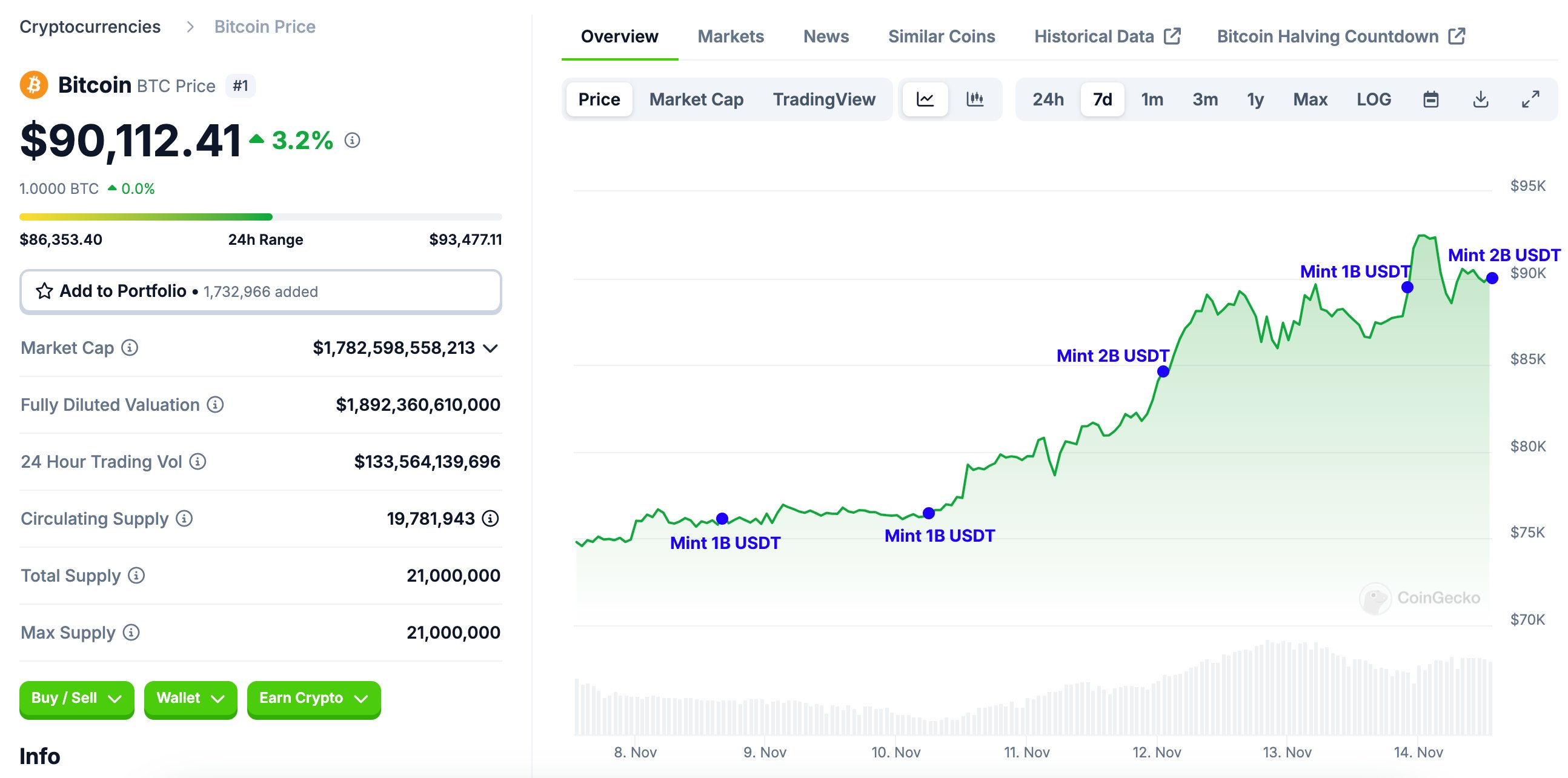

Tether has minted an additional 2 billion USDT today, bringing the total to 7 billion USDT over the past six days.

This substantial increase in USDT supply injects significant liquidity into the cryptocurrency market, potentially influencing trading dynamics and asset valuations.

Increased USDT Minting Suggests Surging Liquidity Demand

Historically, large-scale USDT minting by Tether has correlated with notable market movements. For instance, in May 2024, Tether minted 1 billion USDT, which was linked to subsequent Bitcoin price increases.

Also, the initial $3 billion mint on November 12 coincided with Bitcoin breaking $85,000 and subsequently crossing the $90,000 threshold.

The recent surge in USDT supply may signal increased demand for stablecoins, often used by traders to hedge positions or facilitate transactions without converting to fiat currencies.

This influx of liquidity can enhance market depth, potentially reducing volatility and improving price stability across various digital assets.

Earlier this month, Tether published its quarterly earnings and reported record revenue. In the third quarter of 2024, the stablecoin issuer reported a record-breaking profit of $2.5 billion, bringing its total assets to $134.4 billion.

Tether’s CEO Paolo Ardoino also disclosed that the company’s reserves include 2,454 BTC and 42.3 tons of gold.

New Avenues for Business Expansion

With this year’s increased revenue, Tether is actively exploring new developments and avenues for expansion. The company is considering lending to international commodities traders, particularly in developing markets.

Also, Tether completed its first crude oil transaction in the Middle East earlier this month. The $45 million deal, executed in October, involved 670,000 barrels of oil transacted using USDT.

This marked a significant milestone in the adoption of stablecoins for large-scale commodity trades.

Despite these advancements, the USDT issuer continues to face regulatory scrutiny. A recent Wall Street Journal report alleged Tether’s potential involvement in illegal transactions.

In response, CEO Paolo Ardoino stated that Tether had not observed any indications of a federal probe, reaffirming the company’s commitment to compliance and transparency.