear that the space is in need of more user-friendly platforms, and Matcha could be the first of many.

Kyber Network Upgrade Imminent, KNC Surging

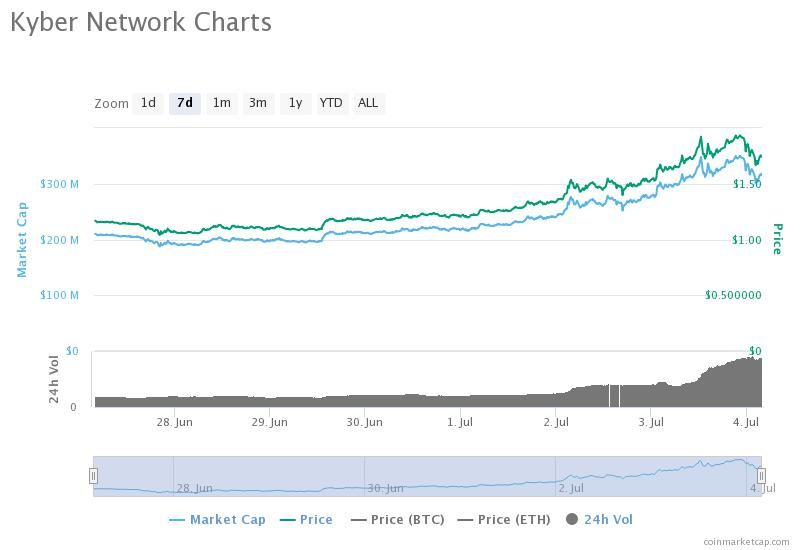

Kyber Network’s KNC is another DeFi token on the move at the moment. Over the few days, KNC has surged almost 50% topping out at a two-year high of just under $2 a few hours ago. The last time the token topped $2 was in May 2018 when crypto markets were crashing from their all-time highs.

The Kyber Network is due a major upgrade in a few days which is driving momentum and FOMO for its native token. According to the blog post, the Katalyst upgrade is due to go live on July 7.

The upgrade will include a number of major technical improvements aimed at enhancing decentralized liquidity for DeFi. It also heralds in the launch of KyberDAO, which is a community platform to facilitate the decentralized governance of the protocol.

Just as Compound Finance and Balancer did before it, Kyber is launching liquidity farming opportunities for KNC holders. Following a governance vote, the breakdown of network fees was decided as follows; 65% will go to staking rewards, 30% to reserve rebates for Fed Price Reserves (FPRs), and 5% to be used for purchasing KNC tokens and burning them. The announcement added:

Once Katalyst is launched, KNC holders can stake their tokens on the KyberDAO and govern the protocol by voting on important proposals and parameters, while earning rewards (in ETH) for their efforts.

KyberDAO operations will be split into ‘epochs,’ with each period lasting for two weeks, except for the first-week genesis, Epoch 0, that begins on July 7.

The promise of staking rewards has driven KNC token prices to a two year high as DeFi growth continues to outpace traditional crypto assets. Kyber is currently ranked at 15th in the DeFi tables according to DeFi Pulse.

Liquidity on the platform has been increasing though it has not seen the spikes that occurred with Compound and Balancer. The total value locked on the platform has hovered around the $7 million level for the past month or so.

Gelato Launched to Mainnet

In a related development, an Ethereum Automation Protocol called Gelato has been launched on mainnet. Gelato is a tool for developers to automate smart contract executions on Ethereum, according to the official announcement:

Rather than having to build and rely on their own relay infrastructure, developers can plug into Gelato and build non-custodial, automated dapps in no time.

Gelato has been integrated with the market-leading decentralized oracle Chainlink network for built-in access to its fast gas/gwei price reference oracle. This enables developers to program a smart contract to auto-execute trades for any gas price and suspend the automation of trades if gas prices rise above a certain threshold.

Automated dApps are used by a number of DeFi protocols such as MakerDAO, DeFi Saver, and the Set Protocol. They can be used for automated liquidation prevention mechanisms, portfolio rebalancing, and the monitoring of collateralization ratios of debt positions in order to liquidate any under collateralized position.

Chainlink prices were slightly down on the day, dropping half a percent to below $4.80. LINK has shown steady growth for the past three months, however, doubling in price to current levels.

Ethereum, meanwhile, is still generally bearish with a slight decline on the day and a 2.6% loss since the same time last weekend. ETH is currently hovering around the $225 level with a market capitalization of $25 billion according to CoinMarketCap.

Other DeFi tokens getting a boost today include Ren, which is a token for a platform providing a mechanism of wrapping Bitcoin for ERC-20 exchanges on DeFi markets. The token has jumped 20% over the past 24 hours to reach an all-time high of $0.18.

zkRollup DEX and payment protocol, Loopring, is also on fire with a similar pump of 20% over the past day. The decentralized prediction markets protocol Augur is also seeing double-digit gains.

DeFi tokens are the new darlings of the digital asset world, and the only one not getting a lift at the moment appears to be the financial ecosystem’s foundation, Ethereum.