The BAT price has been following an ascending support line since December 23, 2019. On February 26, it validated it for the fifth time and the price has been increasing since.

Basic Attention Token (BAT) Price Highlights

- Basic Attention Token is following an ascending support line.

- It has bounced at the 200-day moving average (MA).

- There is support at 2250 satoshis.

- There is resistance at 3200 satoshis.

Will the BAT price be successful in reaching the targets? Continue reading below if you want to find out.$BAT | $BTC

— BillGK (@BillGK_Crypto) February 28, 2020

Keeping it simple with $alts

Bullish MS forming above support after fakeout + reclaim of multi year range. pic.twitter.com/KEypO74nAt

Ascending Support Line

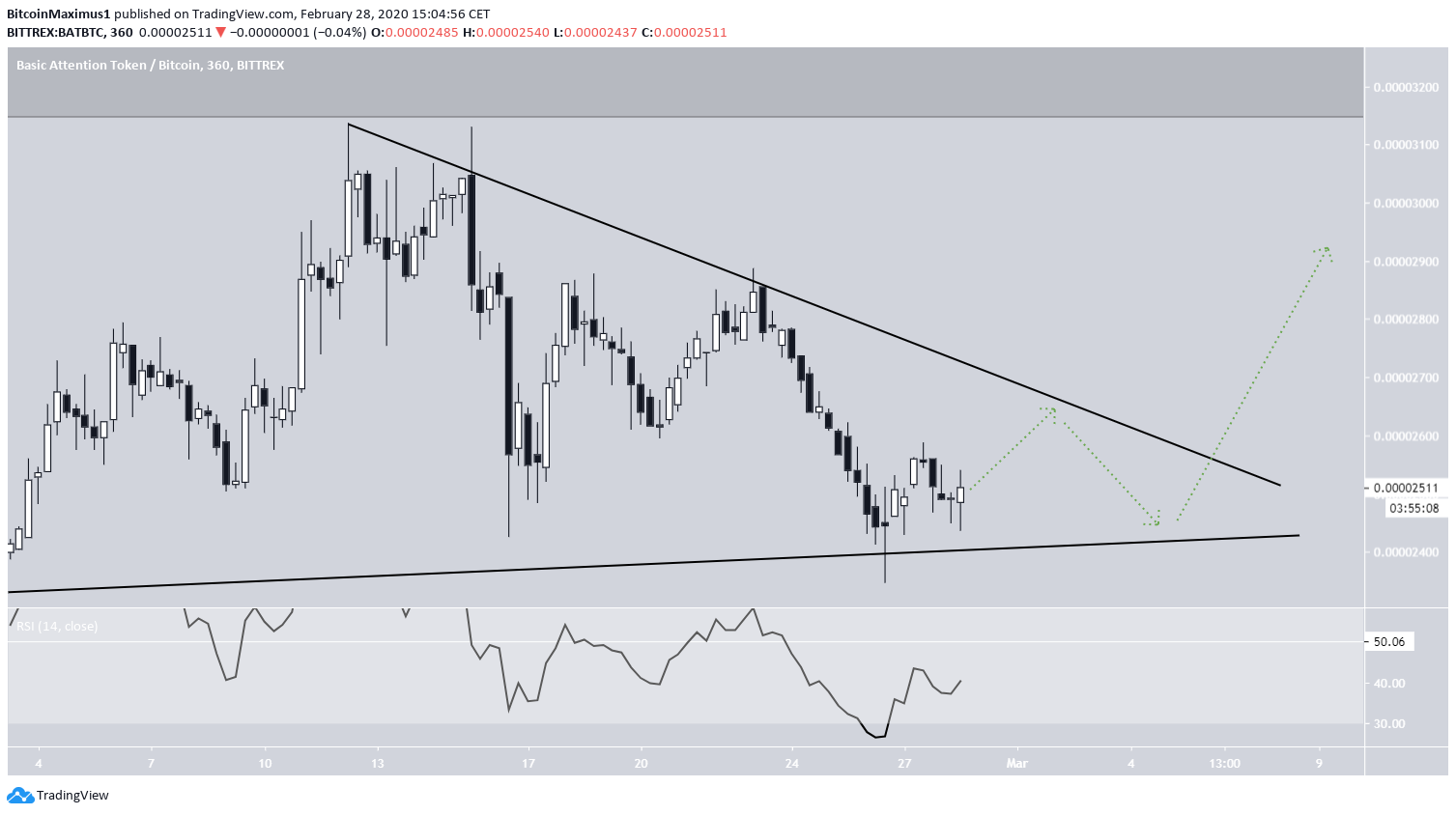

The Basic Attention Token price has been following an ascending support line since December 23, 2019. The price movement has been quite volatile, with several higher and lower highs being created — culminating with a high of 3132 satoshis on February 12. However, the price has always decreased to the support line before beginning the next upward move. It has done this five times until now. Most recently, it created a very long lower wick on February 26, validating both the ascending support line and the 200-day moving average (MA). From here, unless the support breaks down (which seems unlikely), the BAT price is expected to move upwards at the rate predicted by the ascending support line. The shorter-term chart reveals a descending resistance line that creates a symmetrical triangle, which is a neutral pattern.

The lack of bullish divergence in the RSI makes us think that the movement inside this triangle will be gradual, rather than impulsive — eventually leading to a breakout. However, the fact that it is extremely oversold makes us confident in the price moving upwards.

The triangle is projected to end by the middle of March.

The shorter-term chart reveals a descending resistance line that creates a symmetrical triangle, which is a neutral pattern.

The lack of bullish divergence in the RSI makes us think that the movement inside this triangle will be gradual, rather than impulsive — eventually leading to a breakout. However, the fact that it is extremely oversold makes us confident in the price moving upwards.

The triangle is projected to end by the middle of March.

Basic Attention Token Trading Range

The weekly chart reveals the current trading range, which is found between 2250 and 3200 satoshis. The 2250 satoshi area is of crucial importance. It has been acting as support since March 2018 — with the exception of August/September 2019, when the price briefly fell below it, only to reclaim it a short-time afterward. It is quite a bullish development whenever the price falls below a significant support area, only to reclaim it shortly afterward. If the BAT price were to continue moving upwards towards the resistance, it would also cause the weekly RSI to move above 50, confirming that the price is in a bullish trend. This would be confirmed with a breakout above 3200 satoshis. Both the targets are found above this resistance area, so they are considered long-term targets. To conclude, the BAT price is increasing gradually at the rate predicted by an ascending support line. We believe this increase will continue at least until the price reaches the resistance area at 3200 satoshis. A breakout is not ruled out.

To conclude, the BAT price is increasing gradually at the rate predicted by an ascending support line. We believe this increase will continue at least until the price reaches the resistance area at 3200 satoshis. A breakout is not ruled out.

[jnews_block_28 second_title=”Read More” header_type=”heading_5″ number_post=”4″ include_category=”157″ boxed=”true” show_border=”true”]

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored