After the success of yEARN finance (YFI), a yield farming token which saw a rise in price from $35 to over $4000, a number of cryptocurrencies are trying to copy its success.

These include the likes of YFFI, YFII, and Asuka, however, they’ve all witnessed 100% drops and a conspicuous exit scam.

Encouraging Words

Fueled by DeFi platforms where any token with an address can be traded for anything else, these are the days of Wild West token swaps. To clone the YFI token, developers only had to copy code or fork the original.

But Andre Cronje, founder of the original YFI token, has encouraged experimentation and even supported these new tokens. On Twitter, he not only asked people to make more clones, but also to share the data.

Furthermore, he said he had a few ideas of how to tweak the project that he’d love to share with potential cloners.

https://twitter.com/AndreCronjeTech/status/1289959986190147585?s=20

Divided They Fall

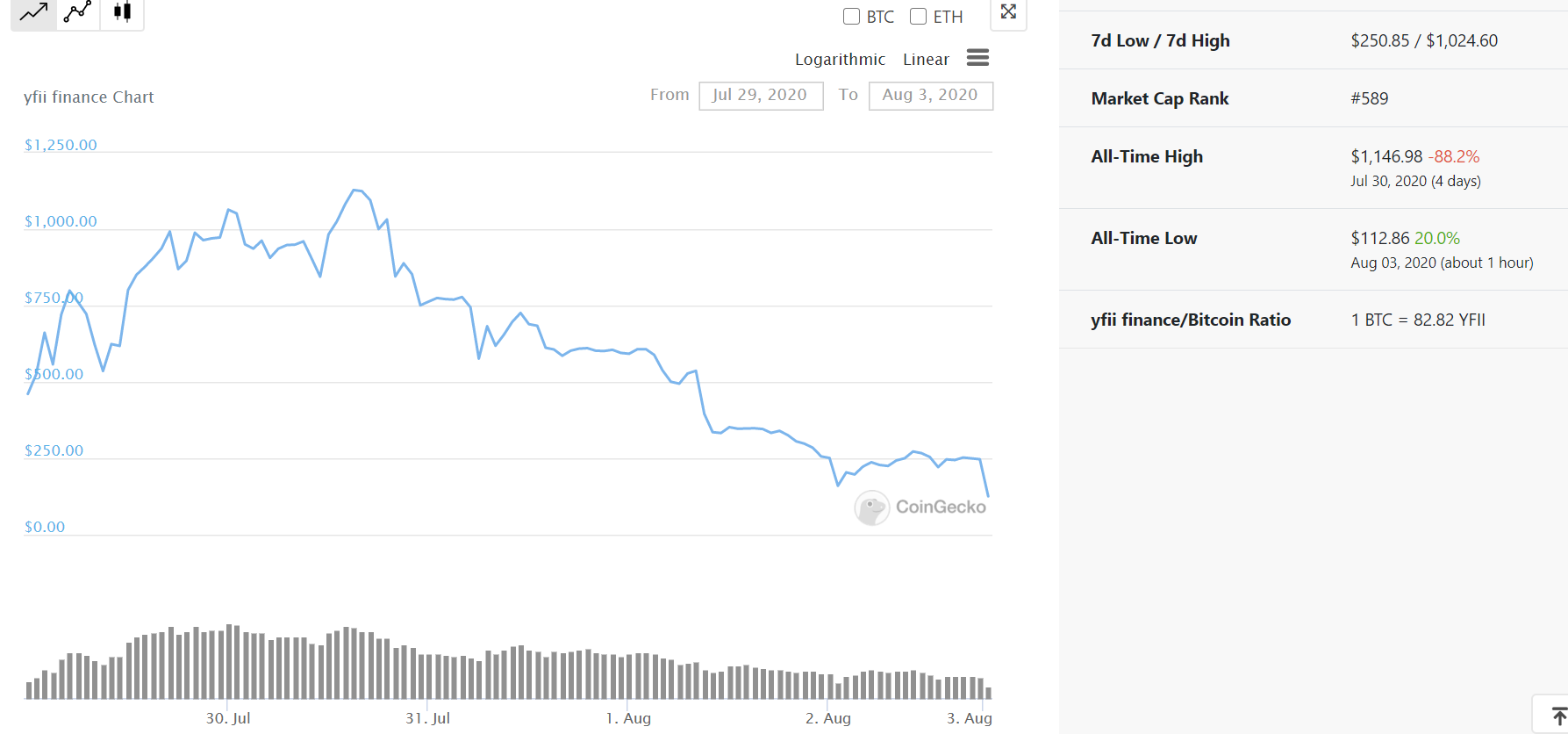

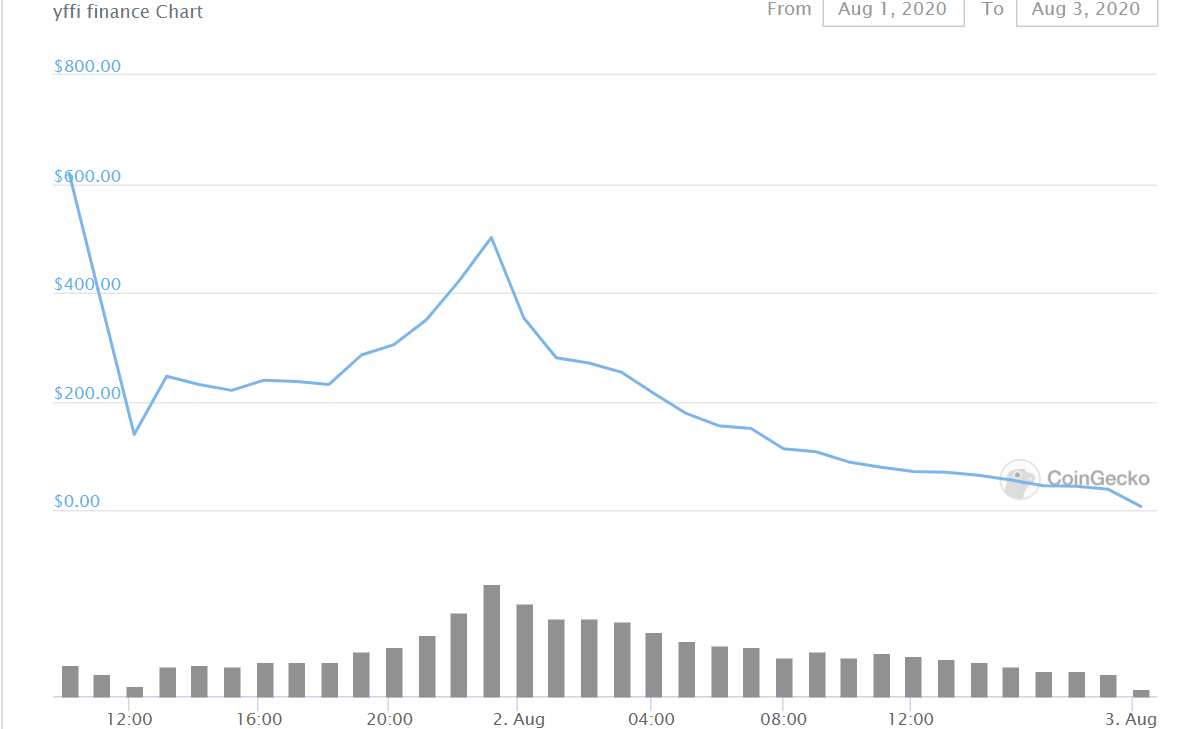

Naturally, these YFI clones gained a fair bit of attention and some significant pumps. As seen in this graph, YFII plummeted from about $1204 to $250 over the course of a couple of days. It now sits 88% off an all-time high.

Not to be outdone, YFFI cratered some 99% from its all-time high, according to Coingecko.

Exit Stage Left

Asuka Finance has been called the Dogecoin of DeFi. Unlike Dogecoin, though, whose creator Jackson Palmer famously left before the money got good, Asuka Finance creator Jongchan Jang is said to have exit scammed.

The price of his token went from $1600 to $34, but not before he traded it for DAI. Asuka’s social media profiles and websites were all shuttered, and Jang reportedly sold all his DAI on Binance.

Doo Wan Nam, part of Maker DAO’s business development team, tweeted about Jang’s scam, pointing out that Jang had previously worked on Ethereum Classic (ETC). According to Nam, this address was associated with Jang and suggests he was sending DAI to Binance.

A Binance spokesperson explained:

“We have identified the relevant account(s). Binance will assist Korean law enforcement in their investigation once we receive a request from them. As always, we will continue to strive for heightened security both on our platform and for the greater crypto space.”

So He used both Telegram, Discord, and KakaoTalk to lure his victims. And Jongchan is a known person. He helped with @eth_classic pic.twitter.com/R03KEeDTyN

— Doo | StableLab (@DooWanNam) August 3, 2020

Who knows? This historic bull run may just be like 2017. It may also, however, leave many eager FOMOing traders in the dust.