After doubling from $18 billion at the beginning of the year to $36 billion in March, Tether’s (USDT) market cap has already reached another milestone, surpassing $50 billion.

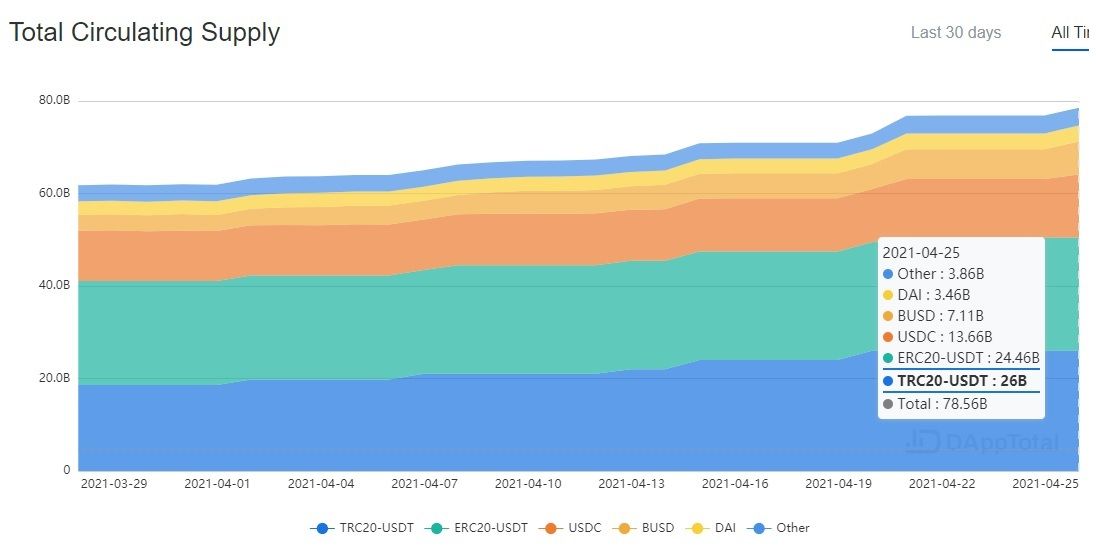

This is also representative of the overall growth of stablecoins. In the past 30 days alone stablecoins, including Tether, have risen in value by almost 30%, from $61 billion to $78 billion.

Tether growth on TRON

In another sign of Tether’s growth, it has now surpassed Ethereum in terms of supply on the TRON blockchain. USDT distribution on TRON stands at $26 billion, while on Ethereum, it is at $24.4 billion.

Sponsored

The entire stablecoin market has exploded this year. DAppTotal is reporting a total stablecoin market cap of $78.5 billion. Tether controls the lion’s share of this market at just under 66% followed up by USD Coin (USDC) with $13.6 billion (17.4%) and Binance’s BUSD at $7.1 billion (9.05%).

‘A wonderful year so far’

According to Tether’s CTO Paolo Ardoino, this is an “incredibly important milestone. He added, “Tether’s success is a blueprint for a Central Bank Digital Currency (CBDC) and a banking system of the future.”

According to a tweet from Ardoino, the $50 billion milestone is one of several Tether has achieved this year.

“2021 has been a wonderful year so far!” the tweet says. Ardoino goes on to reference Tether’s settlement with the New York State Attorney General.

The settlement followed an investigation by the OAG which found that iFinex, the operator of Bitfinex, and Tether made false statements about the backing of the Tether stablecoin and the movement of hundreds of millions of dollars between the two companies. According to the OAG, on Nov, 2, 2018, Tether transferred hundreds of millions of dollars from Tether’s bank accounts to Bitfinex’s.

Because of these issues, Ardoino also highlighted attestations the firm has received from external auditors. Third party audits of the Tether supply have been a major point of contention for quite some time because of the accusation of market manipulation and fraud.