Taking the current #Bitcoin price of $11,540 August would see a return of +1.9% in the green.

— Danny Scott (@CoinCornerDanny) August 29, 2020

The last time August had a green month… 2017

The time before that… 2013

That Was Then, This Is Now

The 2017 bull-run is not too far in the rear-view mirror for crypto investors, during which time the BTC price gripped the attention of pretty much everybody when it shot up from less than $1,000 to nearly $20,000. In 2013, for those who may have joined the party a little later, the BTC price skyrocketed some 700% from roughly $150 to beyond $1,000. That was during the days of the now defunct Mt. Gox, which some attribute to the rise and fall of the bitcoin price in that era. CoinCorner’s Scott points out yet another trend that lends more support to the bullish momentum in the bitcoin price. Even though bitcoin’s peak is close to $20,000, the leading cryptocurrency’s longest stretch trading higher than $10,000 was 61 days, starting on Dec. 1, 2017. The second-longest period in which the BTC price hovered above $10,000 is now, and it is more than halfway there to overtake the previous stretch.In recent days, Vinny Lingham, founder of blockchain-fueled identity startup Civic, offered his rare assessment of where the bitcoin price is headed, expressing doubt that the “sub-$12K price holds for much longer.” If true, this means that bitcoin could be well on its way to overtaking 2017’s above-$10K trend.The most consecutive days #Bitcoin spent above $10,000… 61 from 1st Dec 2017

— Danny Scott (@CoinCornerDanny) August 29, 2020

The 2nd is right now…

33 days and counting! 🚀

It looks to me that #Bitcoin is poised for another leg up, with an overshoot above $15k, but then a retrace and heavy consolidation around $14k for a few weeks at least. I doubt this sub-$12k price holds for much longer and $10k represents strong support right now.

— Vinny Lingham (@VinnyLingham) August 28, 2020

Stablecoin Effect

While the stars appear to be aligning for a bullish run in the BTC price — whether it’s the involvement of sophisticated investors like Paul Tudor Jones entering the space or looming inflation that will drive investors to safe-haven assets — there is also the possibility that the market plays out differently this time around. Twitter user kain.eth pointed out that the rise of stablecoins threatens to disrupt bitcoin’s dominance in the bull market cycle. No longer do investors need to rely on BTC as an “on-ramp to crypto,” thanks to a plethora of stablecoins like Tether, Circle’s USDC and Gemini dollar (GUSD).Twitter user “theonevortex” responded to the thread, saying –There is a very real chance that BTC barely moves as this bull market plays out. The days of BTC as on-ramp to crypto are over, it’s being bypassed almost completely as new money comes in primarily via stablecoins.

— kain.eth (@kaiynne) August 30, 2020

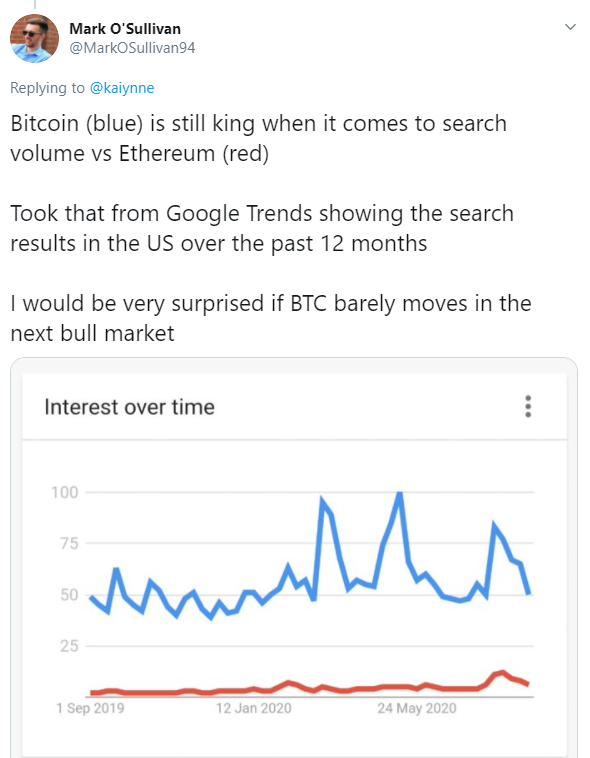

Someone tell Kain that stablecoins are nothing but dry powder and make purchasing bitcoin even easier for HNIs like the CFOs at MicroStrategy.Another Twitter user, @MarkOSullivan94, points out that when it comes to Google trends, bitcoin is still king.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.