Tether released its Attestation Report for Q2 2025, showing a dramatic decrease in US Treasury bond purchases. The firm spent $7 billion on them last quarter, compared to $65 billion in Q1.

Although the company is buying Bitcoin and gold and making corporate investments, all its “cash equivalents”, like bond repurchase agreements and non-US Treasuries, barely rose or fell outright. This may complicate GENIUS Act compliance.

Why Doesn’t Tether Want US Treasuries?

Tether, the world’s largest stablecoin issuer, has been making some very diversified investments lately. According to a recent report, interest from the firm’s US Treasury bonds allowed it to invest in over 120 companies.

Today, Tether released its Q2 2025 Attestation Report, confirming a slight increase in Treasuries holdings.

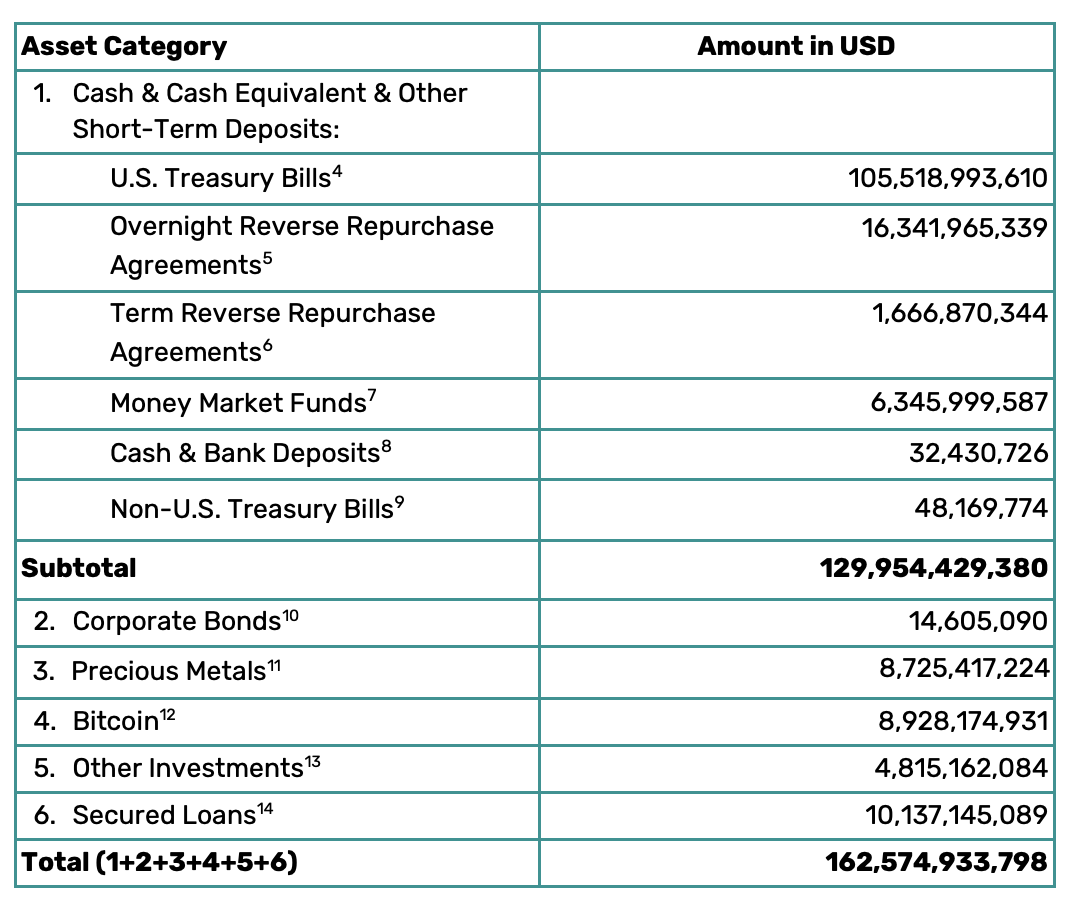

According to the report, Tether currently holds $105.5 billion in US Treasuries and another $24.4 billion in indirect exposure. This includes Overnight Reverse Repurchase Agreements and non-US Treasuries, which may refer to EU bonds for MiCA compliance.

There’s a simple reason why Tether has been buying so many Treasury bonds: stablecoin regulations. The GENIUS Act mandates that stablecoin issuers hold asset reserves in Treasuries, which may cause problems for the firm.

Still, Tether lobbied hard to pass this legislation, so it seems likely that it’s prepared to reach compliance.

However, there is an interesting piece of data here. Since MiCA first took effect, Tether has bought astronomical quantities of Treasury bonds.

In Q4 2024, it purchased $33 billion, and added a whopping $65 billion in Q1 2025.

Today’s report, however, shows less than a $7 billion increase in direct Treasuries holdings throughout all of Q2.

Tether’s non-US Treasury holdings decreased by around $17 billion, and all other “cash equivalents” either fell or rose by less than $1 billion.

Sure, the firm has been buying gold, Bitcoin, and these diverse corporate investments, but its rampant hunger for Treasuries seems to be tapering off. Tether’s holdings are growing, but its strategy is changing.

It’s unclear what to make of all this. According to CEO Paolo Ardoino’s post, Tether has issued over $50 billion more USDT tokens than corresponding US Treasuries. Couldn’t this cause problems for future GENIUS Act compliance?

Ultimately, it’s hard to say whether potential bond market issues caused this change in tactics. It could be very significant, though.